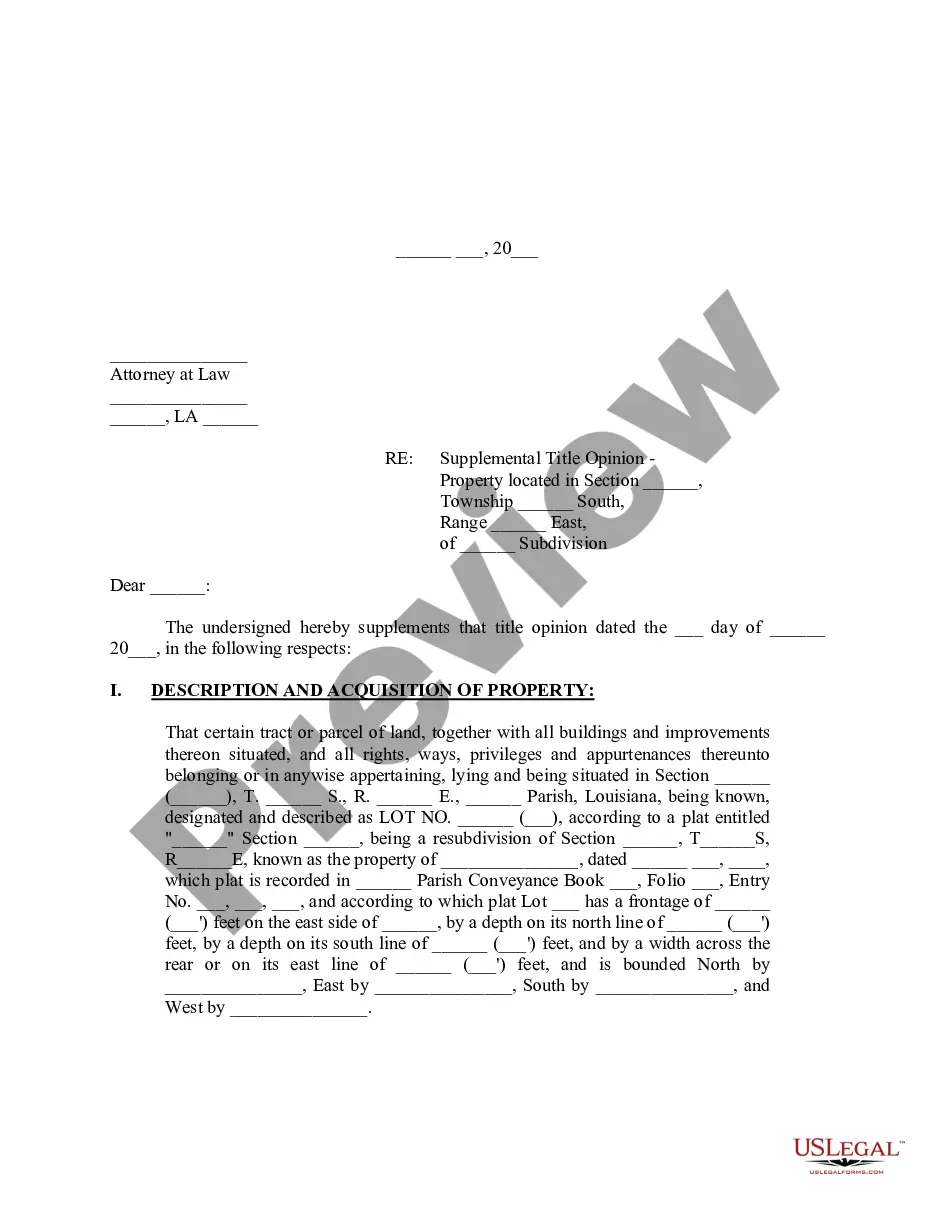

California Subordination Agreement with no Reservation by Lienholder

Description

How to fill out Subordination Agreement With No Reservation By Lienholder?

You can devote time on the web trying to find the legitimate document format that meets the federal and state needs you will need. US Legal Forms provides thousands of legitimate kinds which are analyzed by specialists. It is simple to acquire or print out the California Subordination Agreement with no Reservation by Lienholder from my services.

If you currently have a US Legal Forms accounts, it is possible to log in and click on the Download switch. Next, it is possible to comprehensive, modify, print out, or indication the California Subordination Agreement with no Reservation by Lienholder. Each legitimate document format you get is your own property forever. To acquire an additional backup for any bought type, go to the My Forms tab and click on the related switch.

If you are using the US Legal Forms internet site for the first time, keep to the straightforward guidelines listed below:

- Very first, be sure that you have chosen the right document format to the region/area of your choosing. Read the type explanation to make sure you have chosen the right type. If offered, utilize the Preview switch to search through the document format too.

- If you want to discover an additional version of the type, utilize the Search industry to get the format that fits your needs and needs.

- Once you have discovered the format you need, just click Buy now to proceed.

- Choose the pricing plan you need, type in your references, and sign up for a free account on US Legal Forms.

- Full the transaction. You may use your credit card or PayPal accounts to purchase the legitimate type.

- Choose the formatting of the document and acquire it in your gadget.

- Make modifications in your document if necessary. You can comprehensive, modify and indication and print out California Subordination Agreement with no Reservation by Lienholder.

Download and print out thousands of document web templates using the US Legal Forms Internet site, which offers the most important assortment of legitimate kinds. Use expert and state-certain web templates to take on your organization or person requirements.

Form popularity

FAQ

Hear this out loud PauseExample of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

The creditor usually will require the debtor to sign a subordination agreement which ensures they get paid before other creditors, ensuring they are not taking on high risks.

A subordinated loan agreement (SLA) must be filed with NFA at least ten days prior to the proposed effective date of the agreement.

Hear this out loud PauseA Subordination Agreement is a legal document that establishes the priority of liens or claims against a specific asset.

Hear this out loud PauseTo adjust their priority, subordinate lienholders must sign subordination agreements, making their loans lower in priority than the new lender. A subordination agreement puts the new lender into first position and reassigns an existing mortgage to second position or third position, and so on.

Who Executes a Subordination Agreement? The new lender prepares the subordination agreement in conjunction with the subordinating lienholder. Then, the parties typically sign the agreement.

Hear this out loud PauseSubordination agreements may be included in existing deeds of trust or may be outlined in an independent contract. In situations where two deeds of trust are being recorded concurrently, the lien priority is typically handled by instructing the title company as to which security instrument will be recorded first.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.