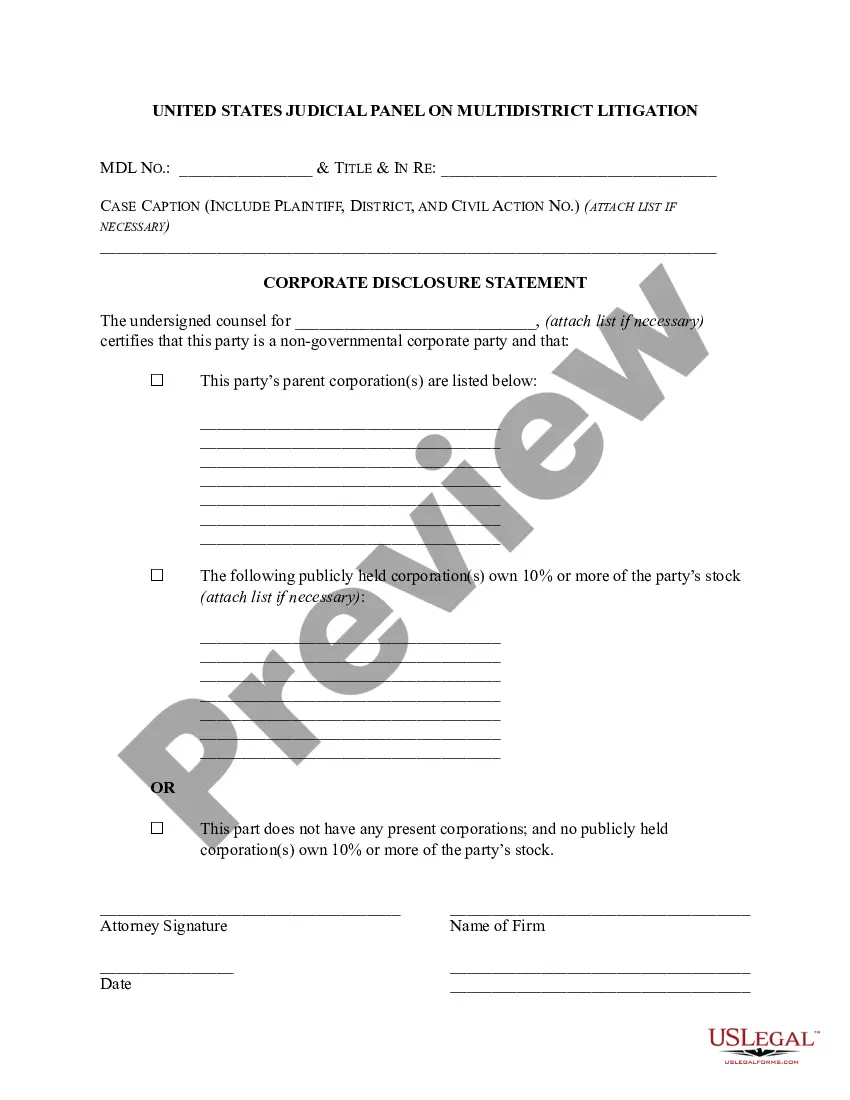

Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2): This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2)

Description

How to fill out Colorado Mandatory Disclosure Form 35.1 - Reference To 16.2 (e)(2)?

The greater the documentation you need to prepare - the more anxious you become.

You can locate a vast amount of Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) templates online, yet, you are uncertain about which ones to rely on.

Eliminate the frustration and simplify acquiring samples with US Legal Forms.

Click on Buy Now to initiate the registration process and select a payment plan that suits your requirements. Provide the necessary information to create your profile and pay for your order using PayPal or a credit card. Choose a convenient file format and receive your copy. Access every document you obtain in the My documents section. Simply navigate there to generate a new copy of your Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2). Even with professionally drafted forms, it’s still essential to consider consulting a local attorney to confirm that your document is accurately completed. Achieve more for less with US Legal Forms!

- Obtain expertly crafted documents that are designed to meet state requirements.

- If you already have a US Legal Forms subscription, Log In to your account, and you will find the Download option on the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2)’s page.

- If you haven't utilized our site previously, complete the registration process with the following steps.

- Verify if the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) is applicable in your state.

- Reconfirm your choice by reviewing the description or by using the Preview feature if they are available for the chosen document.

Form popularity

FAQ

In Colorado, the seller is primarily responsible for completing the seller's property disclosure form. This obligation ensures that sellers provide all relevant information about the property's condition and any issues that might affect its value. By fulfilling this requirement, sellers adhere to the standards of the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2). This promotes a fair and informed transaction process for all parties involved.

The Colorado dual status disclosure form must be utilized whenever a licensee represents both the buyer and seller in a transaction. It ensures that all parties are aware of the dual representation and its implications. Proper use of this form fosters trust and transparency, which is vital in real estate transactions. This practice aligns with the guidelines set forth in the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2).

The Colorado change of status form must be completed promptly whenever there is a change in the relationship between the licensee and the parties involved. This could occur if the licensee transitions from being a buyer's agent to a seller's agent, for instance. Timely completion helps in maintaining clear communication and understanding among all parties. This is crucial in adhering to regulations such as the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2).

A Colorado licensee must disclose any material facts that could influence a party's decision to buy or sell a property. This includes details about property condition, potential hazards, and financial obligations associated with the property. The aim is to provide a clear and honest representation to all involved. This requirement is outlined in the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2), ensuring that all parties are fully informed.

The timeframe for disclosing the Colorado dual status disclosure depends on the specific transaction. Generally, it should be presented to all parties right after contract acceptance. This ensures that everyone involved understands the dual agency relationships, promoting transparency. By adhering to this timeline, you comply with the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2).

The JDF 1111 SS is a specific form used in Colorado that relates to financial disclosures during divorce proceedings. This form serves as a standardized financial statement designed to facilitate fair settlements. Including the JDF 1111 SS along with the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) can help you comply with state regulations and streamline your financial disclosure process.

Sworn financial statements are legal documents that declare your financial status under oath. These statements list your income, expenses, assets, and liabilities, providing a complete picture for the court. It is crucial to present truthful and comprehensive information to avoid legal repercussions. The Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) typically requires such sworn statements to uphold transparency.

Filling out a financial statement for divorce requires gathering all your financial documents. You need to include details on income, expenses, assets, and debts. Make sure to accurately reflect your financial situation, as this will be essential for legal purposes. Utilizing the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) can simplify this process, ensuring you meet state requirements.

Mandatory disclosures in financial statements are essential pieces of information that accompany financial reports, providing insight into the financial health of the parties involved. These disclosures may include details about outstanding liabilities, assets, and any contingent liabilities. Under the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2), these disclosures help maintain fairness and transparency in legal proceedings.

Financial disclosure requirements dictate the types of financial information individuals need to reveal during legal proceedings. These requirements ensure transparency and can vary by case type. For cases involving the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2), parties must adhere to specific guidelines that define what financial data must be disclosed.