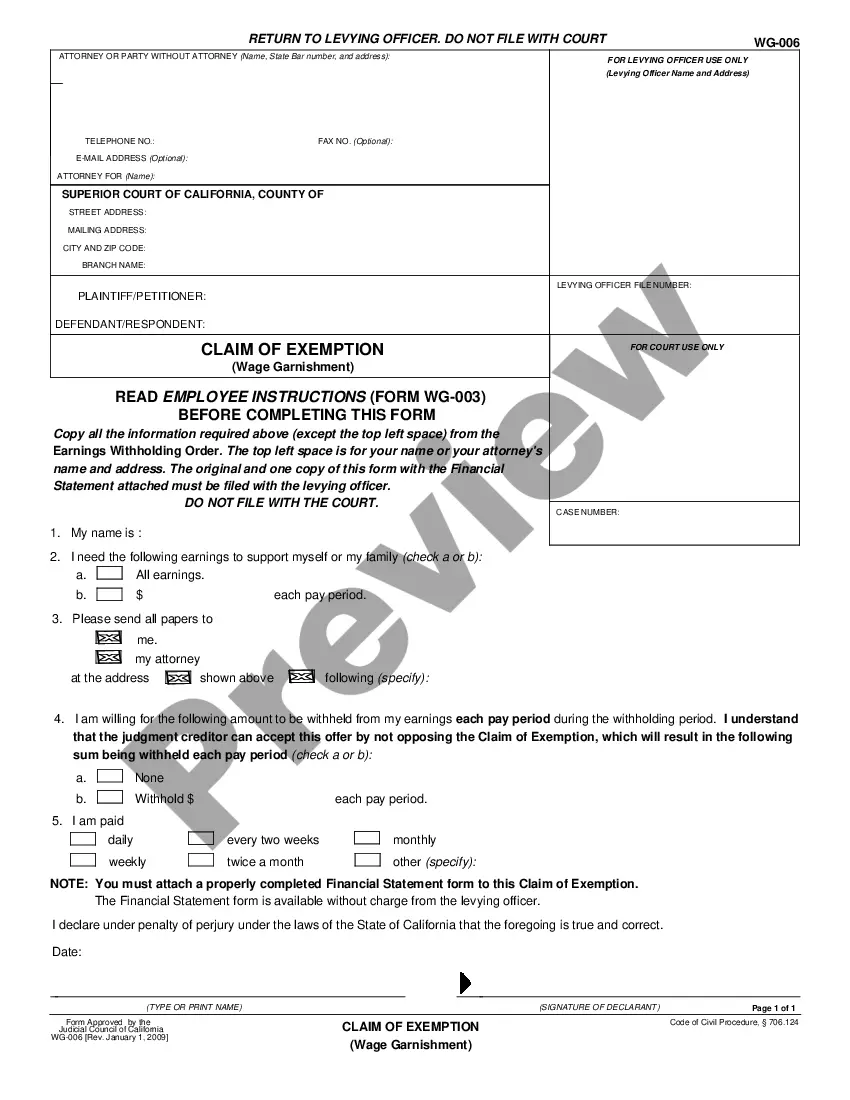

This form is a claim of exemption and financial statement. A garnishment debtor can use this form to explain the resources he or she needs to have exempted from a garnishment in order to pay basic living expenses.

California Claim of Exemption and Financial Declaration

Description

How to fill out California Claim Of Exemption And Financial Declaration?

If you’re looking for suitable California Claim of Exemption and Financial Declaration samples, US Legal Forms is exactly what you need; locate documents created and validated by state-authorized attorneys.

Utilizing US Legal Forms not only prevents stress associated with legal documents; you also save time, effort, and money! Downloading, printing, and submitting a professional document is considerably more affordable than hiring a lawyer to do it for you.

And that’s all. In just a few simple steps, you have an adjustable California Claim of Exemption and Financial Declaration. Once you create an account, all future transactions will be even easier. After obtaining a US Legal Forms subscription, simply Log In to your account and click the Download button you find on the form’s page. Then, whenever you need to use this template again, you’ll always be able to locate it in the My documents section. Don’t waste your time and effort comparing countless documents on different online sources. Get accurate forms from one reliable service!

- To start, complete your registration process by providing your email and creating a secure password.

- Follow the steps outlined below to create an account and locate the California Claim of Exemption and Financial Declaration sample to address your needs.

- Utilize the Preview tool or review the document details (if available) to ensure that the template is the one you need.

- Check its relevance in your locality.

- Click on Buy Now to place an order.

- Choose a desired pricing plan.

- Create an account and pay using your credit card or PayPal.

- Select a suitable file format and save the document.

Form popularity

FAQ

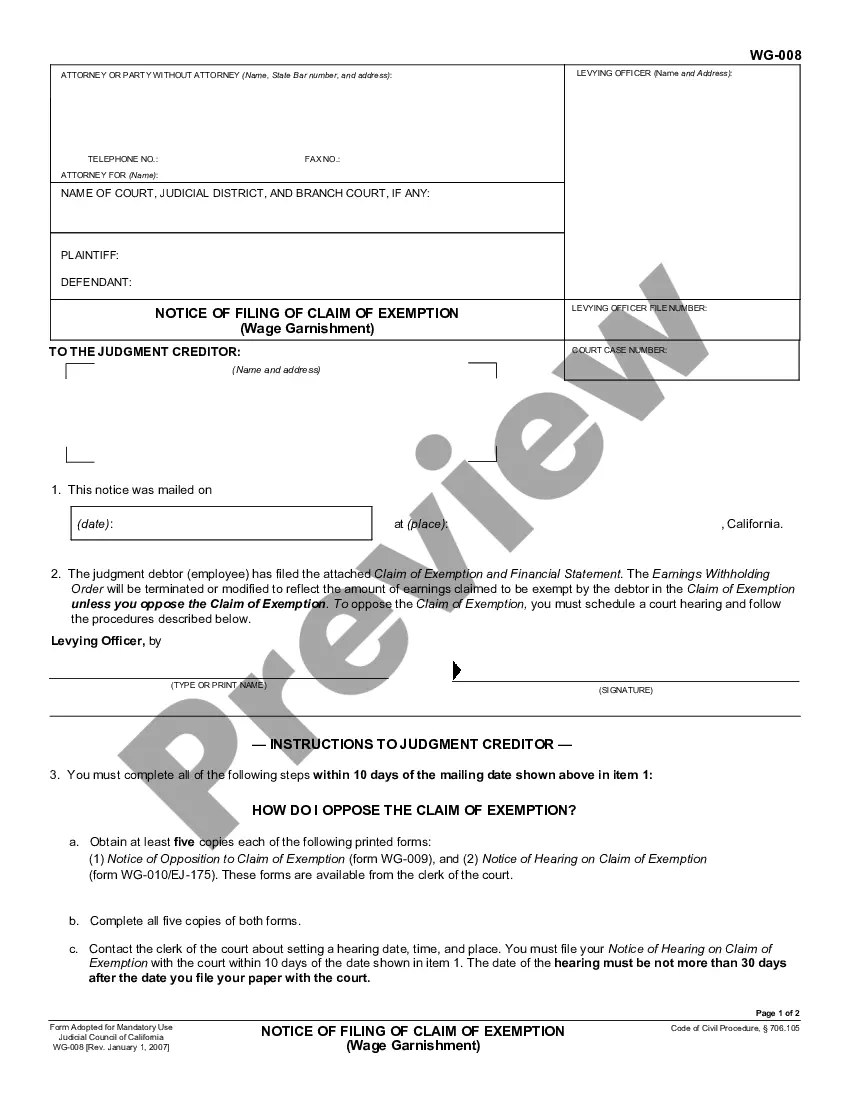

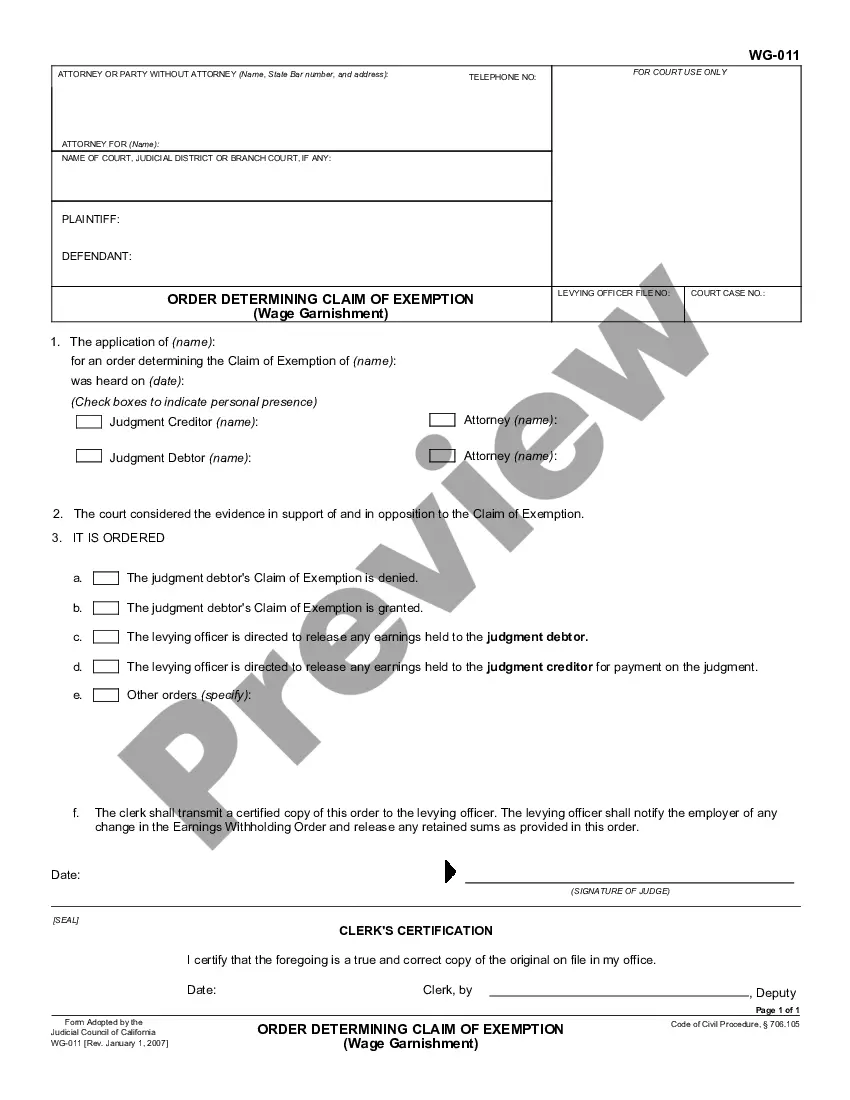

The best way to stop a garnishment is to file a California Claim of Exemption and Financial Declaration if you qualify. This legal action could help protect your earnings from being garnished, particularly if you demonstrate financial hardship. Additionally, it is wise to communicate directly with your creditor to explore options for resolving the issue. For legal forms and advice tailored to your situation, visit US Legal Forms.

To apply for garnishment hardship in California, you must complete the California Claim of Exemption and Financial Declaration. This form helps demonstrate your financial difficulties and the impact of garnishment on your well-being. Be specific about your circumstances and provide necessary documentation to support your claim. If you require assistance, consider utilizing resources from US Legal Forms for guidance.

When writing a letter to stop wage garnishment, first state your information clearly and the reason for your request. Include a reference to the California Claim of Exemption and Financial Declaration if applicable. Attach any supporting documents that validate your claim, and ensure you send the letter to the appropriate parties. If you're unsure of the format, US Legal Forms offers templates that can simplify the process.

The new garnishment law in California, effective from 2022, includes changes that protect debtors by limiting the amount of disposable earnings that can be garnished. Under the California Claim of Exemption and Financial Declaration, you can assert your rights to exempt funds if the garnishment exceeds allowable amounts. Keeping up to date on these changes can help you manage your finances better. For clear information on how it affects you, visit platforms that specialize in legal forms.

To fill out a wage garnishment exemption, start by completing the California Claim of Exemption and Financial Declaration form. Clearly indicate your income, expenses, and any other financial obligations. Ensure that you provide accurate information to support your claim, as this will help demonstrate your need for exemption. If you have questions, consider using resources such as US Legal Forms for detailed guidance.

To stop a wage garnishment in California instantly, you should file a claim of exemption as soon as possible. This legal action asserts your rights to protect specific portions of your income from being garnished. By utilizing the California Claim of Exemption and Financial Declaration, you can expedite the process and effectively communicate your financial situation. Seeking assistance from platforms like uslegalforms can help streamline your filing and improve your chances of success.

To file a California exemption claim, you need to complete the appropriate forms, including the California Claim of Exemption and Financial Declaration. Ensure that you provide accurate financial information to support your claim. Once completed, submit the forms to the court handling your case, or provide them to your creditor to halt collection efforts. Resources such as uslegalforms can offer you tailored assistance during this process.

Choosing between 1 or 0 allowances depends on your financial situation and tax liability. Claiming 1 allowance typically results in a smaller amount withheld from your paycheck, which may lead to a larger tax refund. Conversely, claiming 0 allowances results in higher withholdings but can also be beneficial if you want to avoid tax obligations later. The California Claim of Exemption and Financial Declaration may provide valuable insights into optimizing your overall financial management.

When you claim exemptions, you are formally requesting that specific income or assets be exempt from garnishment or collection. This process provides legal backing for protecting portions of your earnings, such as wages or government benefits, which are essential for your living expenses. Utilizing the California Claim of Exemption and Financial Declaration, you can clearly present your case for exemptions.

The right to claim exemptions grants individuals the ability to shield a portion of their financial resources from creditors. This means that, under California law, you are entitled to protect specific income and assets from garnishment. By filing the California Claim of Exemption and Financial Declaration, you assert these rights and can provide evidence of your financial need.