This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

California Royalty Payments

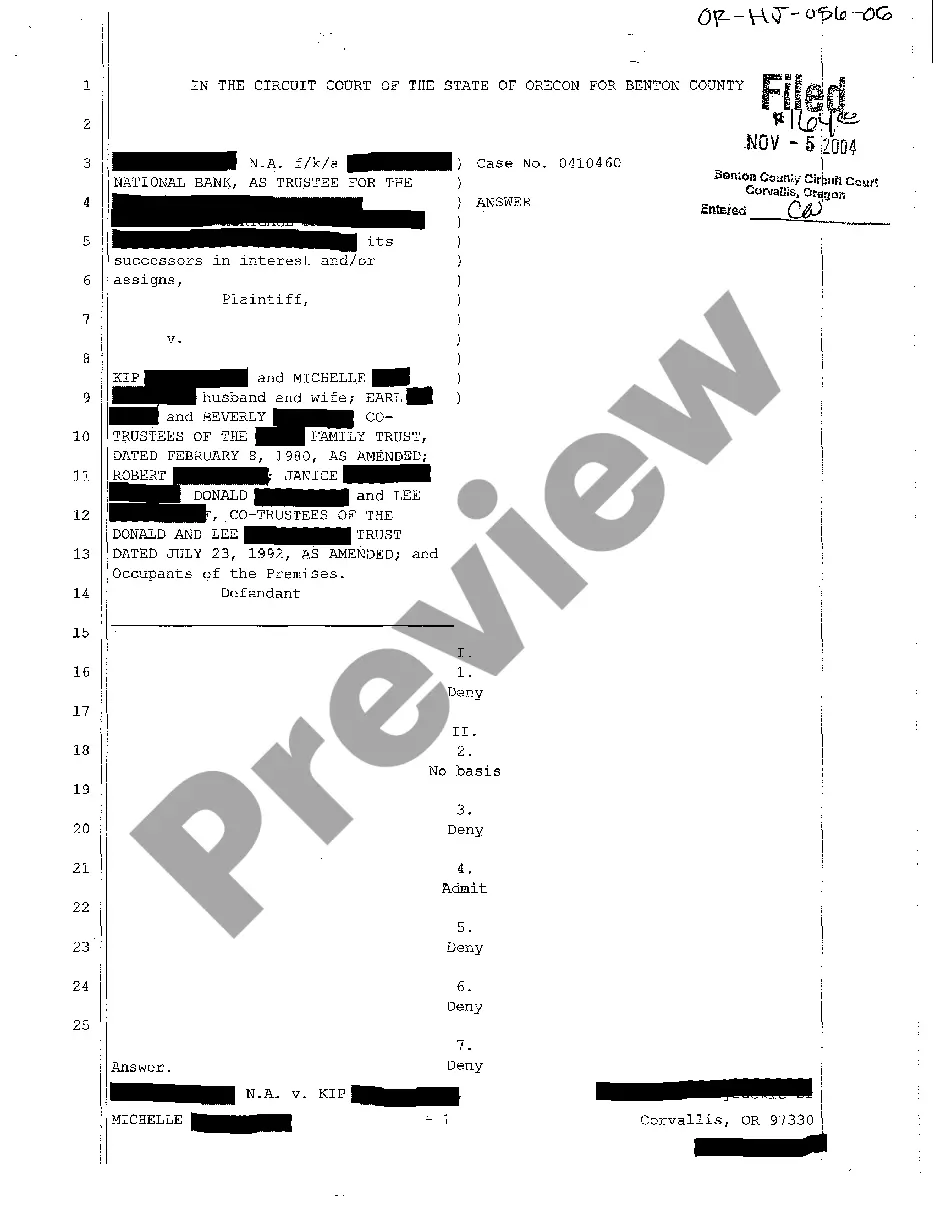

Description

How to fill out Royalty Payments?

Have you been inside a situation in which you need documents for both business or person functions just about every day time? There are a lot of lawful record layouts available on the net, but getting ones you can depend on is not effortless. US Legal Forms delivers a large number of develop layouts, just like the California Royalty Payments, that happen to be published to satisfy federal and state specifications.

If you are presently familiar with US Legal Forms site and have an account, just log in. Next, you are able to obtain the California Royalty Payments format.

Should you not have an accounts and want to start using US Legal Forms, follow these steps:

- Obtain the develop you need and make sure it is to the right town/county.

- Take advantage of the Review switch to examine the form.

- Read the outline to ensure that you have selected the right develop.

- In the event the develop is not what you are looking for, utilize the Search discipline to discover the develop that fits your needs and specifications.

- When you obtain the right develop, just click Acquire now.

- Select the costs strategy you want, fill out the desired info to produce your money, and purchase the transaction utilizing your PayPal or charge card.

- Select a practical file format and obtain your backup.

Get each of the record layouts you possess purchased in the My Forms food list. You can get a extra backup of California Royalty Payments anytime, if required. Just click the required develop to obtain or print out the record format.

Use US Legal Forms, probably the most extensive selection of lawful types, to conserve time as well as stay away from blunders. The service delivers professionally made lawful record layouts that you can use for a range of functions. Create an account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Royalty income is generally reported on Schedule E; however, if you are in business as a self-employed writer, inventor, artist, etc., report your royalty income and expenses on Schedule C (Form 1040) Profit or Loss From Business (if you need help accessing Schedule C, go to our Schedule C - Entering Sole ...

Investing in Royalty Trusts The easiest way to invest for royalty income is by purchasing shares of a royalty trust. These are publicly traded corporations that acquire ownership of rights to leases and deposits of oil, gas and minerals. The income generated from royalties is distributed to shareholders as dividends.

Royalty income is the amount received through a licensing or rights agreement for the use of copyrighted works, influencer endorsements, intellectual property like patents, or natural resources like oil and gas properties, often including an upfront payment and ongoing earnings and payments.

Royalty Payment Income royalty contract, agreement, or statement confirming amount, frequency, and duration of the income; and. borrower's most recent signed federal income tax return, including the related IRS Form 1040, Schedule E.

Royalties. Royalties from copyrights, patents, and oil, gas and mineral properties are taxable as ordinary income. You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss.

The California Franchise Tax Board (FTB) requires the withholding of tax from payments of rents and royalties for the use of property (real or personal) located in California. ( Sec. 18662, Rev. & Tax.

You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss. However, if you hold an operating oil, gas, or mineral interest or are in business as a self-employed writer, inventor, artist, etc., report your income and expenses on Schedule C.

In most cases, you'll report your royalties in Part I of Schedule E on your Form 1040 or Form 1040-SR, identified as Supplemental Income and Loss.