California Proposed issuance of common stock

Description

How to fill out Proposed Issuance Of Common Stock?

Choosing the right authorized file web template might be a struggle. Naturally, there are tons of templates available online, but how would you discover the authorized type you want? Utilize the US Legal Forms internet site. The support provides 1000s of templates, such as the California Proposed issuance of common stock, which you can use for organization and private requires. Every one of the forms are examined by professionals and fulfill state and federal needs.

If you are presently authorized, log in to the account and click the Acquire key to get the California Proposed issuance of common stock. Make use of account to check from the authorized forms you possess purchased earlier. Go to the My Forms tab of your account and acquire one more copy in the file you want.

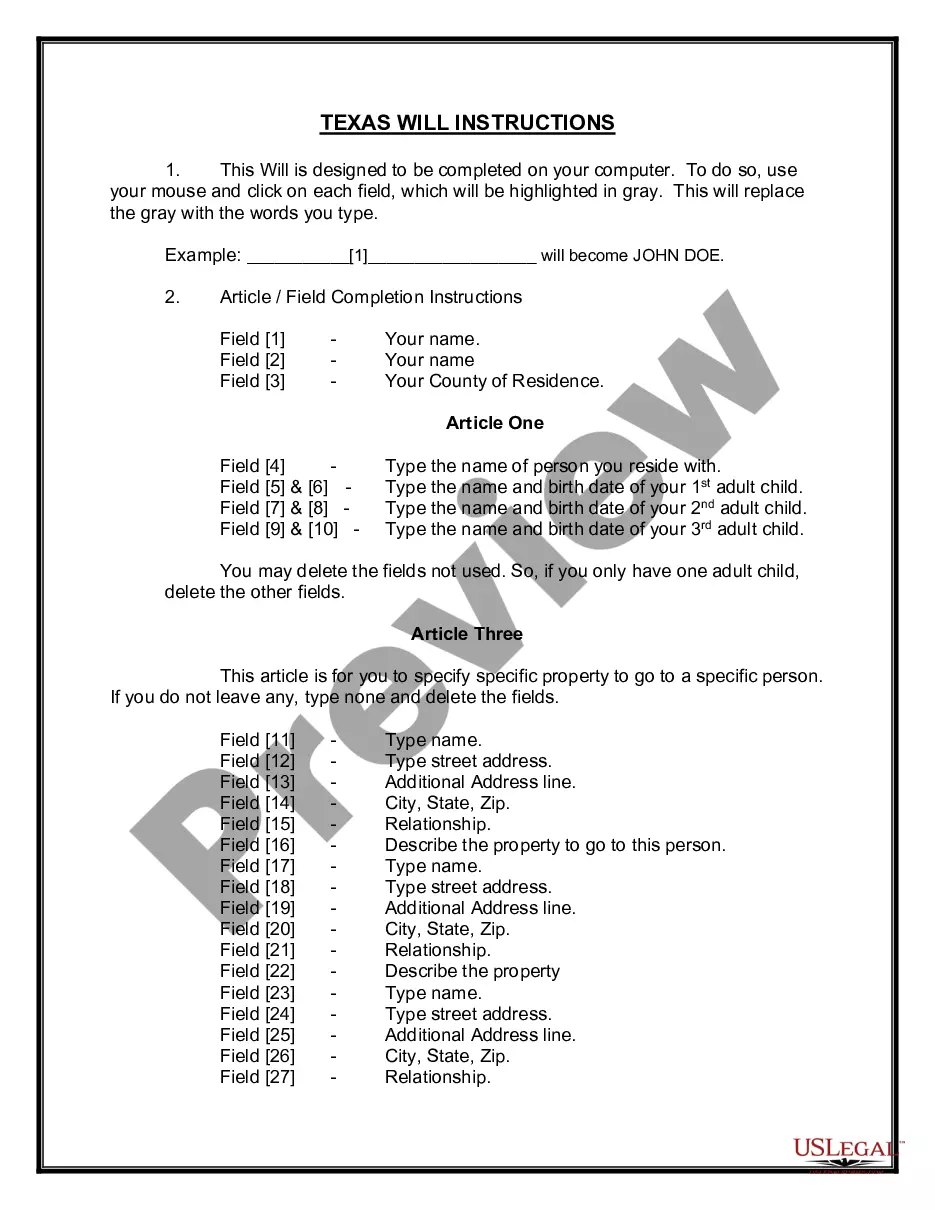

If you are a brand new user of US Legal Forms, here are simple instructions that you can stick to:

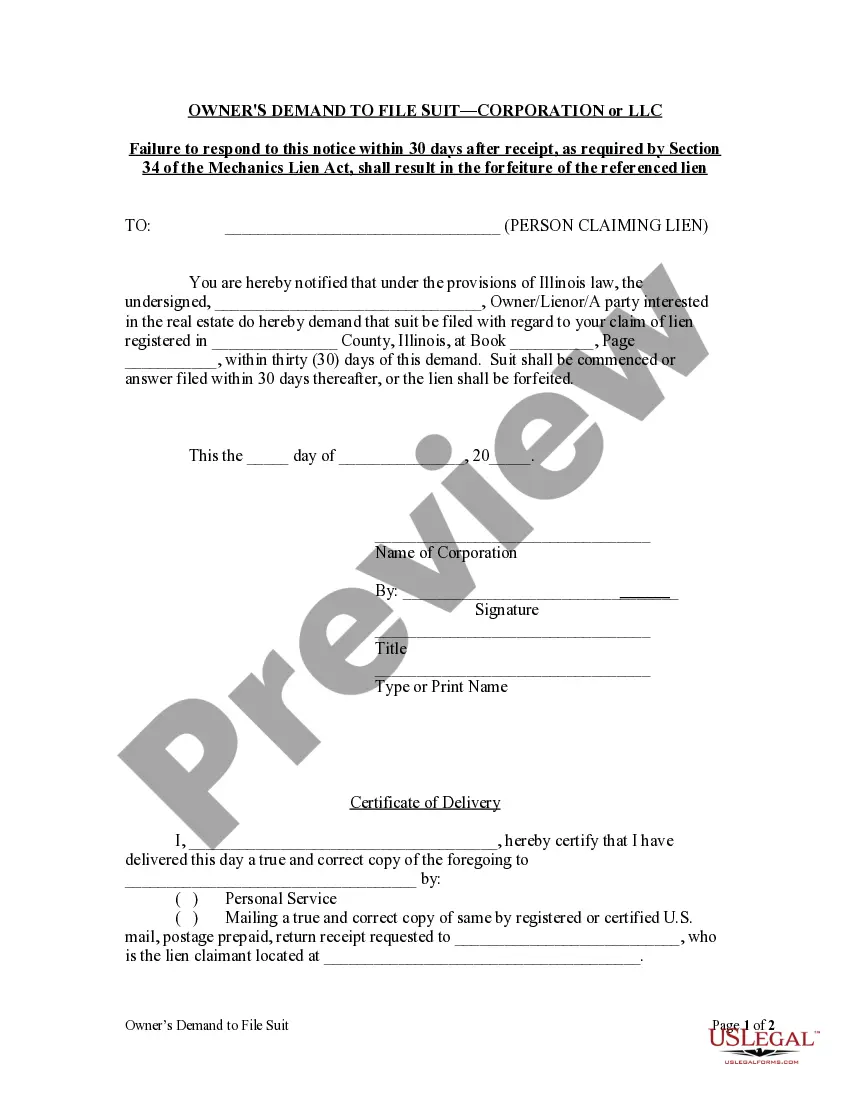

- Initial, be sure you have chosen the correct type for your town/state. You can look through the shape utilizing the Review key and browse the shape description to ensure it is the right one for you.

- If the type does not fulfill your preferences, make use of the Seach field to find the appropriate type.

- Once you are sure that the shape is acceptable, click the Purchase now key to get the type.

- Pick the prices prepare you want and type in the needed information and facts. Create your account and buy the order using your PayPal account or Visa or Mastercard.

- Pick the submit formatting and acquire the authorized file web template to the product.

- Total, change and printing and signal the attained California Proposed issuance of common stock.

US Legal Forms may be the most significant library of authorized forms for which you can discover different file templates. Utilize the company to acquire professionally-created paperwork that stick to express needs.

Form popularity

FAQ

Some corporations issue both common stock and preferred stock. However, most corporations issue only common stock. In other words, it is necessary that a business corporation issue common stock, but it is optional whether the corporation will decide to also issue preferred stock.

California Corporations Code Section 416(b) allows the issuance of shares without certificates under certain circumstances.

Section 25102(f) of the California Corporations Code is a California state exemption from the requirement to register a securities offering. For startups issuing shares to founders, they typically rely on Section 4(a)(2) of the Securities Act.

In California, a corporation must authorize at least one share but may authorize any number. You, as the founder, can be the sole stockholder and own all authorized shares yourself, or you can issue shares to others who you desire to co-own the corporation.

The 25102(o) notice can be filed online. It must be filed within 30 days following the initial issuance of a security under the startup's option plan. Note that a new notice filing is required whenever the startup increases the number of shares reserved under its option plan.

Rule 504 of Regulation D exempts from registration the offer and sale of up to $10 million of securities in a 12-month period. A company is required to file a notice with the Commission on Form D within 15 days after the first sale of securities in the offering.

The Corporation must issue at least one share in order to be properly formed. Otherwise there were no owners (shareholders) of the business. Shares are issued through a resolution prepared and signed by the incorporator, founder, or directors.

Even if there is no legal requirement to issue physical stock certificates, investors may still like to have a certificate as physical evidence of their investment. Therefore, even if your corporation's official way of documenting stock ownership is by bookkeeping entries, you can still issue stock certificates.