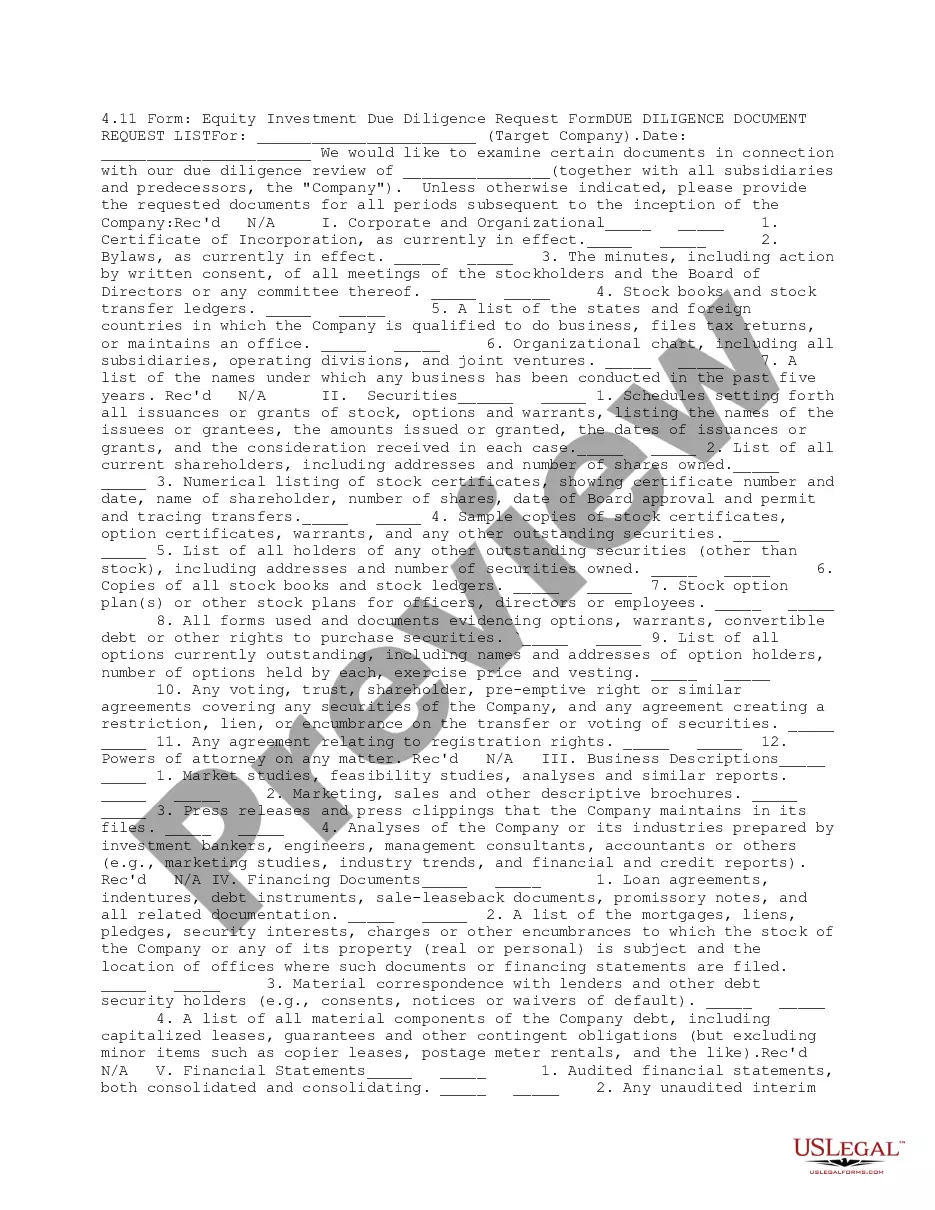

This is a due diligence document request list requesting certain documents to be used in the due diligence review. It asks for corporate and organizational documents, securities documents, business descriptions, financing documents, and other documents necessary for the due diligence review.

California Equity Investment Due Diligence Request Form

Description

How to fill out Equity Investment Due Diligence Request Form?

Choosing the right lawful file template could be a battle. Naturally, there are plenty of web templates accessible on the Internet, but how will you find the lawful type you will need? Take advantage of the US Legal Forms site. The services gives a huge number of web templates, for example the California Equity Investment Due Diligence Request Form, which can be used for company and private demands. All the kinds are checked out by professionals and satisfy state and federal demands.

In case you are currently listed, log in to your profile and then click the Obtain option to have the California Equity Investment Due Diligence Request Form. Use your profile to search from the lawful kinds you have acquired earlier. Check out the My Forms tab of your own profile and acquire another version of the file you will need.

In case you are a whole new consumer of US Legal Forms, listed below are easy recommendations that you should stick to:

- Initial, make certain you have chosen the correct type to your town/state. You may look over the shape utilizing the Review option and read the shape outline to ensure this is the best for you.

- If the type fails to satisfy your expectations, use the Seach field to get the correct type.

- Once you are positive that the shape is proper, go through the Buy now option to have the type.

- Select the pricing program you need and type in the required details. Create your profile and pay money for the transaction with your PayPal profile or credit card.

- Pick the document formatting and obtain the lawful file template to your product.

- Total, modify and printing and sign the received California Equity Investment Due Diligence Request Form.

US Legal Forms may be the biggest catalogue of lawful kinds where you will find numerous file web templates. Take advantage of the company to obtain skillfully-produced paperwork that stick to express demands.

Form popularity

FAQ

The due diligence questionnaire (DDQ) is an industry-standard form that many LPs, especially the larger institutional ones, may use to quickly cross-compare and answer typical questions that arise in their diligence process. Many of the questions in the document may also be answered elsewhere in your data room.

A typical due diligence checklist for private equity will include finance, legal, tax, management team, and assets?but depending on the PE fund and the target company industry, you will likely add more categories to your due diligence checklist.

Due diligence is the process of gathering and verifying relevant information about a company or person to enable the ordering party to make an informed decision. The ordering party can be the buyer or the seller ? due diligence has value for both parties in any M&A scenario.

Due diligence is defined as an investigation of a potential investment (such as a stock) or product to confirm all facts. These facts can include such items as reviewing all financial records, past company performance, plus anything else deemed material.

Due diligence (DD) is an extensive process undertaken by an acquiring firm in order to thoroughly and completely assess the target company's business, assets, capabilities, and financial performance. There may be as many as 20 or more angles of due diligence analysis.

A due diligence letter is a notice sent to a debtor informing them of the creditor agency's intention to refer their debt to TOP for offset against federal payments. The letter contains specific language informing the debtor of their options and rights.

Due diligence is how PE firms assess all the investment opportunities and determine which deals are worth pursuing, and which ones should be passed over. This is a large pool to evaluate; the average private equity investor reviews 80 opportunities for every one investment.

Due diligence is a rigorous process that determines whether or not the venture capital fund or other investor will invest in your company. The process involves asking and answering a series of questions to evaluate the business and legal aspects of the opportunity.