California Disability Services Contract - Self-Employed

Description

How to fill out Disability Services Contract - Self-Employed?

Are you presently in a situation where you require documents for both professional or specific purposes almost daily.

There are numerous legal document templates available online, but finding reliable ones isn't easy.

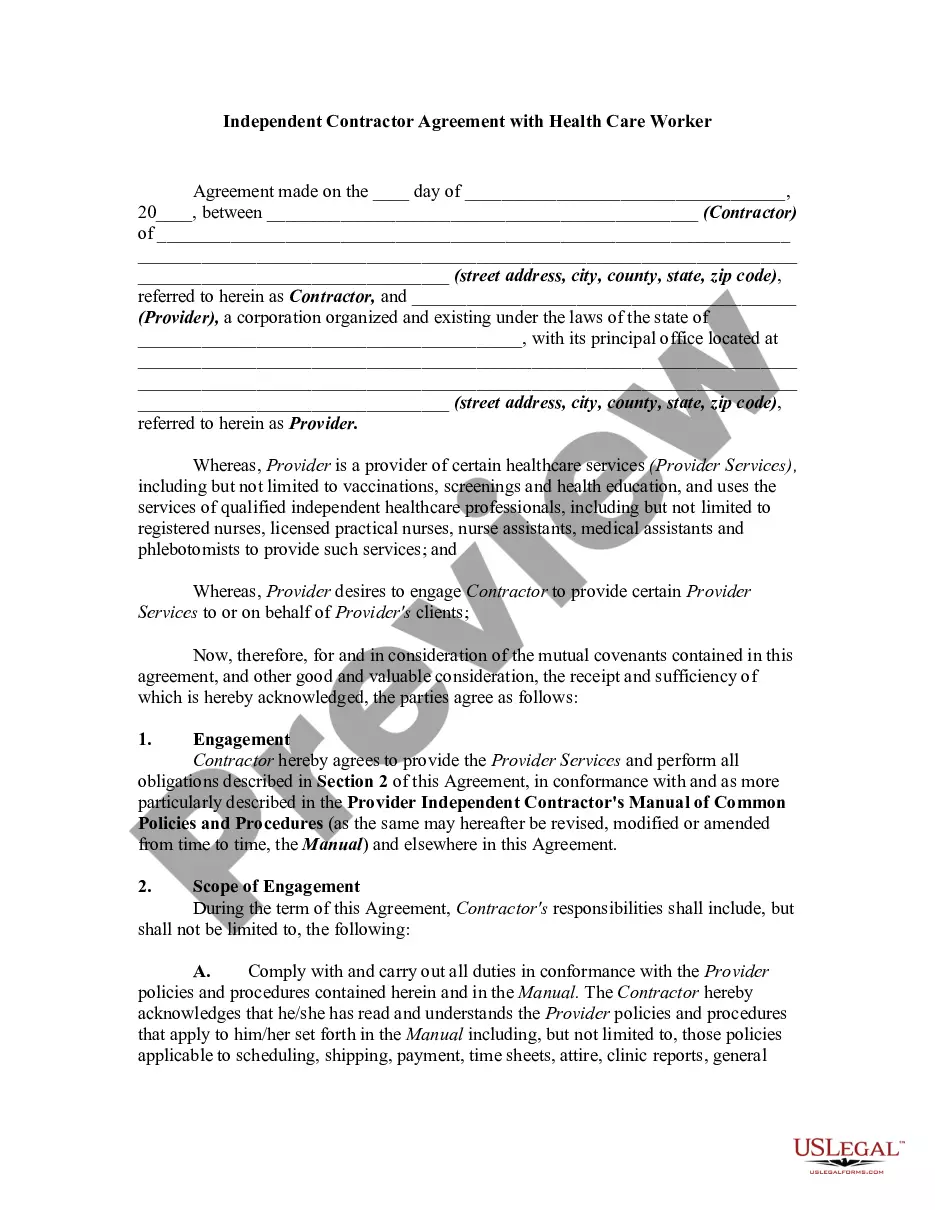

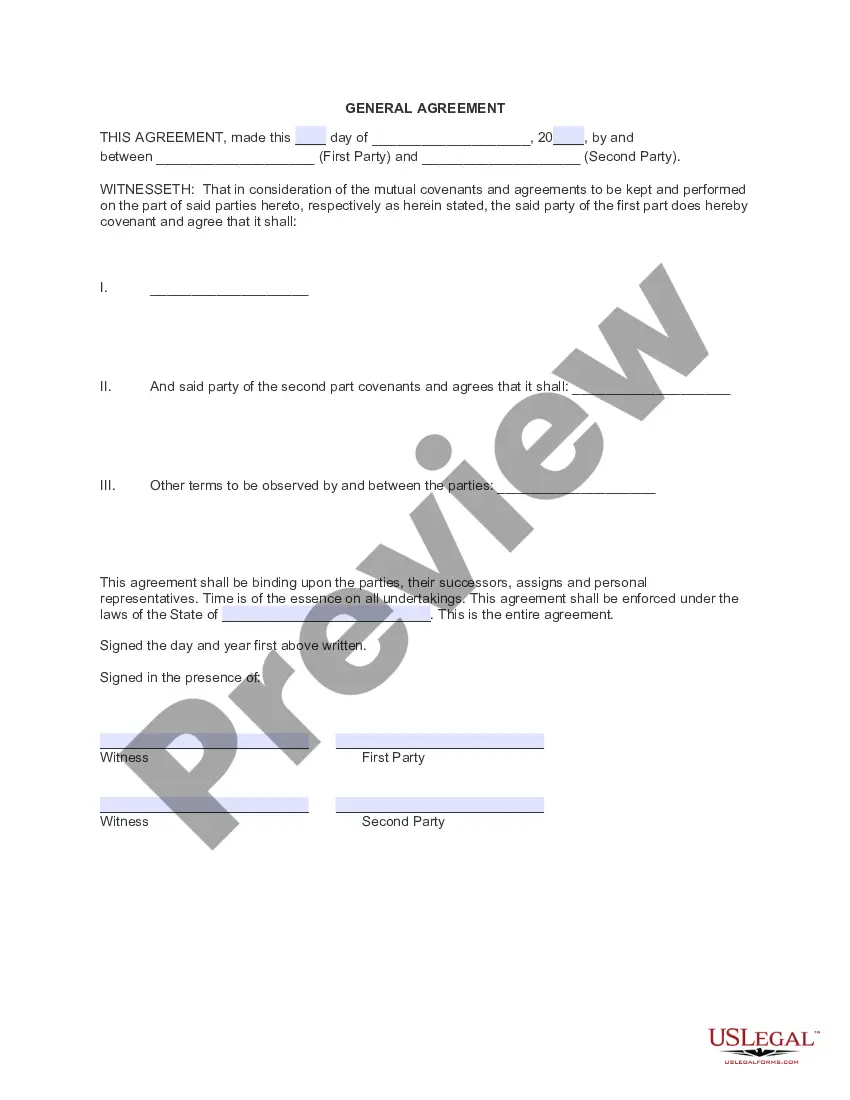

US Legal Forms offers a vast array of form templates, including the California Disability Services Contract - Self-Employed, designed to meet state and federal requirements.

Once you acquire the appropriate form, click Buy now.

Select the pricing plan you desire, complete the necessary information to create your account, and finalize the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the California Disability Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct state/region.

- Utilize the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Yes, you often need a license to work as an independent contractor in California. The specific requirements depend on your industry and the services you provide. For instance, many professions require a California Disability Services Contract - Self-Employed to comply with legal standards and service provisions. Consult your local licensing board to ensure you meet all necessary regulations.

Obtaining disability insurance as a self-employed person involves a few straightforward steps. You begin by researching various providers that offer a California Disability Services Contract - Self-Employed. Then, you compare policies to identify the coverage options that suit your needs best. Finally, apply for a plan that covers your specific income requirements and risks.

Disability insurance is an essential investment for self-employed individuals. It protects your income in case you cannot work due to a medical condition. With a California Disability Services Contract - Self-Employed, you ensure financial stability and peace of mind during unexpected circumstances. Consider this coverage as a safety net that allows you to focus on your business.

Be unable to do your regular or customary work for at least eight days. Have lost wages because of your disability. Be employed or actively looking for work at the time your disability begins. Have earned at least $300 from which State Disability Insurance (SDI) deductions were withheld during your base period.

Self-employed individuals are only covered by the SDI program if they have enrolled in Disability Insurance Elective Coverage with EDD and paid the premiums. Usually you become eligible for benefits after six months of elective coverage.

If you are an independent contractor, you can opt in to Paid Family Leave (PFL) and State Disability Insurance (SDI) by applying for the Disability Insurance Elective Coverage (DIEC) program. You would need to start paying into the program in advance of needing it in order to establish a base period.

Any self-employed person, independent contractor, or general partner who meets the requirements can apply for Disability Insurance Elective Coverage (DIEC). It is not required that all active general partners be included in the application.

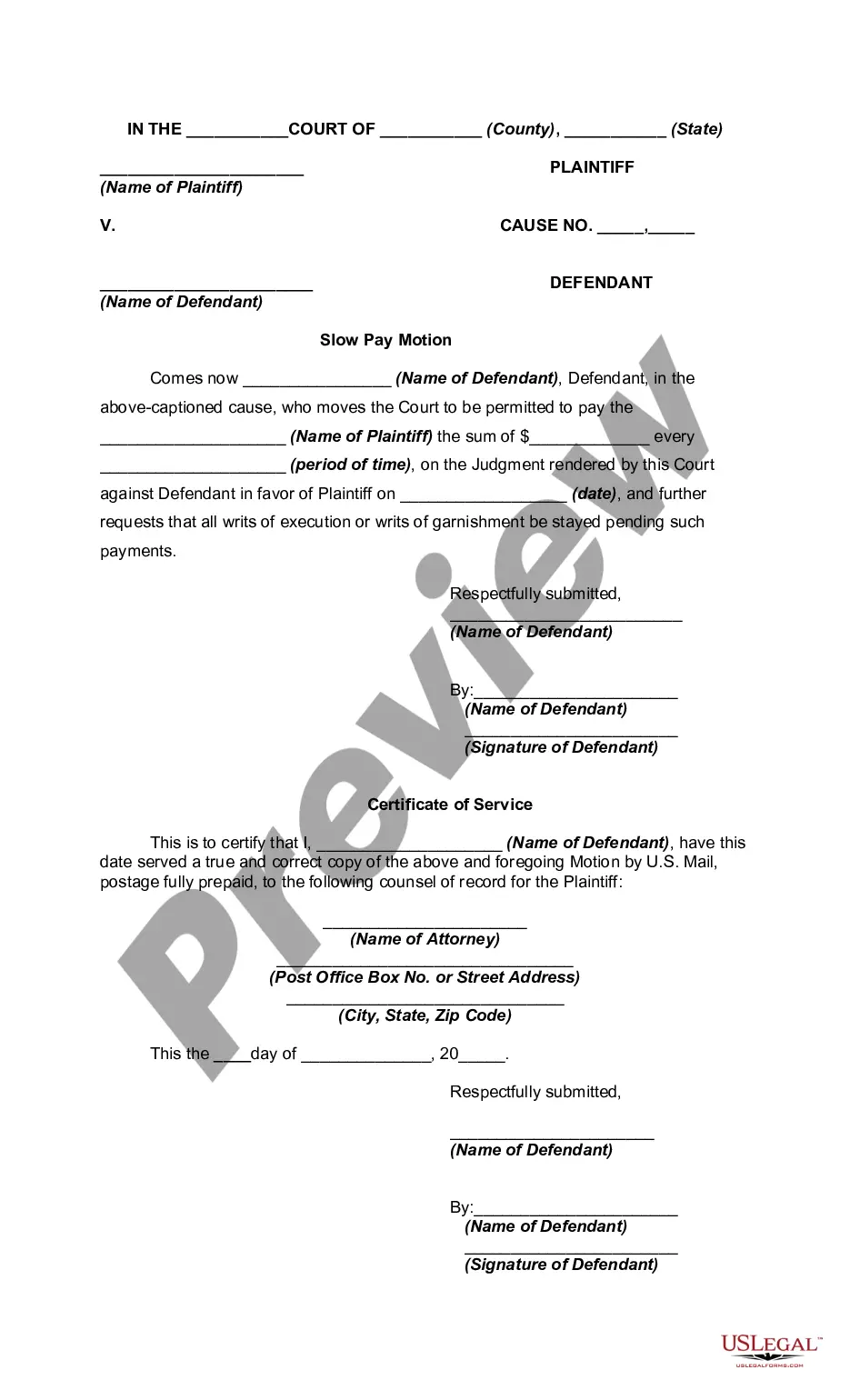

Reporting Requirements You must report independent contractor information to the EDD within 20 days of either making payments totaling $600 or more or entering into a contract for $600 or more or entering with an independent contractor in any calendar year, whichever is earlier.

The following were eligible for PUA: Business owners. Self-employed workers. Independent contractors.

Students under the age of 22 in a qualified work experience program are exempt from UI, ETT, and SDI but are subject to PIT withholding. Students working for the school in which they are enrolled and regularly attending classes are not subject to UI, ETT, and SDI.