California Information Checklist - Accredited Investor Certifications Under Rule 501 of Regulation D

Description

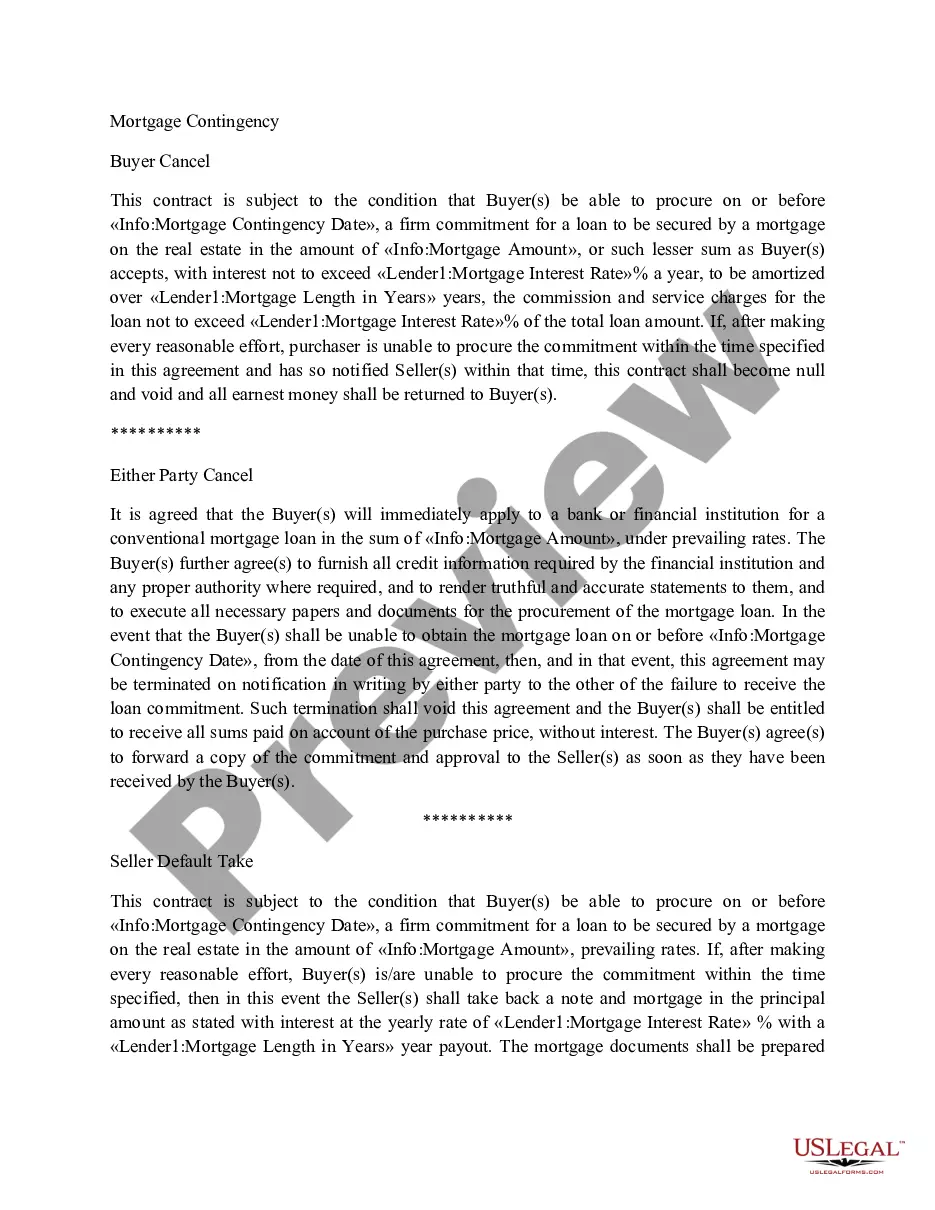

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims.

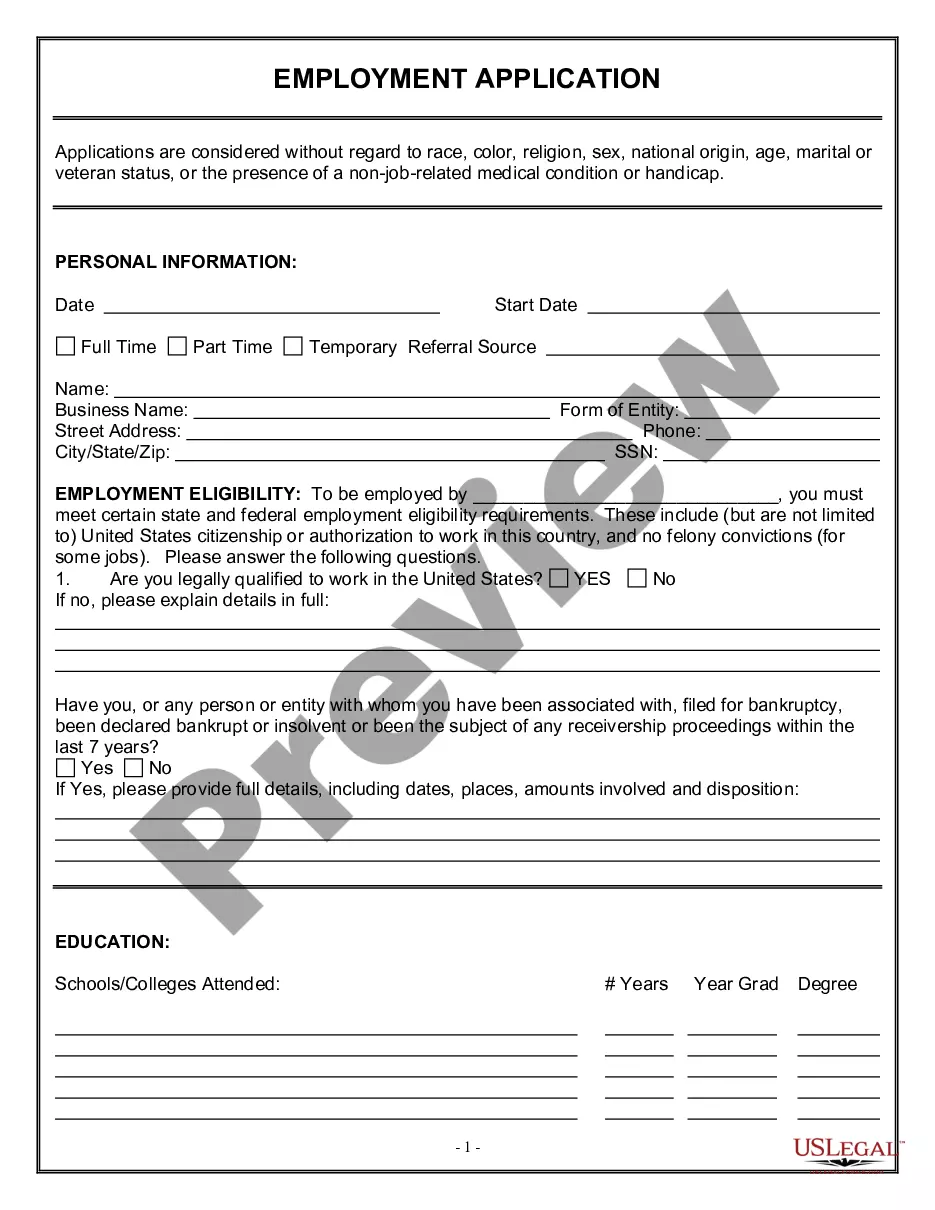

How to fill out Information Checklist - Accredited Investor Certifications Under Rule 501 Of Regulation D?

Have you been in a placement where you require files for either company or personal reasons nearly every day? There are a variety of legal file templates available on the Internet, but locating ones you can rely is not simple. US Legal Forms provides 1000s of develop templates, like the California Information Checklist - Accredited Investor Certifications Under Rule 501 of, that are composed to fulfill state and federal demands.

If you are already acquainted with US Legal Forms web site and have a merchant account, merely log in. Following that, it is possible to obtain the California Information Checklist - Accredited Investor Certifications Under Rule 501 of template.

Unless you come with an account and need to begin using US Legal Forms, abide by these steps:

- Get the develop you want and make sure it is for your appropriate metropolis/area.

- Use the Preview option to review the form.

- Read the information to ensure that you have chosen the proper develop.

- In case the develop is not what you are trying to find, take advantage of the Lookup field to find the develop that suits you and demands.

- When you get the appropriate develop, click on Get now.

- Choose the pricing program you desire, complete the desired information and facts to create your money, and pay for your order using your PayPal or credit card.

- Decide on a convenient data file structure and obtain your backup.

Discover all the file templates you possess purchased in the My Forms food selection. You can obtain a more backup of California Information Checklist - Accredited Investor Certifications Under Rule 501 of anytime, if required. Just select the required develop to obtain or print out the file template.

Use US Legal Forms, the most extensive selection of legal varieties, to save lots of some time and avoid faults. The support provides appropriately created legal file templates which can be used for a variety of reasons. Produce a merchant account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

The law prohibits fraud, deceit, and misrepresentation in the sale of securities, such as bonds or stocks. Rule 501(a) is the part of Regulation D of the '33 Act that defines who and what qualifies to invest in unregistered securities, or an accredited investor.

To qualify as accredited, an individual investor must have a net worth (excluding his or her primary residence) of at least $1 million dollars or an annual income of over $200,000 (or over $300,000 in joint income with a spouse) for the two most recently completed years with a reasonable expectation of achieving the ...

Corporate Entities, Trusts, as Accredited Investors In addition, entities such as banks, partnerships, corporations, nonprofits, and trusts may be accredited investors.

The law prohibits fraud, deceit, and misrepresentation in the sale of securities, such as bonds or stocks. Rule 501(a) is the part of Regulation D of the '33 Act that defines who and what qualifies to invest in unregistered securities, or an accredited investor.

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

The SEC in 2020 issued rules in Release No. 33-10824, Accredited Investor Definition, allowing investors holding certain professional licenses, such as a Series 7, to qualify as accredited, even if they fall short of meeting the income or asset tests.