California Convertible Secured Promissory Note

Description

How to fill out Convertible Secured Promissory Note?

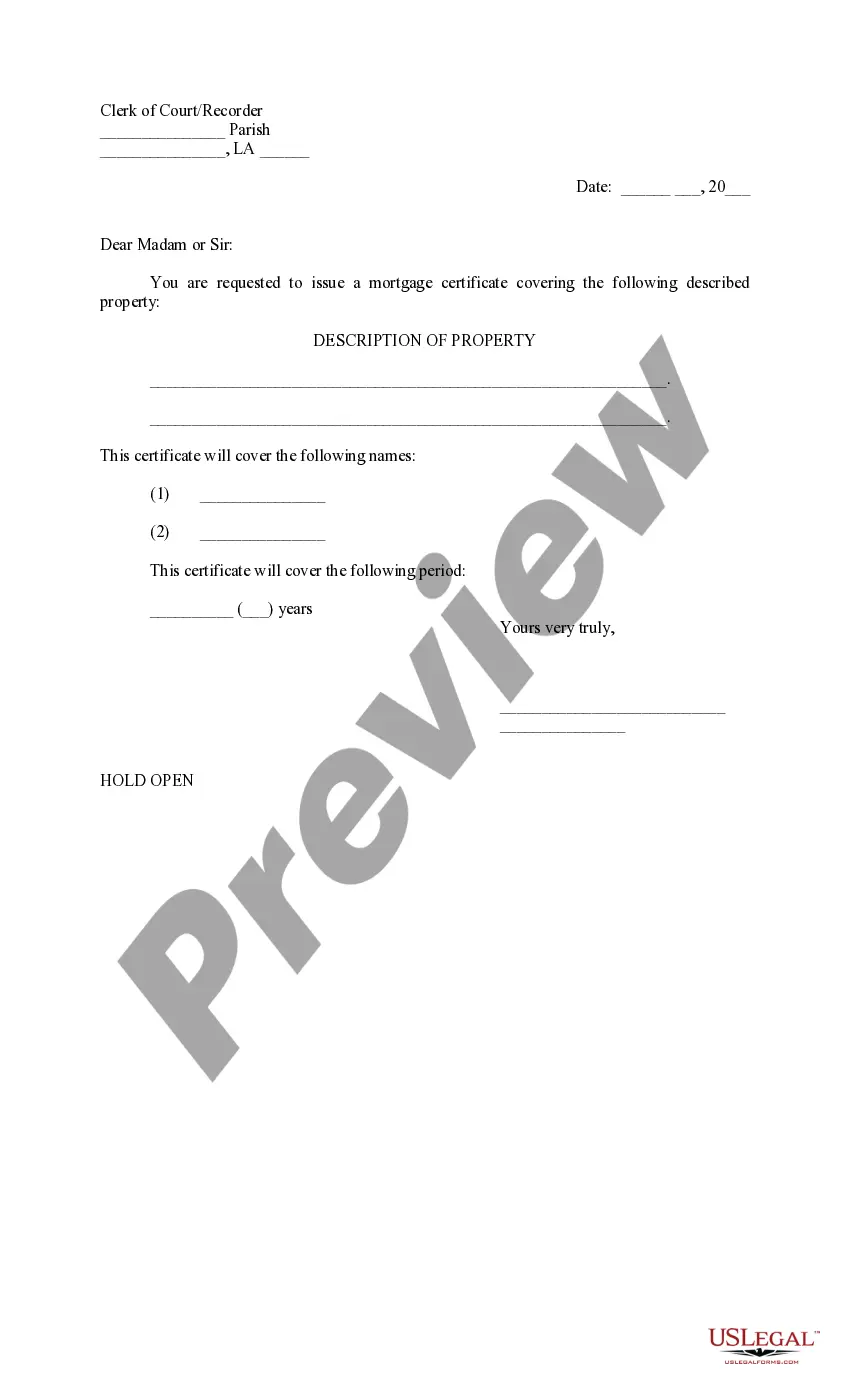

Choosing the best legal papers format can be a have a problem. Of course, there are plenty of templates accessible on the Internet, but how will you discover the legal kind you require? Utilize the US Legal Forms website. The assistance offers a large number of templates, for example the California Convertible Secured Promissory Note, that you can use for organization and private demands. All of the varieties are examined by professionals and meet up with state and federal demands.

When you are currently listed, log in to your bank account and click the Down load option to have the California Convertible Secured Promissory Note. Make use of bank account to check through the legal varieties you might have ordered in the past. Check out the My Forms tab of the bank account and have an additional duplicate of your papers you require.

When you are a fresh user of US Legal Forms, listed here are simple guidelines for you to adhere to:

- Very first, ensure you have selected the proper kind for your metropolis/county. You may look through the form utilizing the Review option and browse the form explanation to make sure it will be the right one for you.

- If the kind fails to meet up with your expectations, use the Seach field to discover the right kind.

- Once you are positive that the form would work, click on the Get now option to have the kind.

- Select the costs strategy you want and type in the needed information and facts. Create your bank account and buy the order making use of your PayPal bank account or charge card.

- Select the file formatting and acquire the legal papers format to your gadget.

- Full, edit and print and indication the attained California Convertible Secured Promissory Note.

US Legal Forms may be the most significant collection of legal varieties that you can see various papers templates. Utilize the company to acquire expertly-produced documents that adhere to express demands.

Form popularity

FAQ

Conversion to Equity - Accounting for Convertible Debt When the note converts, usually during a new funding round, the liability moves to the equity section of the balance sheet. At this stage, the convertible note is settled, and new equity instruments, typically preferred shares, are issued to the investor.

A secured convertible promissory note, or SCP for short, is a type of security instrument that gives the holder the right to convert their debt into equity in the issuer company. Typically, an SCP will convert at a discount to the market value of the company's shares at the time of conversion.

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral.

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral. Free Secured Promissory Note Template & FAQs Rocket Lawyer ? ... ? Loans Rocket Lawyer ? ... ? Loans

What is a Secured Promissory Note? A secured promissory note is an acknowledgment of debt that includes collateral (security) if the borrower defaults. The note will include when the payments are due and, if paid late, the security will be handed over to the lender as a replacement for the amount owed. Free Secured Promissory Note Template - PDF | Word - eForms eForms ? Promissory Note eForms ? Promissory Note

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount. Promissory Notes - Definition, Types, Elements & Points to Remember bankbazaar.com ? personal-loan ? promisso... bankbazaar.com ? personal-loan ? promisso...

A contract for a collateral loan should clearly state what asset(s) are being used to secure the loan and include a clause on what could happen to the asset if the borrower defaults. It should also clearly outline the circumstances under which the collateral could be forfeited to the lender. How to Write a Personal Loan Agreement | LendingTree lendingtree.com ? personal-loan-contracts lendingtree.com ? personal-loan-contracts