California Stockholder derivative actions

Description

How to fill out Stockholder Derivative Actions?

US Legal Forms - one of several biggest libraries of legitimate forms in the USA - offers a wide range of legitimate record templates you can down load or produce. Using the internet site, you may get 1000s of forms for organization and specific purposes, sorted by types, claims, or keywords and phrases.You can find the latest types of forms such as the California Stockholder derivative actions within minutes.

If you have a registration, log in and down load California Stockholder derivative actions from your US Legal Forms catalogue. The Down load switch will appear on each and every form you look at. You have accessibility to all previously saved forms from the My Forms tab of your account.

If you wish to use US Legal Forms initially, listed here are straightforward instructions to obtain started out:

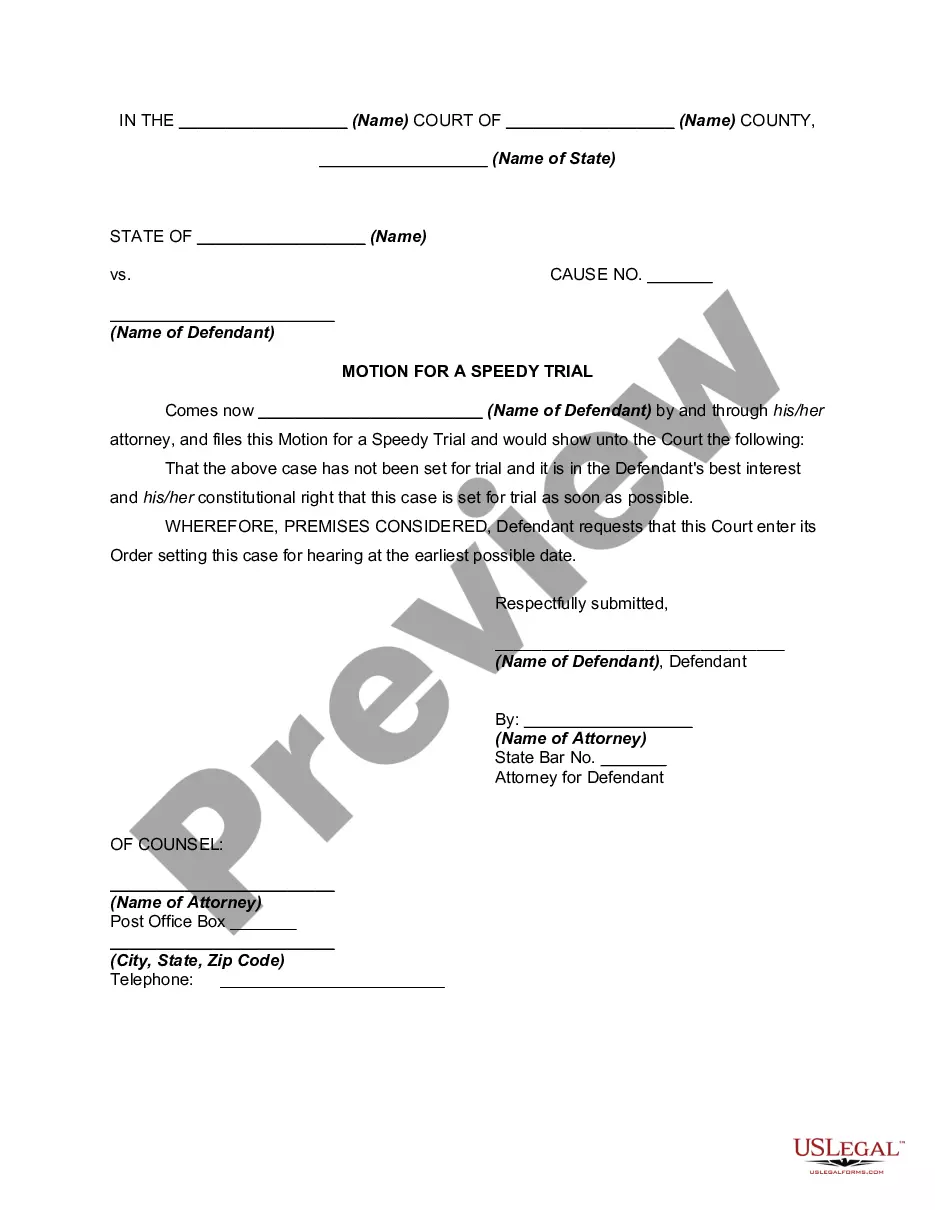

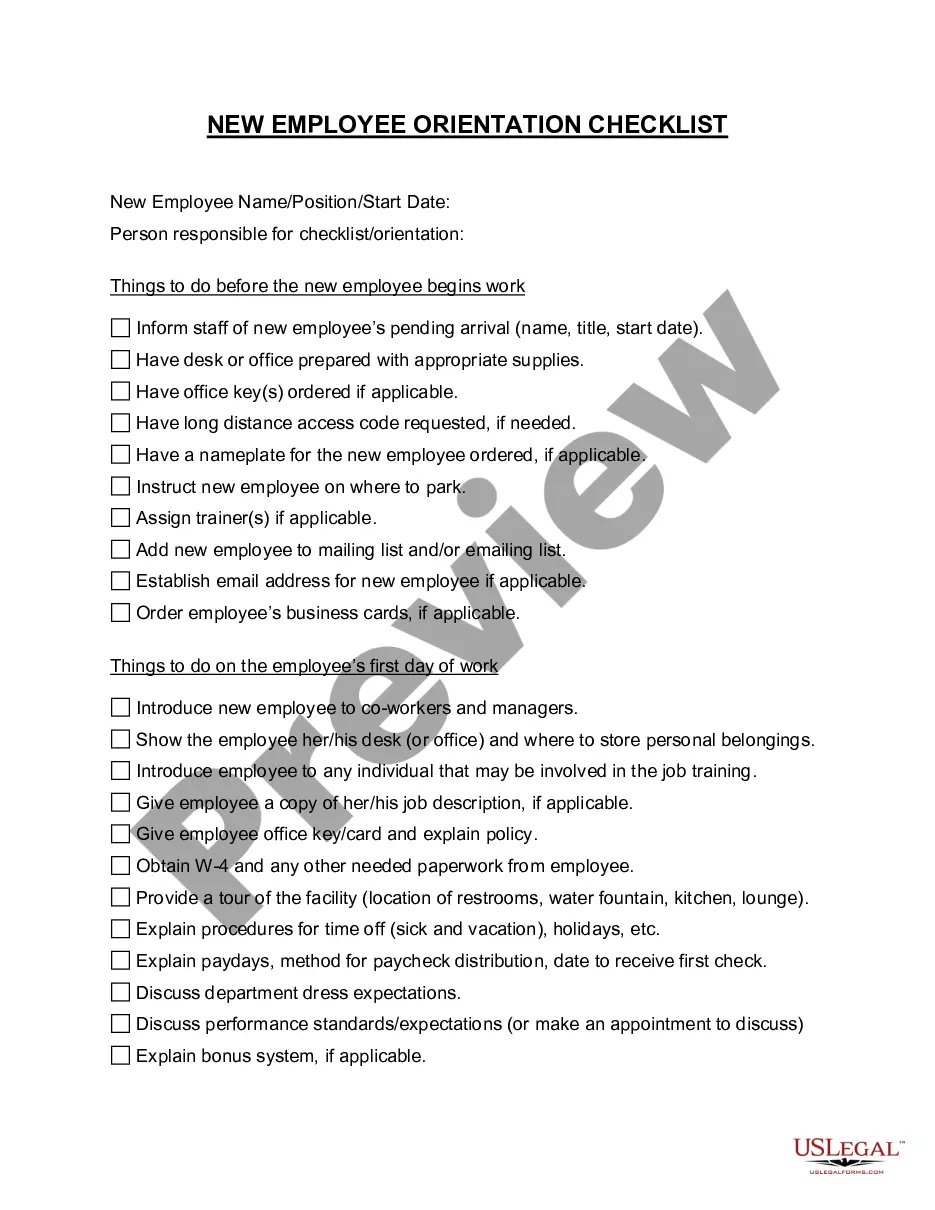

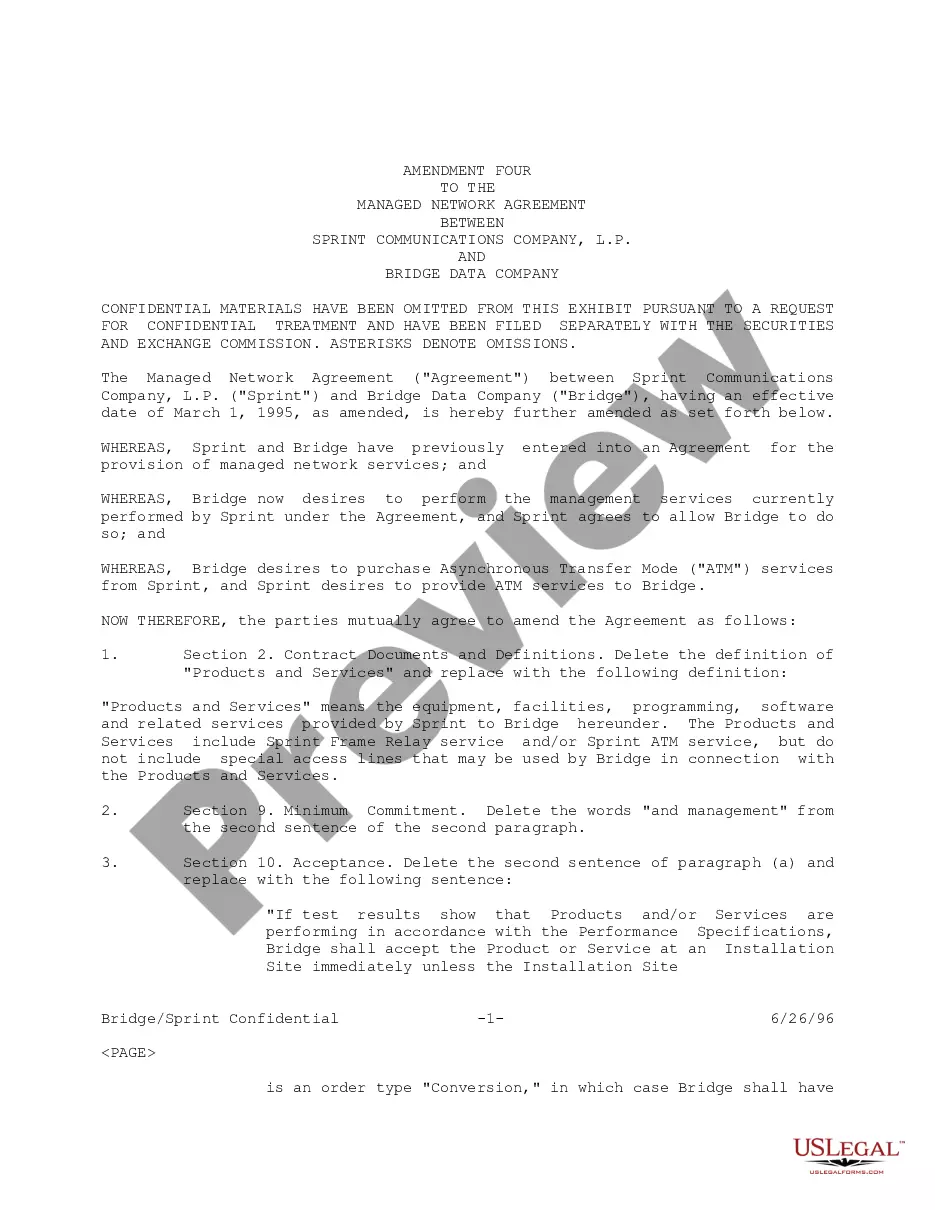

- Be sure to have chosen the correct form for your personal city/region. Select the Preview switch to examine the form`s content. See the form information to actually have chosen the appropriate form.

- If the form does not satisfy your demands, use the Lookup discipline on top of the screen to get the one that does.

- When you are pleased with the form, verify your option by visiting the Purchase now switch. Then, pick the rates prepare you favor and provide your qualifications to register for the account.

- Method the purchase. Utilize your Visa or Mastercard or PayPal account to finish the purchase.

- Choose the formatting and down load the form in your product.

- Make alterations. Complete, revise and produce and signal the saved California Stockholder derivative actions.

Every web template you included with your money does not have an expiry date and it is your own eternally. So, if you would like down load or produce another duplicate, just check out the My Forms portion and click on the form you need.

Gain access to the California Stockholder derivative actions with US Legal Forms, probably the most comprehensive catalogue of legitimate record templates. Use 1000s of expert and condition-certain templates that satisfy your small business or specific requires and demands.

Form popularity

FAQ

Grounds for bringing a derivative claim The duty to act in the company's best interests. The duty to exercise reasonable care, skill and diligence. The duty to promote the success of the company. The duty to declare an interest in a proposed transaction or arrangement.

The derivative action is the route by which shareholders, usually minority shareholders, are able to enforce the company's rights where directors have breached their duties (since in these circumstances it is unlikely that the directors, who usually act on behalf of the company, will want to take action).

A shareholder (stockholder) derivative suit is a lawsuit brought by a shareholder or group of shareholders on behalf of the corporation against the corporation's directors, officers, or other third parties who breach their duties. The claim of the suit is not personal but belongs to the corporation.

In a derivative action, the wronged shareholder brings an action on behalf of the corporation (or LLC) against the wrongdoing directors, officers, and/or controlling shareholder(s).

What is the difference between a stockholder's derivative suit and a class action? A derivative lawsuit is brought by a shareholder of a corporation for the benefit of the corporation. A shareholder's class action lawsuit is brought by a shareholder for the benefit of themselves and the other shareholders.

Examples of successful derivative actions may include lawsuits against directors or officers for mismanagement of funds, failure to divulge material information, or breach of fiduciary duty.

A shareholder (stockholder) derivative suit is a lawsuit brought by a shareholder or group of shareholders on behalf of the corporation against the corporation's directors, officers, or other third parties who breach their duties. The claim of the suit is not personal but belongs to the corporation.

A derivative action may be settled, voluntarily dismissed, or compromised only with the court's approval. Notice of a proposed settlement, voluntary dismissal, or compromise must be given to shareholders or members in the manner that the court orders.