California Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan

Description

How to fill out Approval Of Grant Of Security Interest In All Of Assets To Secure Obligations Pursuant To Terms Of Informal Creditor Workout Plan?

Discovering the right lawful document format could be a struggle. Of course, there are tons of web templates available online, but how can you get the lawful develop you require? Use the US Legal Forms website. The support provides a huge number of web templates, like the California Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan, which can be used for enterprise and private demands. All the varieties are checked by pros and satisfy state and federal specifications.

When you are already listed, log in for your account and click the Obtain key to get the California Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan. Use your account to search throughout the lawful varieties you have bought previously. Visit the My Forms tab of the account and acquire an additional copy of the document you require.

When you are a brand new user of US Legal Forms, listed below are basic recommendations that you can stick to:

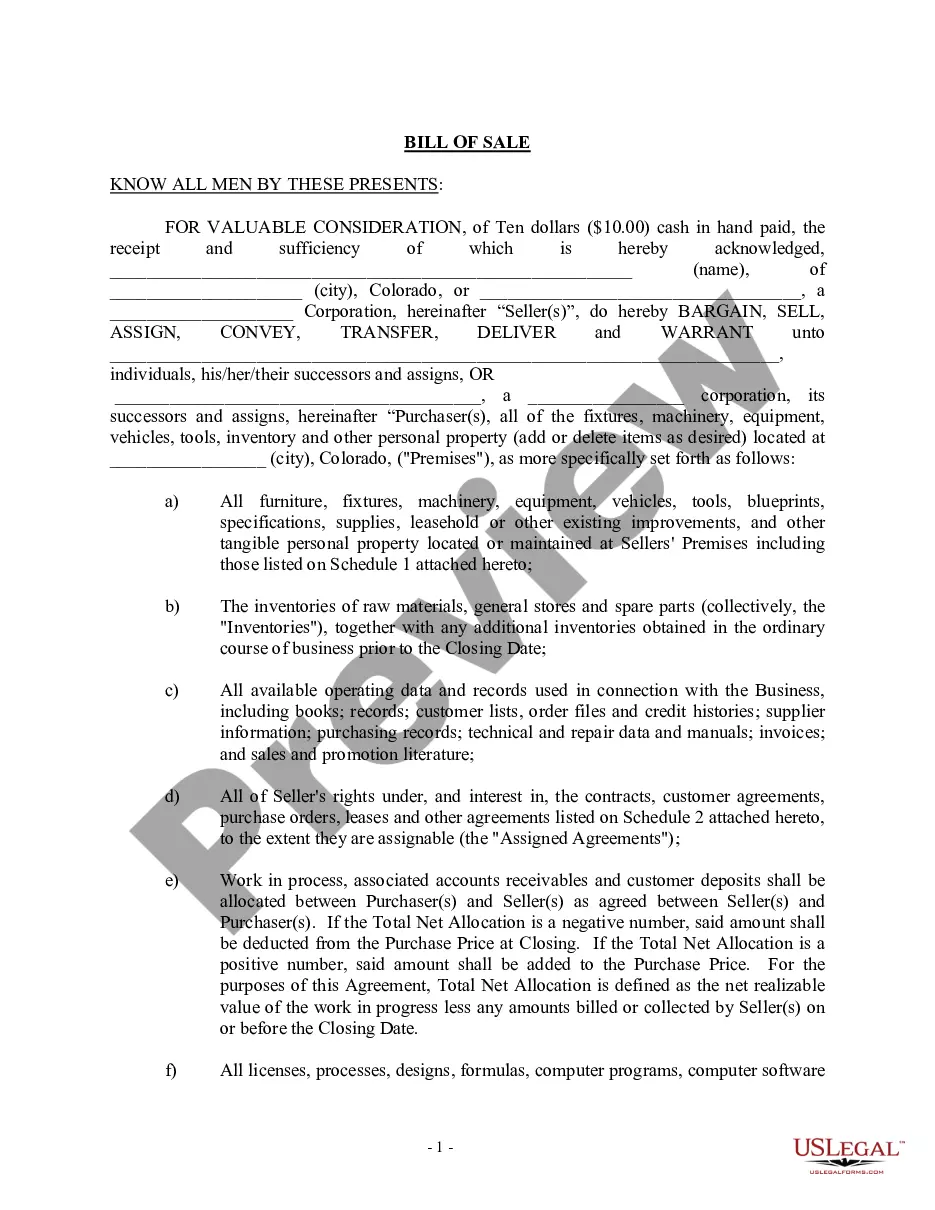

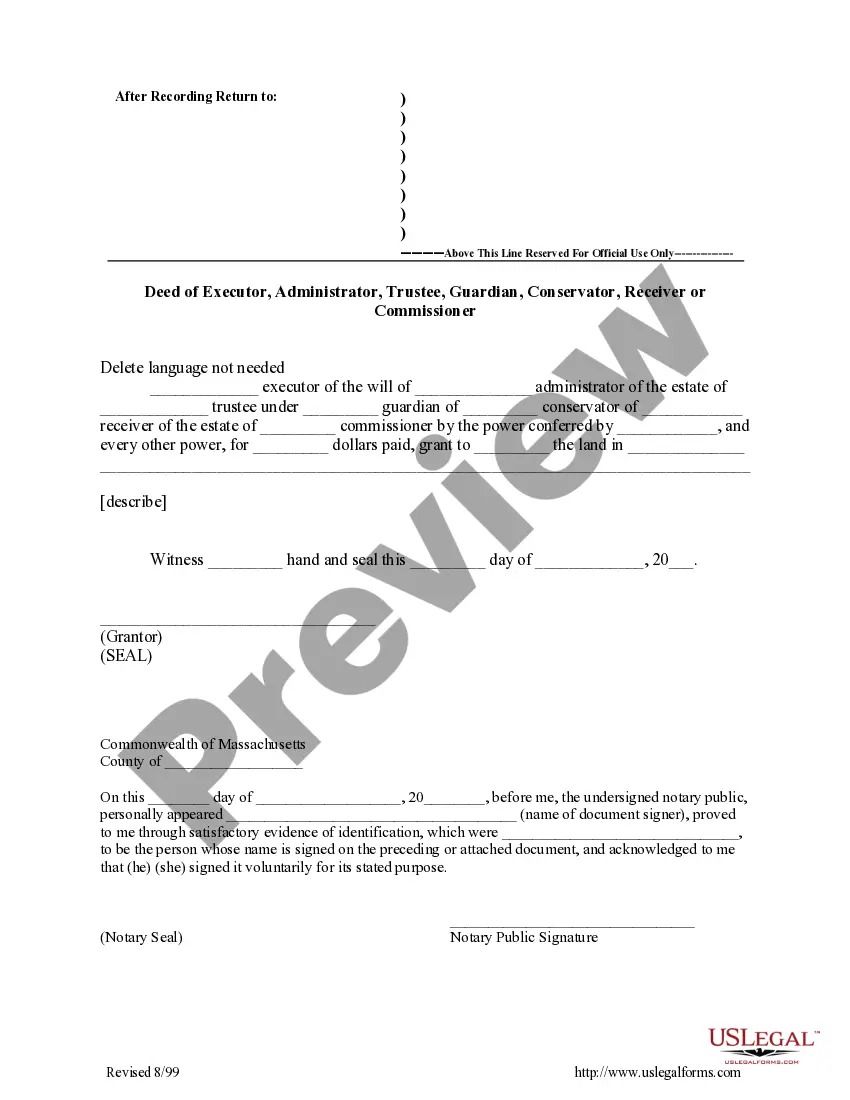

- Initially, make sure you have chosen the right develop for your area/state. You may look over the shape while using Preview key and read the shape explanation to ensure it is the right one for you.

- When the develop is not going to satisfy your needs, make use of the Seach field to discover the correct develop.

- When you are positive that the shape would work, go through the Acquire now key to get the develop.

- Opt for the rates prepare you want and type in the essential details. Design your account and buy the transaction using your PayPal account or charge card.

- Choose the document structure and acquire the lawful document format for your device.

- Full, modify and printing and indicator the acquired California Approval of grant of security interest in all of assets to secure obligations pursuant to terms of informal creditor workout plan.

US Legal Forms is the greatest collection of lawful varieties in which you can discover numerous document web templates. Use the company to acquire expertly-manufactured files that stick to express specifications.

Form popularity

FAQ

If your judgment has already expired, you should consult an attorney before taking any action. California judgments last for 10 years from the date they were entered. If you win a judgment issued by a federal court, you may start collecting right away.

The most effective way to stop a writ of execution is to ask the Judgment Creditor to stop it. The sheriff will often back off if the parties are working to resolve the judgment. We have plenty of experience in settling judgments. Another sure fire way to stop a writ of execution is to file for Bankruptcy.

If you know where the Judgment Debtor banks, you can ask the Sheriff to collect money from their account (bank account levy). If you know where the Judgment Debtor works, the Sheriff can collect 25% of the debtor's wages each pay period until your judgment is paid in full (wage garnishment).

A judgment is valid in ance with California Law for ten years, and then it will automatically expire. However, a judgment can be extended another ten years at the creditor's request as long as it's before the ten years expires.

If your judgment has already expired, you should consult an attorney before taking any action. California judgments last for 10 years from the date they were entered. If you win a judgment issued by a federal court, you may start collecting right away. The defendant has 30 days to file an appeal or post a bond.

Debt collectors may not be able to sue you to collect on old (time-barred) debts, but they may still try to collect on those debts. In California, there is generally a four-year limit for filing a lawsuit to collect a debt based on a written agreement.

Personal Property Levies as a Judgment Collection Tool A personal property levy allows a creditor to obtain possession of much of the debtor's property in California (e.g., equipment, inventory, vehicles, cash in cash registers), excluding real property and property held by third parties.

The general rule is that a renewal lasts 10 years. There is no limit on how many times a judgment creditor can renew the judgment. This general rule applies to any judgment against a business or government agency, or when the debtor owes $200,000 or more.