California Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York

Description

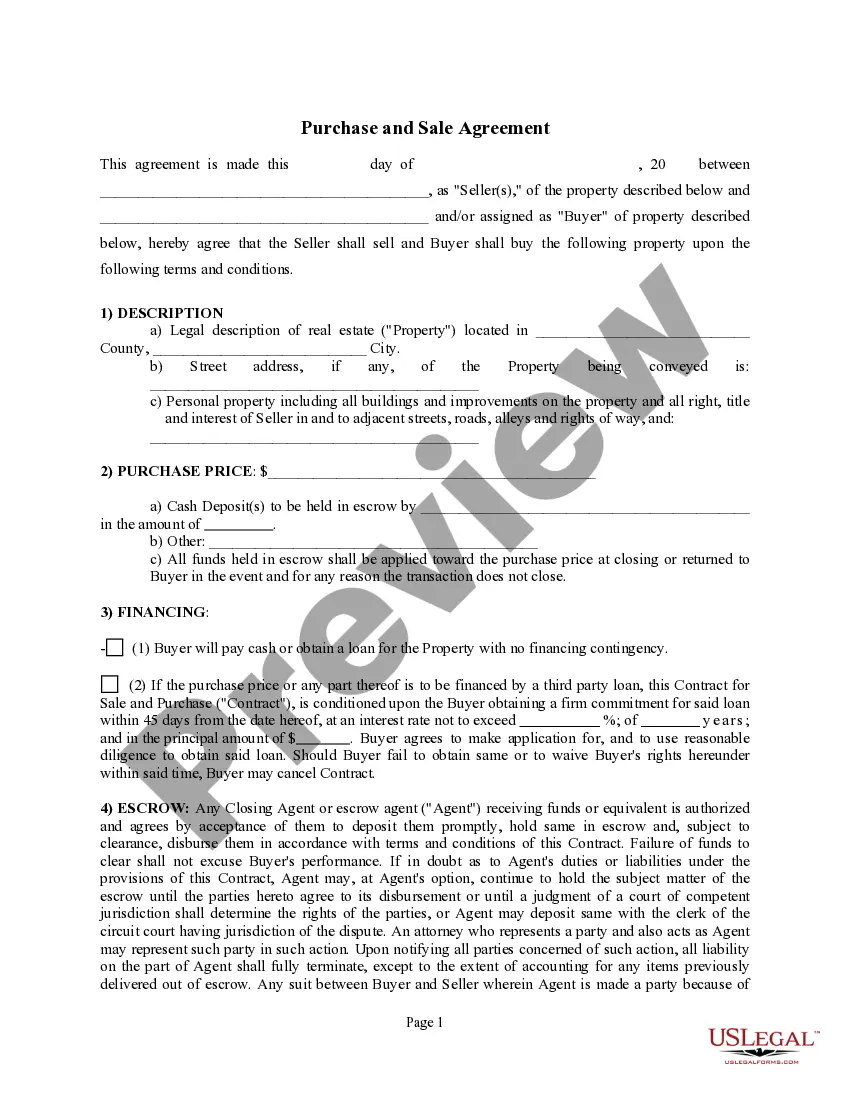

How to fill out Subsequent Pledge Agreement Between ABFS Mortgage Loan Trust And The Bank Of New York?

If you wish to complete, obtain, or produce legitimate papers layouts, use US Legal Forms, the greatest assortment of legitimate kinds, which can be found on-line. Make use of the site`s simple and easy convenient search to find the papers you will need. A variety of layouts for organization and individual uses are sorted by categories and says, or key phrases. Use US Legal Forms to find the California Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York within a handful of click throughs.

When you are already a US Legal Forms customer, log in for your profile and then click the Download switch to get the California Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York. Also you can entry kinds you previously acquired inside the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have chosen the form for the appropriate town/nation.

- Step 2. Use the Review method to examine the form`s content material. Do not neglect to read through the description.

- Step 3. When you are not satisfied using the develop, utilize the Look for area near the top of the monitor to locate other models from the legitimate develop template.

- Step 4. After you have identified the form you will need, go through the Purchase now switch. Opt for the rates prepare you favor and add your credentials to sign up on an profile.

- Step 5. Method the transaction. You can utilize your bank card or PayPal profile to finish the transaction.

- Step 6. Choose the file format from the legitimate develop and obtain it in your product.

- Step 7. Complete, change and produce or sign the California Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York.

Each and every legitimate papers template you acquire is your own property permanently. You may have acces to every develop you acquired in your acccount. Select the My Forms segment and decide on a develop to produce or obtain once more.

Be competitive and obtain, and produce the California Subsequent Pledge Agreement between ABFS Mortgage Loan Trust and The Bank of New York with US Legal Forms. There are many specialist and express-particular kinds you can use for your personal organization or individual requirements.

Form popularity

FAQ

Conventional Mortgages Conventional mortgages are the most common type of mortgage. That said, conventional loans may have different requirements for a borrower's minimum credit score and debt-to-income (DTI) ratio than other loan options.

When purchasing a house, there are three main types of mortgages to choose from: fixed-rate, conventional, and standard adjustable rate. All have different benefits and shortcomings that assist various homebuyer profiles.

Components of a Mortgage Payment Principal. - the amount that was loaned to you by the mortgage lender. Interest. - the fee you're paying the bank for lending you the money. Escrow. - monthly allowance for property taxes and homeowner's insurance.

Bank Account Pledge Agreement means the pledge agreement entered into between the Issuer and the Trustee on or about the First Issue Date in respect of a first priority pledge over the Bank Account and all funds held on the Bank Account from time to time, granted in favour of the Trustee and the Bondholders ( ...

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own. Seven things to look for in a mortgage.

Types of home loans Conventional loan: Best for borrowers with good credit scores. Jumbo loan: Best for borrowers with excellent credit looking to buy a more expensive home. Government-backed loan: Best for borrowers who have lower credit scores and minimal cash for a down payment.

A loan is a sum of money that an individual or company borrows from a lender. It can be classified into three main categories, namely, unsecured and secured, conventional, and open-end and closed-end loans.