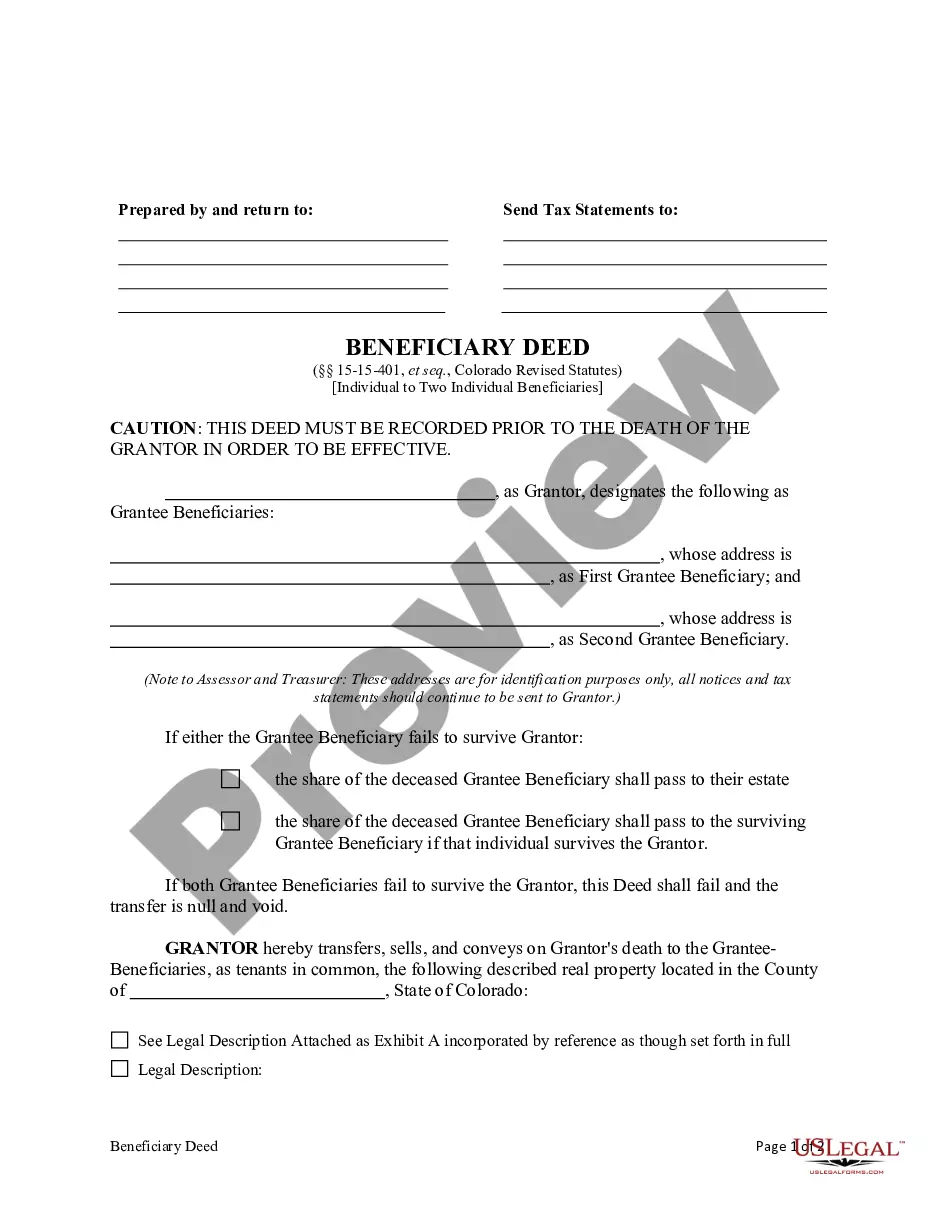

This form is a Beneficiary Deed where the Grantor is an individual and there are two Grantee Beneficiaries. There are NO named Successor Grantee Beneficiaries. Grantor conveys and transfers, upon Grantor's death, to the surviving Grantee Beneficiaries. This Deed is not effective unless recorded prior to Grantor's death. This deed complies with all state statutory laws.

Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries

Description

Key Concepts & Definitions

Beneficiary Deed: A legal document used in some states in the United States that allows property owners to transfer real estate upon their death directly to a beneficiary without the need for probate. Also known as a 'transfer on death deed' or 'death deed'. Real Estate encompasses the land along with any permanent improvements attached to the land, whether natural or man-made.

Step-by-Step Guide for Transferring a Beneficiary Deed from an Individual to Two Individuals

- Review Property Law: Ensure understanding of the state-specific laws concerning beneficiary deeds. Some states do not recognize these deeds.

- Identify Beneficiaries: Decide the two individuals (e.g., husband and wife) who will receive the property. Legal clarity in identifying beneficiaries helps prevent disputes.

- Prepare Deed: Draft the deed with clear details of the property and the beneficiaries. Include any specific clauses if needed.

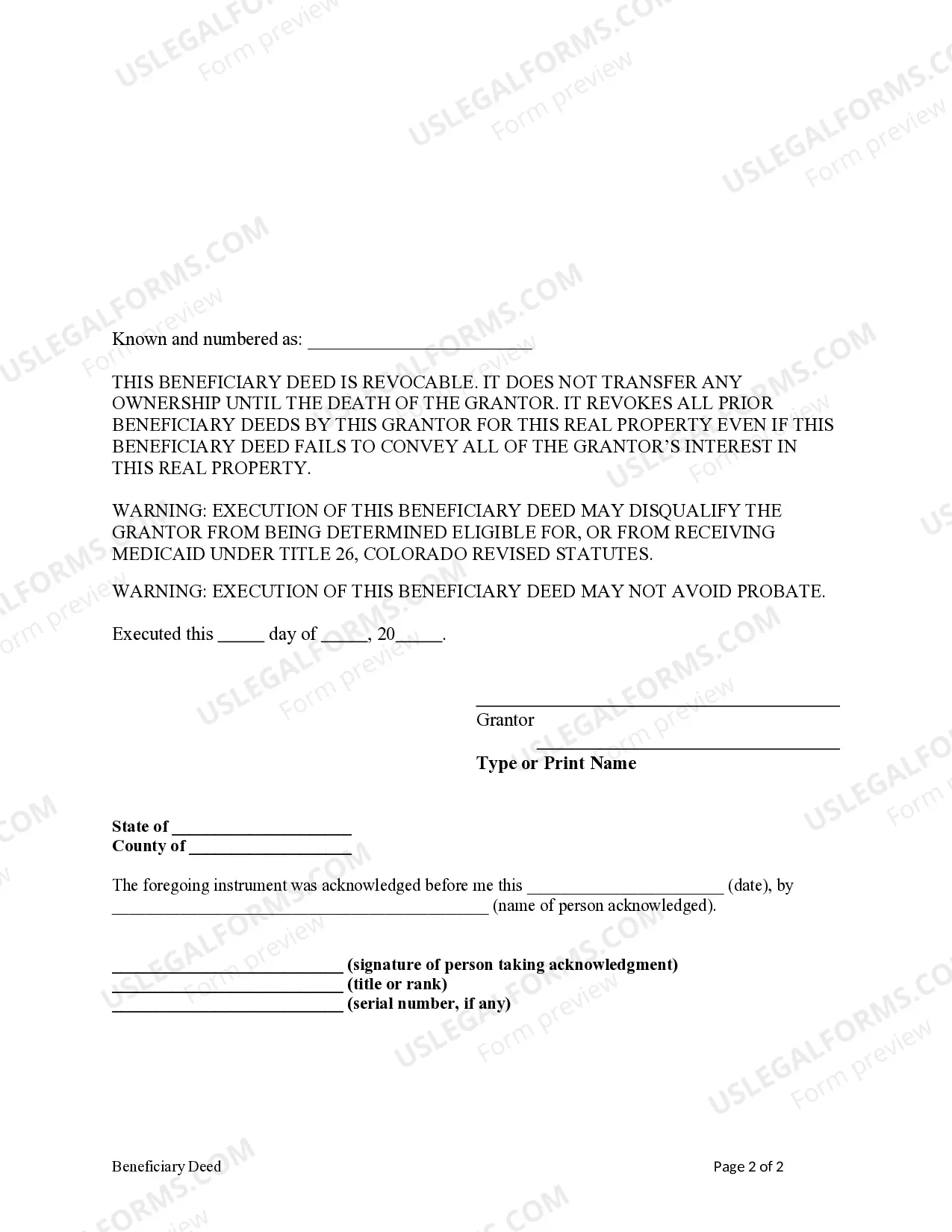

- Sign and Notarize: The deed must be signed in the presence of a notary to be legally binding.

- Record the Deed: Submit the signed and notarized deed to the local office handling property records to meet recording requirements.

- Notify Beneficiaries: Inform the beneficiaries about the deed to ensure they are aware of the personal security and responsibilities entailed.

Risk Analysis of Changing Beneficiary Deeds

- Legal Disputes: Improper drafting or unclear terms can lead to contests between beneficiaries or with other heirs.

- Recording Issues: Failure to properly record the deed can lead to non-recognition of the transfer, affecting the new beneficiaries' legal claim to the property.

- Regulation Changes: Changes in property law can affect the validity or execution of existing deeds.

Comparison Table for States Allowing Beneficiary Deeds

Because no real data was specified regarding individual state laws and practices regarding beneficiary deeds, this section has been omitted.

Key Takeaways

- Beneficiary deeds provide a streamlined method for property transfer upon death, avoiding probate.

- Legal clarity and compliance with recording requirements are critical for effective transfers.

- Beneficiaries should be clearly identified, especially in cases involving multiple individuals such as a husband and wife.

How to fill out Colorado Beneficiary Deed - Individual To Two Individuals Without Successor Beneficiaries?

If you're looking for precise Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries examples, US Legal Forms is what you require; discover documents crafted and authenticated by state-licensed attorneys.

Utilizing US Legal Forms not only protects you from hassles related to legal documents; additionally, you conserve time, effort, and money! Downloading, printing, and completing a qualified template is significantly more economical than hiring a lawyer to handle it for you.

And there you have it. In just a few simple steps, you possess an editable Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries. When you set up your account, all future requests will be handled even more smoothly. With a US Legal Forms subscription, just Log In and then click the Download button visible on the form’s page. Then, whenever you need to use this blank again, you'll always be able to find it in the My documents section. Don’t waste your time and effort sifting through numerous forms on various sites. Acquire accurate documents from a single reliable service!

- To begin, complete your registration process by providing your email and creating a password.

- Follow the instructions below to set up an account and locate the Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries example to address your needs.

- Utilize the Preview option or review the file description (if available) to ensure that the form is the one you are seeking.

- Verify its validity in your residing state.

- Click on Buy Now to place your order.

- Select a recommended pricing plan.

- Establish your account and make a payment using a credit card or PayPal.

Form popularity

FAQ

A Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries does take precedence over a will in terms of property transfer. If you designate beneficiaries in your deed, they will receive the property directly, bypassing the probate process. However, it's essential to ensure that your will and the deed do not conflict. Utilizing services like US Legal Forms can help clarify your intentions and ensure all documents work harmoniously.

Filling out a Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries involves several key steps. Start with your information, including your name and address, followed by the property details. Next, enter the names of the beneficiaries and the statement about the transfer upon your death. For detailed guidance, US Legal Forms provides user-friendly instructions and templates that streamline the process.

While it is not mandatory to hire a lawyer for a Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries, consulting one can be beneficial. A legal professional can provide guidance and ensure compliance with state laws. Using platforms like US Legal Forms can also help you create a valid deed without needing extensive legal knowledge. However, if your situation is complex, expert advice is always a good option.

To write a Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries, start by identifying the property and listing the names of the beneficiaries. Clearly state your intentions regarding the transfer of the property upon your death. Ensure the deed meets all state requirements, including signatures and notarization. You can use resources like US Legal Forms to access templates that simplify this process.

To create a valid Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries, you must include specific details. These include the grantor's and beneficiaries' names, a legal description of the property, and your intent for the property to transfer upon death. Additionally, the deed must be signed and recorded at the county clerk's office to ensure its legality.

A beneficiary deed in Colorado allows for two names to be listed as beneficiaries. This is particularly useful for couples or partners who want to ensure their property passes to each other seamlessly. The Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries simplifies the inheritance process, ensuring clarity and ease for the beneficiaries.

On a beneficiary deed, you can typically name up to two individuals. In the context of the Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries, this means you can designate two people to inherit your property. This provision helps streamline the transfer process while allowing for joint ownership among the named beneficiaries.

To transfer a Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries, you need to complete the necessary documentation. Start by preparing the deed that clearly states both beneficiaries' names. After you have signed it, ensure it is recorded with the appropriate county clerk's office to make the transfer effective upon your death.

While a beneficiary deed offers advantages, it does have some downsides. For instance, the property might not be shielded from creditors, and errors in completing the deed can lead to legal disputes. It's essential to consider these potential issues carefully when utilizing a Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries.

In Colorado, you can have multiple names listed on a beneficiary deed. Specifically, the Colorado Beneficiary Deed - Individual to Two Individuals Without Successor Beneficiaries allows you to name two individuals as beneficiaries. This flexibility helps ensure that your property transfers smoothly after your passing, without complications.