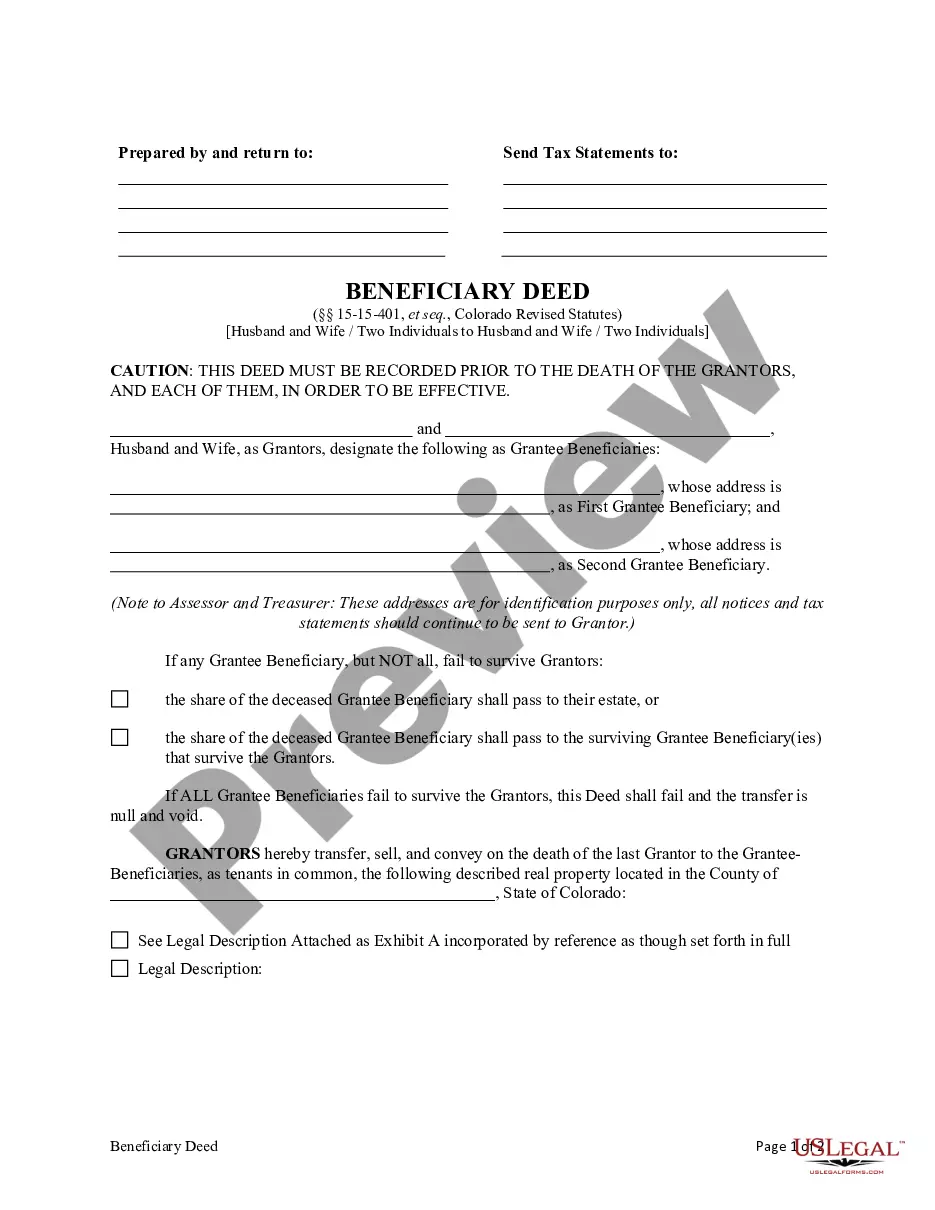

This form is a Beneficiary or Transfer on Death Deed from two individual or husband and wife as Owner Grantors to two individuals or husband and wife as Grantee Beneficiaries. Grantors convey and transfer, upon the death of the last surviving Grantor, to the Grantee Beneficiaries. This Deed is not effective unless recorded prior to the death of either Grantor. This deed complies with all state laws.

Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife.

Description

Key Concepts & Definitions

Beneficiary Deed: Also known as a Transfer on Death (TOD) deed, this legal document allows property owners in the United States to name someone to inherit their property without the property having to go through probate after their death. The 'beneficiary or transfer on death deed from two' typically refers to a situation where two property owners co-own the property and wish to specify their successors.

Step-by-Step Guide

- Select a Co-owner: Ensure that you and another individual are listed as co-owners on the current property title.

- Choose a Beneficiary: Decide who will inherit the property upon the death of the co-owners. This needs to be a unanimous decision between all current owners.

- Create the TOD Deed: Draft the deed with precise terms, specifying the beneficiaries and the percentage of ownership they will inherit.

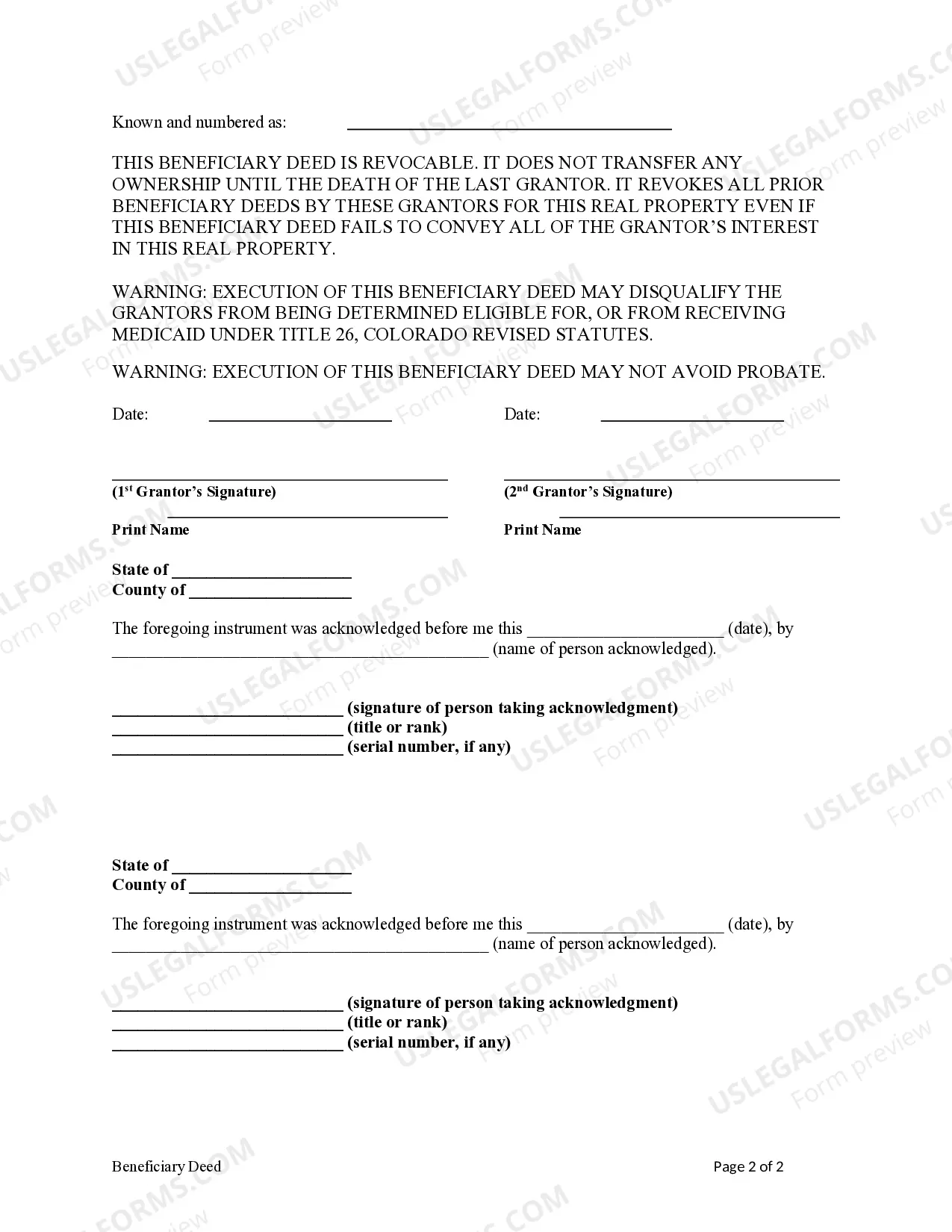

- Sign the Deed: Both owners must sign the deed in the presence of a notary public.

- Record the Deed: File the signed deed at the local county recorders office to make it legally binding and effective upon death.

Risk Analysis

- Legal Challenges: Disputes can arise, especially when there are multiple potential beneficiaries or if the deed is not clearly written.

- Financial Implications: There may be tax implications for the beneficiary, which can vary by state and property value.

- Impact of Changes: Any significant life changes (e.g., divorce, death of a co-owner) might affect the TOD deed and require revisions.

Key Takeaways

Utilizing a TOD deed can significantly ease the process of transferring property upon death, eliminating the need for probate court. Its crucial for co-owners to carefully draft and record their deed to ensure their wishes are accurately honored.

How to fill out Colorado Beneficiary Or Transfer On Death Deed From Two Individuals / Husband And Wife To Two Individuals / Husband And Wife.?

If you're looking for precise Colorado Beneficiary or Transfer on Death Deed from Two Parties / Husband and Wife to Two Parties / Husband and Wife. web templates, US Legal Forms is precisely what you require; discover documents created and verified by state-certified legal experts.

Using US Legal Forms not only saves you from issues concerning legal documents; you also save time, effort, and money! Downloading, printing, and completing a professional template is significantly cheaper than hiring an attorney to do it for you.

And that's it! With just a few simple steps, you have an editable Colorado Beneficiary or Transfer on Death Deed from Two Parties / Husband and Wife to Two Parties / Husband and Wife. After you establish an account, all subsequent purchases will be processed even more easily. When you have a US Legal Forms subscription, just Log In and click the Download option visible on the form's page. Then, whenever you need to use this template again, you will always be able to find it in the My documents section. Do not waste your time searching through multiple forms on different websites. Purchase professional documents from one reliable platform!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the instructions below to establish your account and locate the Colorado Beneficiary or Transfer on Death Deed from Two Parties / Husband and Wife to Two Parties / Husband and Wife. template to address your needs.

- Utilize the Preview feature or review the document description (if available) to ensure that the template is the one you desire.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Select a suitable pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose a preferred format and save the file.

Form popularity

FAQ

To create a valid beneficiary deed in Colorado, certain requirements must be met. The deed must identify the property being transferred, include the owner's legal description, and name the beneficiaries clearly. It must also be signed by the owner and be recorded in the local county office. Utilizing a platform like uslegalforms can simplify the process of drafting a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife, ensuring compliance with all legal requirements.

A beneficiary deed serves as an indication of how ownership of a property will transfer upon death, but it does not act as proof of current ownership. The property owner remains the legal owner until their passing, and the deed only takes effect upon death. For individuals looking to clarify ownership documents, understanding the differences between a title and a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is crucial.

In Colorado, there are specific rules governing how beneficiary deeds operate. To be valid, the deed must be signed by the property owner and recorded in the county where the property is located. It must also clearly designate the beneficiaries, who will inherit the property upon the owner's death. If you are considering a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife, it's wise to consult legal resources or professionals for guidance.

While a beneficiary deed can simplify the transfer of property upon death, there are certain disadvantages to consider. One key issue is that it does not provide any tax benefits during the grantor's lifetime. Additionally, if the property owner decides to sell or refinance the property, they need to revoke the beneficiary deed first. It's important to evaluate the Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife within your broader estate planning strategy.

In Colorado, if one owner of a jointly owned property passes away, the surviving owner automatically inherits the property. This transfer of ownership occurs outside of probate due to the rights of survivorship. Therefore, the surviving spouse or partner retains full control of the property without delays or additional legal requirements. Understanding the implications of the Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife can provide further clarity.

Filing a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is straightforward. First, prepare the deed by including the names of the beneficiaries and a legal description of the property. Next, sign and date the deed in front of a notary public. Finally, file the deed with the clerk and recorder in the county where the property is located to ensure it is legally effective.

A transfer on death deed can designate multiple beneficiaries, allowing you to include as many individuals as you desire. When naming beneficiaries, clarity is crucial to avoid future disputes. This flexibility makes the Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife an excellent option for couples looking to secure their property for their loved ones. For assistance with the process, consider using platforms like uslegalforms.

One disadvantage of a transfer on death deed is that it does not provide asset protection from creditors. If you have debts, your beneficiaries may still face claims on the property. This deed also may complicate Medicaid eligibility or other assistance programs because the property remains part of your estate until death. Understanding the nuances of a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife can help you make informed decisions.

While you can create a transfer on death deed without a lawyer, it is often beneficial to consult one. A lawyer can ensure that your deed meets Colorado requirements and reflects your intentions accurately. This can prevent unexpected complications when transferring property after death, especially for a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife. If you choose to go it alone, consider using reliable resources like uslegalforms.

Many states, including Colorado, allow a transfer on death deed. This deed enables property owners, particularly husband and wife pairs, to pass their property directly to beneficiaries upon their death. States like Arizona, California, and Texas also recognize this deed, offering a simple process to transfer ownership. It is important to check each state’s specific regulations for the Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife.