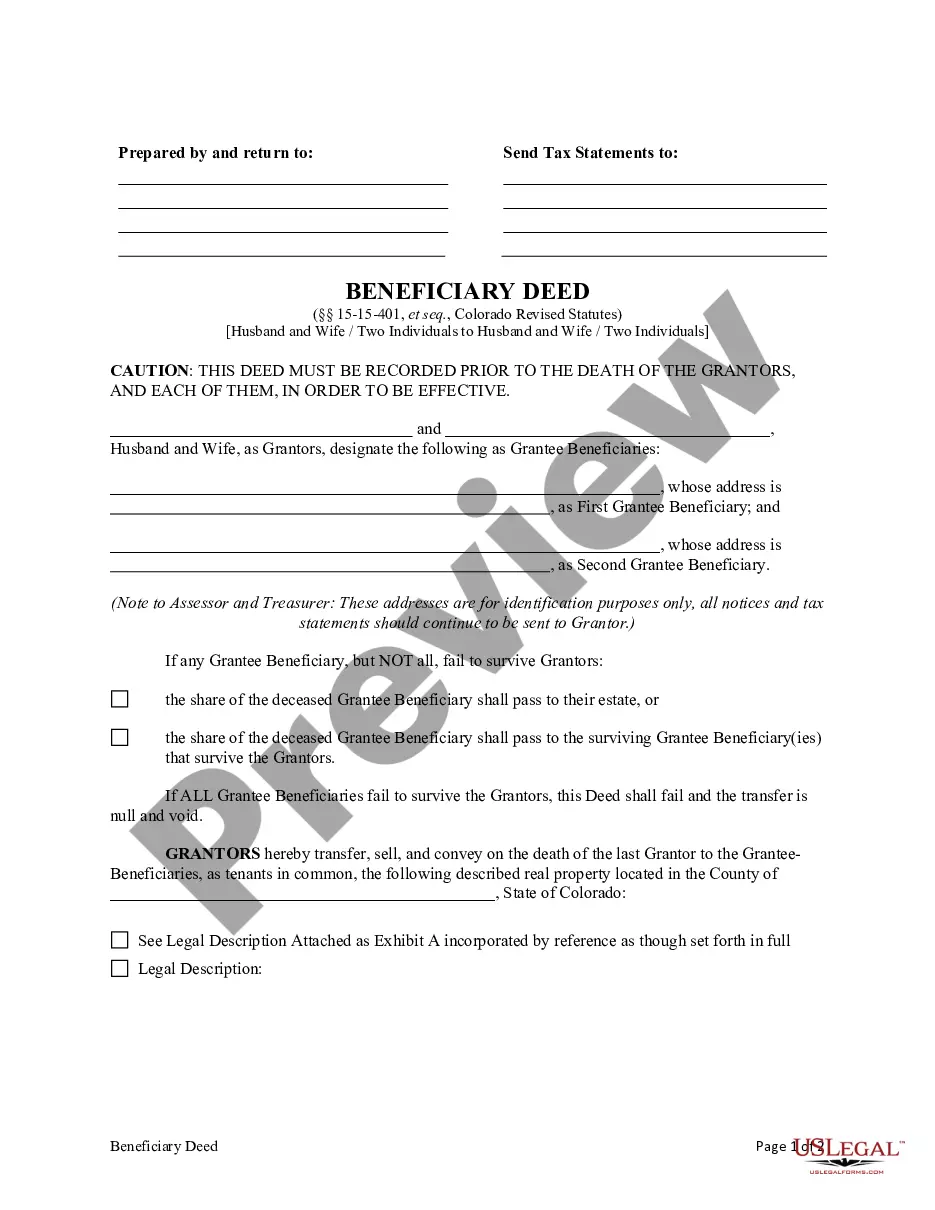

Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife.

Definition and meaning

A Colorado Beneficiary or Transfer on Death Deed is a legal document that allows two individuals, such as partners or spouses, to designate one or more individuals to receive property upon their death without the need for probate. This deed ensures that the property automatically transfers to the named beneficiaries, simplifying the estate settlement process.

How to complete a form

To properly complete this deed, follow these steps:

- Begin by identifying the grantors (the individuals creating the deed) and the grantee beneficiaries (the individuals receiving the property).

- Fill in the legal description of the property, ensuring it accurately reflects the property being transferred.

- Include the addresses of the grantee beneficiaries for identification purposes.

- Sign the deed in the presence of a notary public, ensuring all signatures are properly witnessed.

- Record the completed deed with the appropriate county clerk and recorder's office to make it legally effective.

Who should use this form

This form is ideal for individuals or partners who own real property in Colorado and wish to transfer ownership upon their death without going through probate. It is particularly useful for married couples or people in domestic partnerships looking to simplify their estate planning process.

Legal use and context

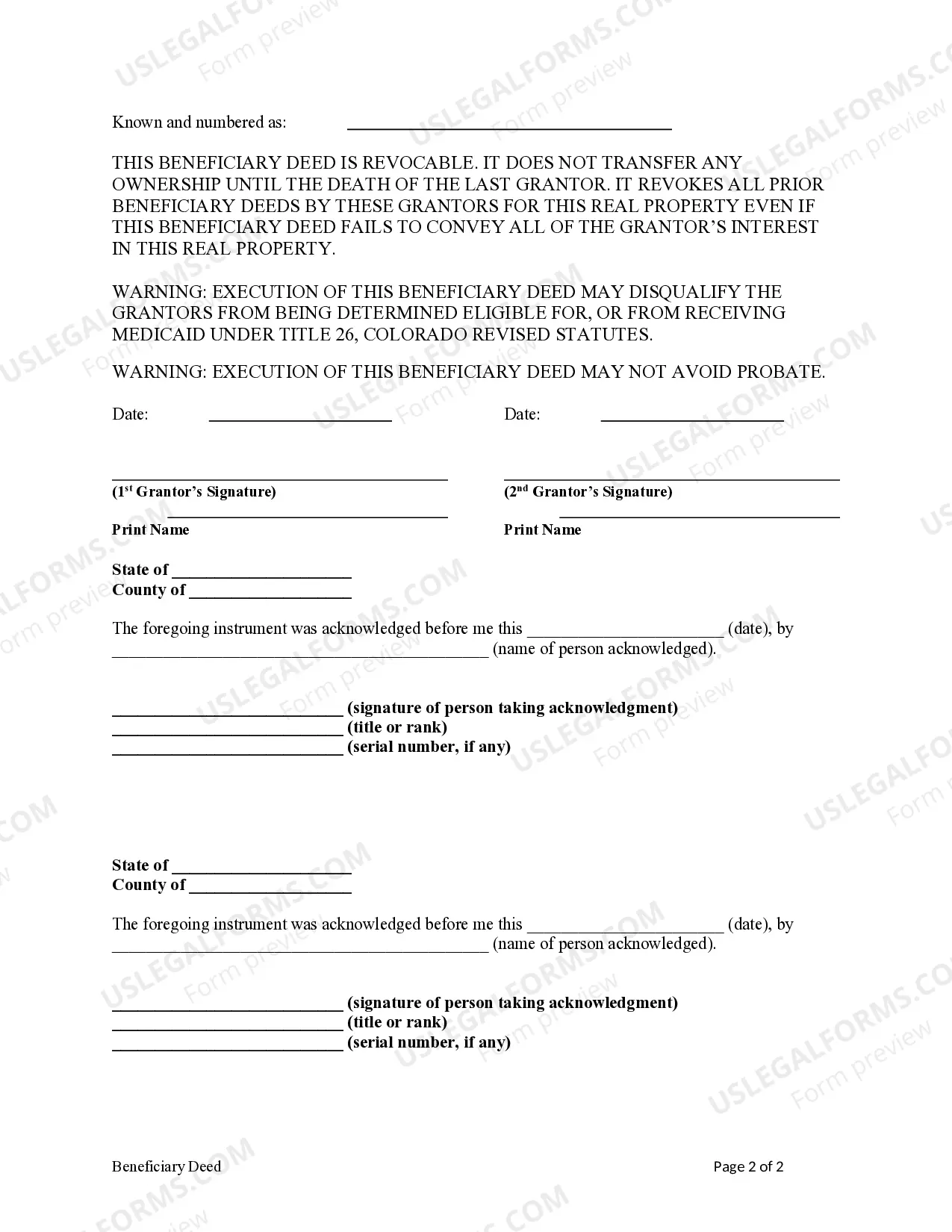

The Colorado Beneficiary Deed is governed by Colorado Revised Statutes. It is considered a revocable deed, meaning that the grantors can change or revoke it at any time during their lifetime. The deed becomes effective upon the death of the last grantor, making it a popular choice for estate planning among Colorado residents.

State-specific requirements

In Colorado, the following requirements must be met for the deed to be valid:

- The deed must be executed by the grantors and notarized.

- It must identify the property clearly and include a legal description.

- The deed must be recorded in the county where the property is located prior to the death of the grantors.

Common mistakes to avoid when using this form

When completing a Colorado Beneficiary Deed, be wary of the following common mistakes:

- Failing to provide a clear legal description of the property.

- Not signing the deed in the presence of a notary public.

- Neglecting to record the deed with the county clerk and recorder's office.

- Using incorrect or outdated forms that may not comply with current laws.

Form popularity

FAQ

To create a valid beneficiary deed in Colorado, certain requirements must be met. The deed must identify the property being transferred, include the owner's legal description, and name the beneficiaries clearly. It must also be signed by the owner and be recorded in the local county office. Utilizing a platform like uslegalforms can simplify the process of drafting a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife, ensuring compliance with all legal requirements.

A beneficiary deed serves as an indication of how ownership of a property will transfer upon death, but it does not act as proof of current ownership. The property owner remains the legal owner until their passing, and the deed only takes effect upon death. For individuals looking to clarify ownership documents, understanding the differences between a title and a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is crucial.

In Colorado, there are specific rules governing how beneficiary deeds operate. To be valid, the deed must be signed by the property owner and recorded in the county where the property is located. It must also clearly designate the beneficiaries, who will inherit the property upon the owner's death. If you are considering a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife, it's wise to consult legal resources or professionals for guidance.

While a beneficiary deed can simplify the transfer of property upon death, there are certain disadvantages to consider. One key issue is that it does not provide any tax benefits during the grantor's lifetime. Additionally, if the property owner decides to sell or refinance the property, they need to revoke the beneficiary deed first. It's important to evaluate the Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife within your broader estate planning strategy.

In Colorado, if one owner of a jointly owned property passes away, the surviving owner automatically inherits the property. This transfer of ownership occurs outside of probate due to the rights of survivorship. Therefore, the surviving spouse or partner retains full control of the property without delays or additional legal requirements. Understanding the implications of the Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife can provide further clarity.

Filing a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife is straightforward. First, prepare the deed by including the names of the beneficiaries and a legal description of the property. Next, sign and date the deed in front of a notary public. Finally, file the deed with the clerk and recorder in the county where the property is located to ensure it is legally effective.

A transfer on death deed can designate multiple beneficiaries, allowing you to include as many individuals as you desire. When naming beneficiaries, clarity is crucial to avoid future disputes. This flexibility makes the Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife an excellent option for couples looking to secure their property for their loved ones. For assistance with the process, consider using platforms like uslegalforms.

One disadvantage of a transfer on death deed is that it does not provide asset protection from creditors. If you have debts, your beneficiaries may still face claims on the property. This deed also may complicate Medicaid eligibility or other assistance programs because the property remains part of your estate until death. Understanding the nuances of a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife can help you make informed decisions.

While you can create a transfer on death deed without a lawyer, it is often beneficial to consult one. A lawyer can ensure that your deed meets Colorado requirements and reflects your intentions accurately. This can prevent unexpected complications when transferring property after death, especially for a Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife. If you choose to go it alone, consider using reliable resources like uslegalforms.

Many states, including Colorado, allow a transfer on death deed. This deed enables property owners, particularly husband and wife pairs, to pass their property directly to beneficiaries upon their death. States like Arizona, California, and Texas also recognize this deed, offering a simple process to transfer ownership. It is important to check each state’s specific regulations for the Colorado Beneficiary or Transfer on Death Deed from Two Individuals / Husband and Wife to Two Individuals / Husband and Wife.