California Underwriter Agreement - Self-Employed Independent Contractor

Description

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

Are you presently in a situation where you often require documents for either business or personal activities nearly every day.

There are numerous legal document templates available online, but finding ones you can trust is not simple.

US Legal Forms provides a vast array of form templates, including the California Underwriter Agreement - Self-Employed Independent Contractor, which can be tailored to meet state and federal requirements.

Utilize US Legal Forms, one of the most extensive collections of legal documents, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the California Underwriter Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/region.

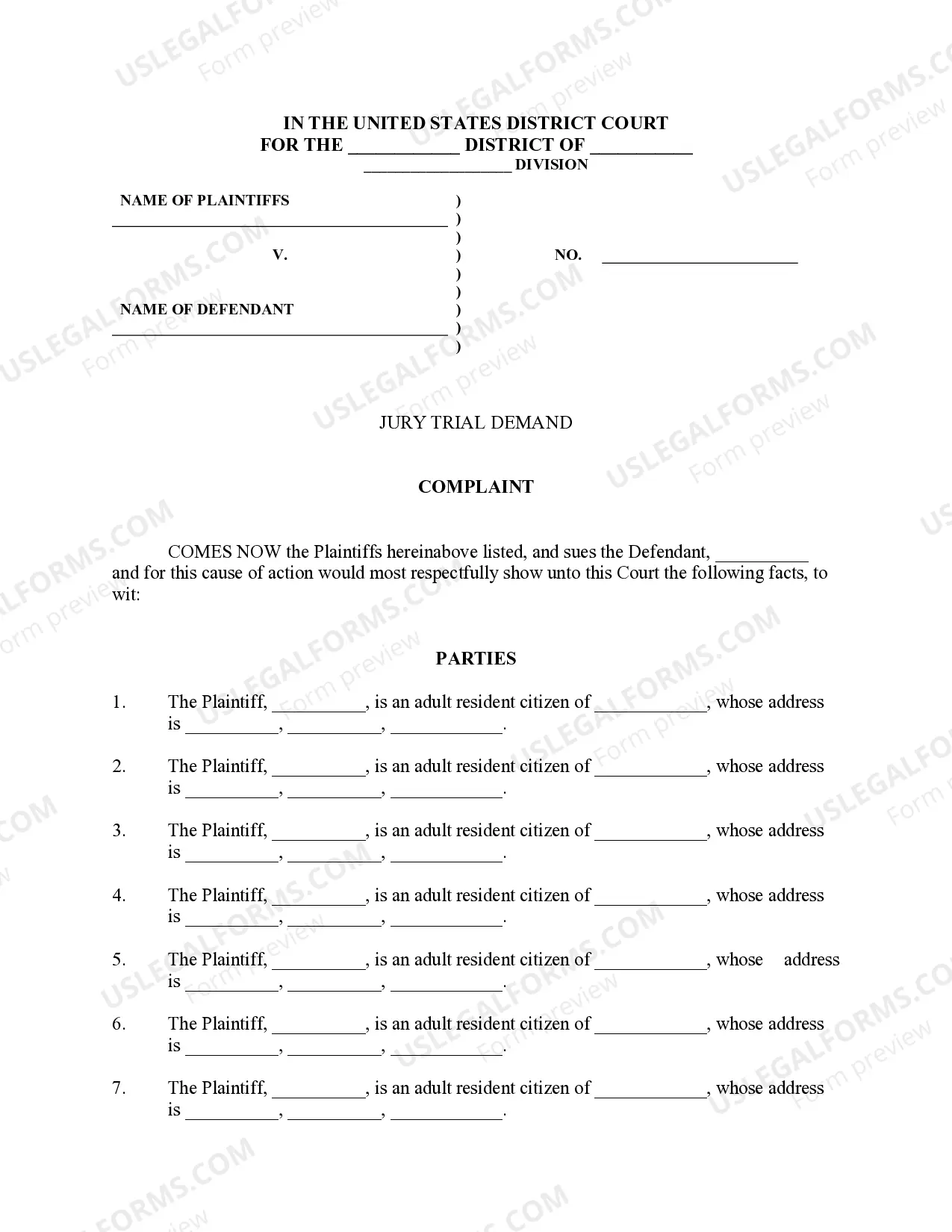

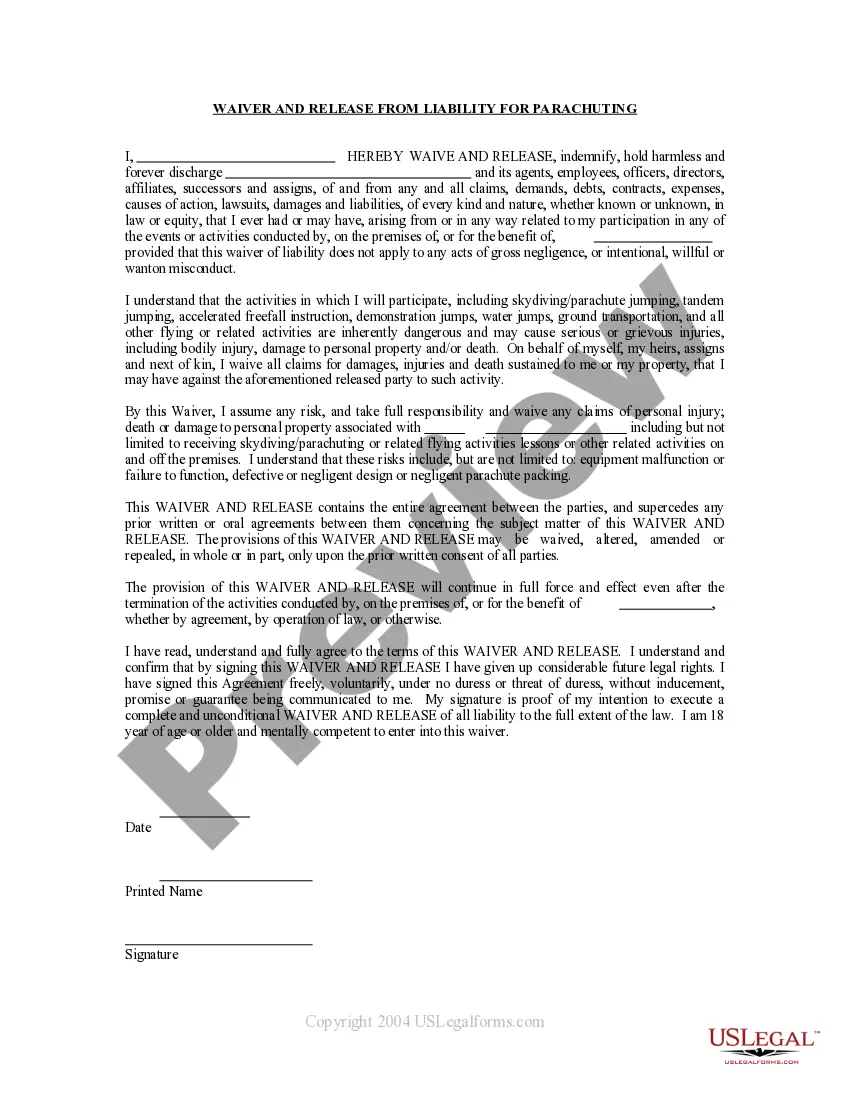

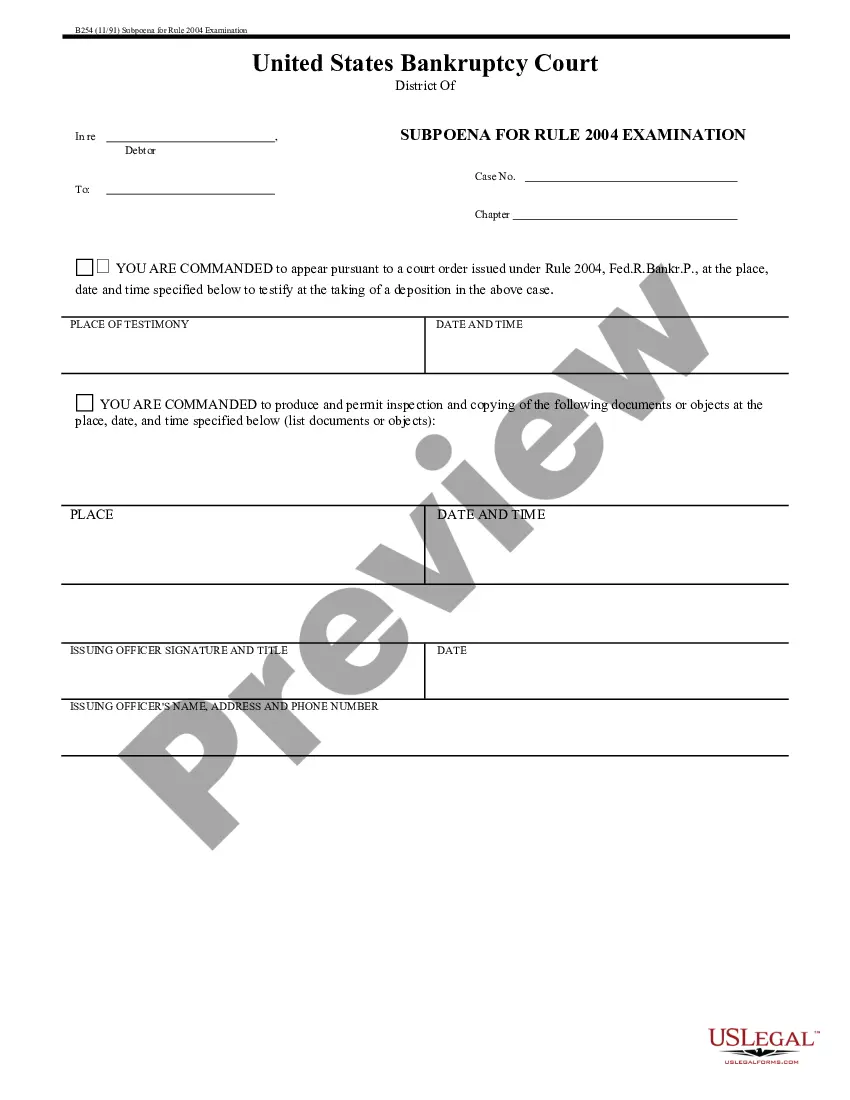

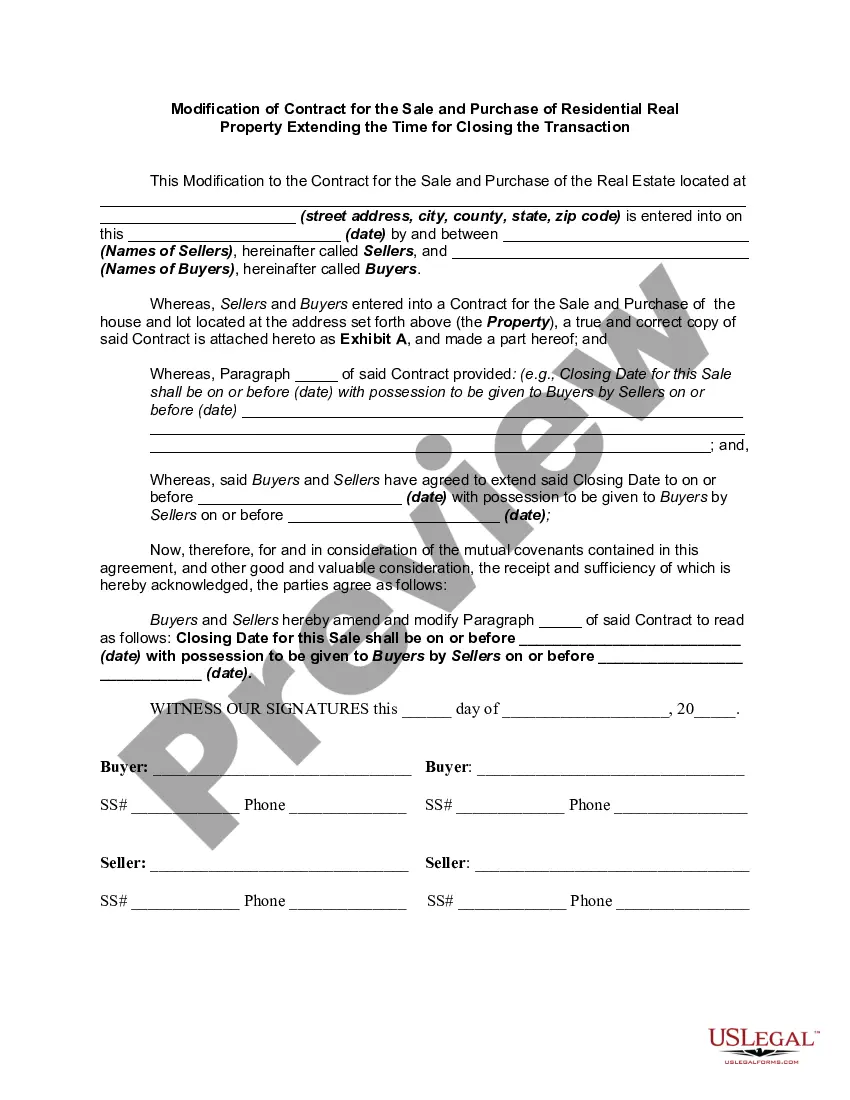

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your needs and requirements.

- Once you find the right form, just click Get now.

- Select the pricing plan you prefer, fill in the necessary details to create your account, and purchase your order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents list.

- You can obtain another copy of the California Underwriter Agreement - Self-Employed Independent Contractor at any time, if needed.

- Simply select the desired form to download or print out the document template.

Form popularity

FAQ

Independent contractors must adhere to several legal requirements, including tax responsibilities, licensing, and compliance with local regulations. Additionally, they often need to sign contracts that define the terms of their work and ensure they meet the criteria outlined in state laws, such as AB5 in California. Those engaged in the California Underwriter Agreement - Self-Employed Independent Contractor should seek legal advice or resources, like US Legal Forms, to navigate these requirements effectively.

The new federal rule on independent contractors aims to simplify the classification process while still protecting workers' rights. This rule seeks to provide a clearer framework for determining whether individuals qualify as independent contractors or employees. For those utilizing the California Underwriter Agreement - Self-Employed Independent Contractor, it's crucial to stay updated on these federal guidelines to ensure compliance and stability in their business practices.

Yes, an independent contractor is typically considered self-employed, as they operate their own business and provide services to clients independently. This status allows for greater flexibility and control over work arrangements, making it appealing to many professionals. If you are navigating the California Underwriter Agreement - Self-Employed Independent Contractor, this classification allows you to maximize your business opportunities.

As of 2025, proposed changes to the freelance law in California aim to clarify the rules around independent contracting. While specifics are still evolving, these changes may continue to emphasize the requirement for independent contractors to be distinct from employees. Staying informed about this legislation is vital for those engaged in agreements such as the California Underwriter Agreement - Self-Employed Independent Contractor.

Generally, independent contractors are not considered employees in California, but the distinction can be nuanced due to laws like AB5. This law introduces a more stringent test for determining independent contractor status, which affects how many individuals are classified. Understanding these differences is essential, particularly for those utilizing the California Underwriter Agreement - Self-Employed Independent Contractor.

AB5, also known as Assembly Bill 5, significantly impacts how independent contractors are classified in California. Under this law, it becomes more challenging for individuals to qualify as independent contractors since it adopts a stricter standard for determining employment status. For those involved in the California Underwriter Agreement - Self-Employed Independent Contractor, understanding AB5 is crucial for compliance and to maintain their working status.

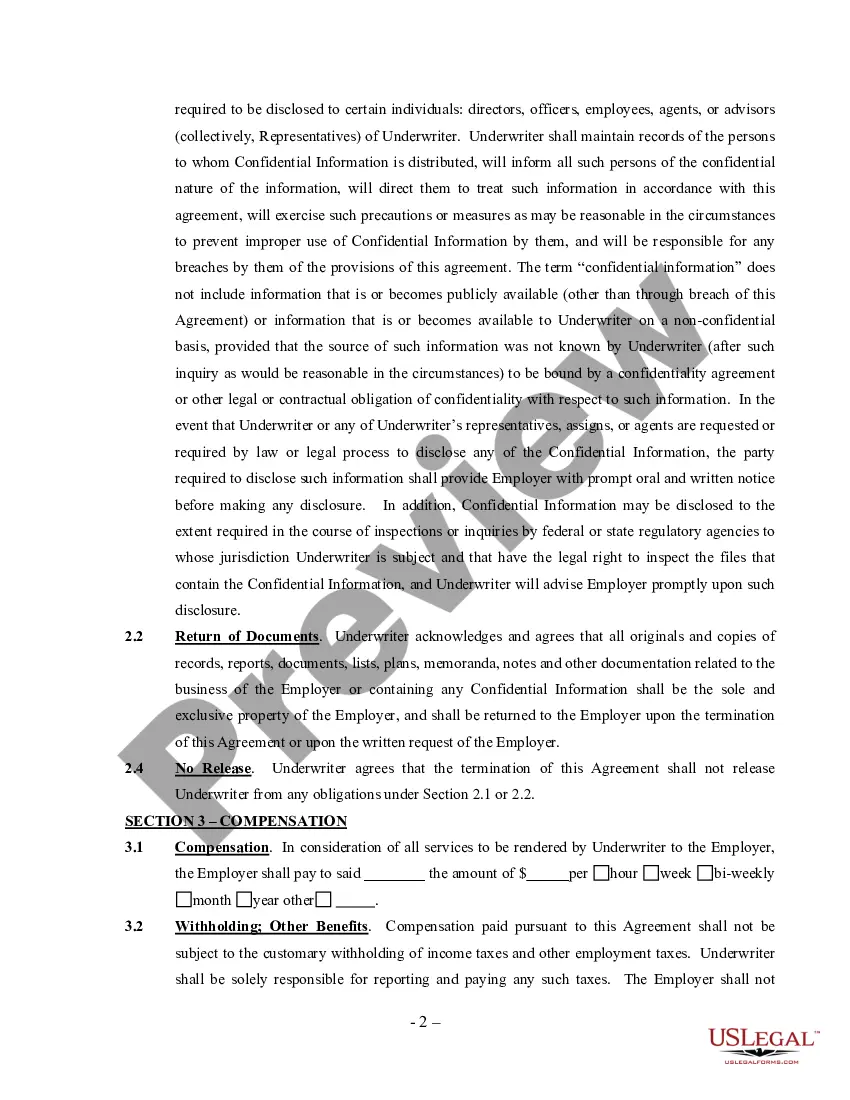

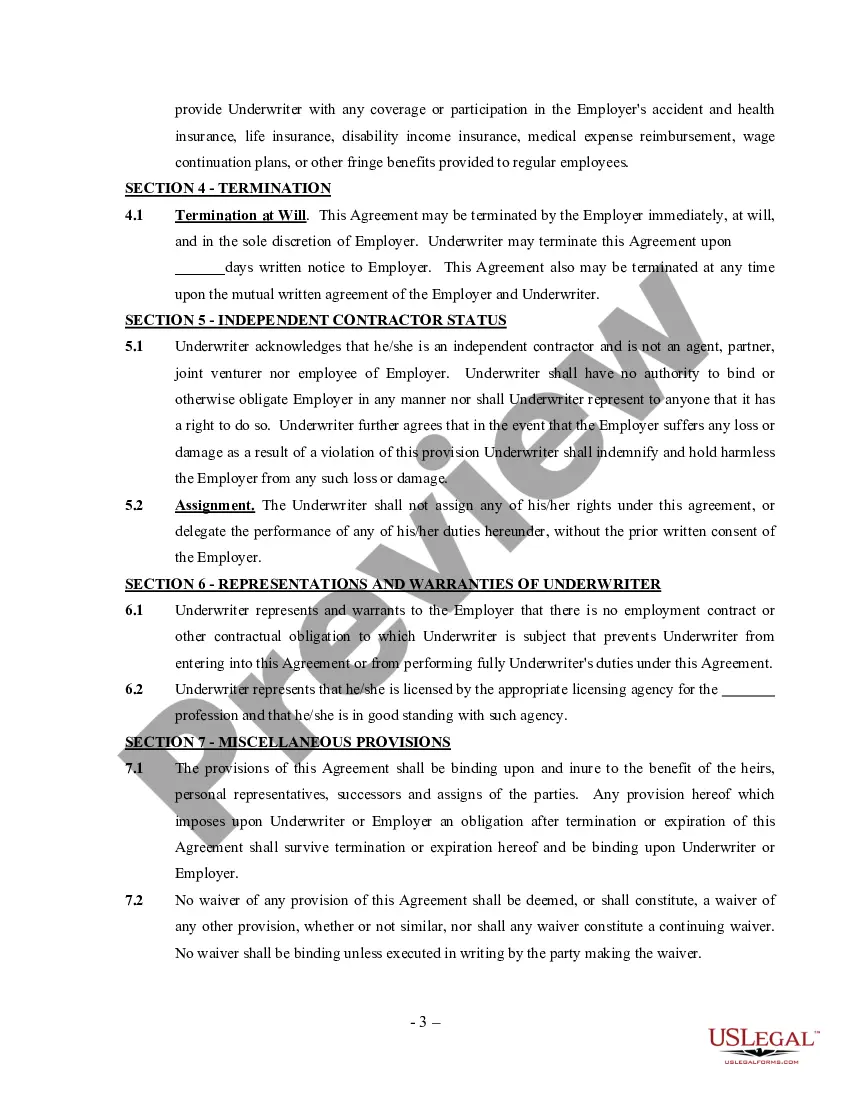

Filling out an independent contractor agreement is straightforward when you know what to include. Clearly state the roles, responsibilities, payment structure, and any confidentiality clauses. Utilizing resources from USLegalForms can help you draft an agreement that aligns with the California Underwriter Agreement - Self-Employed Independent Contractor, ensuring you meet all legal requirements effectively.

To complete a declaration of independent contractor status form, you need to include your name, business address, and a description of services rendered. Be sure to reference any laws, such as the California Underwriter Agreement - Self-Employed Independent Contractor, relevant to your classification. This form is vital for maintaining your status and ensuring compliance with state regulations.

Filling out an independent contractor form involves providing your personal information, the nature of your work, and payment methods. Carefully review each section to ensure accuracy and completeness. You can streamline this process by using templates from USLegalForms, which provide guidance tailored to the California Underwriter Agreement - Self-Employed Independent Contractor.

Writing an independent contractor agreement requires clarity and detail. Start by outlining the scope of work, payment terms, and deadlines. Ensure you include the California Underwriter Agreement - Self-Employed Independent Contractor components to protect both parties and avoid any misunderstandings related to responsibilities and deliverables.