California Supplemental Executive Retirement Plan - SERP

Description

How to fill out Supplemental Executive Retirement Plan - SERP?

Are you inside a place where you need to have files for possibly company or personal purposes virtually every day? There are a lot of legitimate document web templates available on the Internet, but getting versions you can trust is not easy. US Legal Forms delivers a large number of develop web templates, just like the California Supplemental Executive Retirement Plan - SERP, that are composed to meet federal and state requirements.

When you are already familiar with US Legal Forms internet site and have a free account, basically log in. Following that, you may obtain the California Supplemental Executive Retirement Plan - SERP template.

Should you not offer an account and wish to start using US Legal Forms, abide by these steps:

- Get the develop you will need and ensure it is for that right city/area.

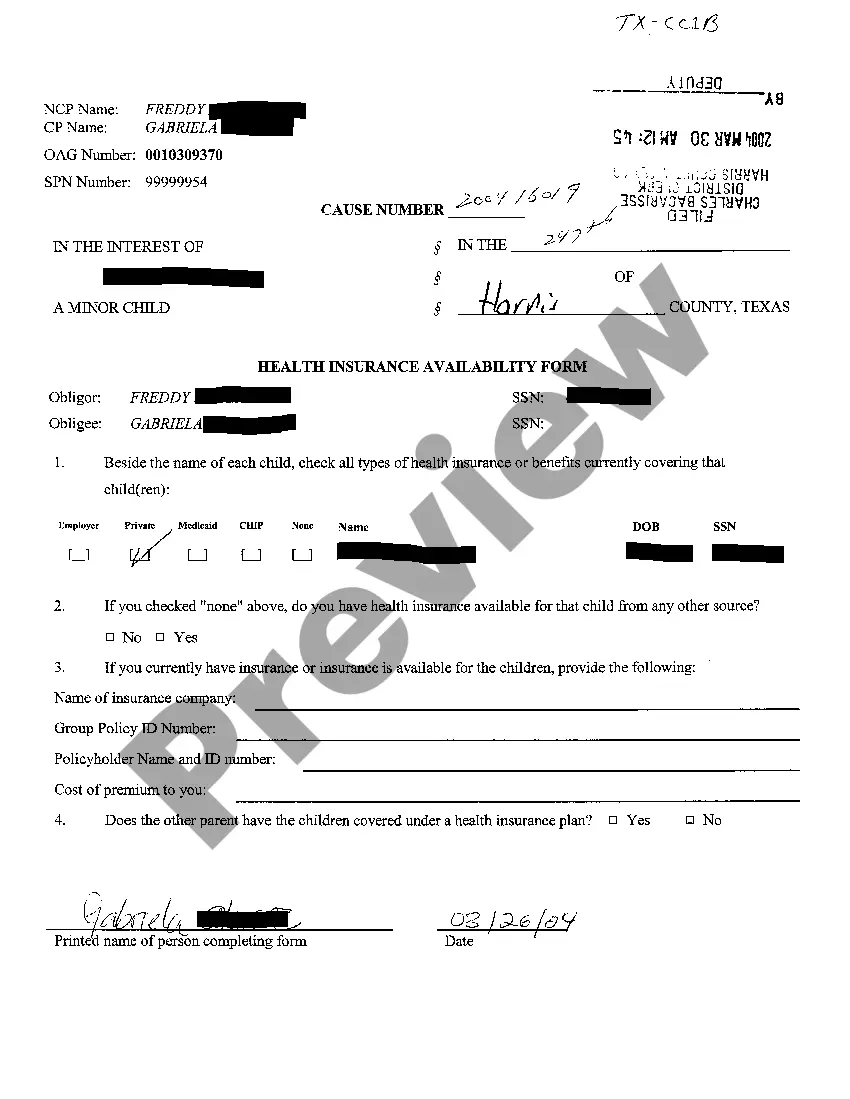

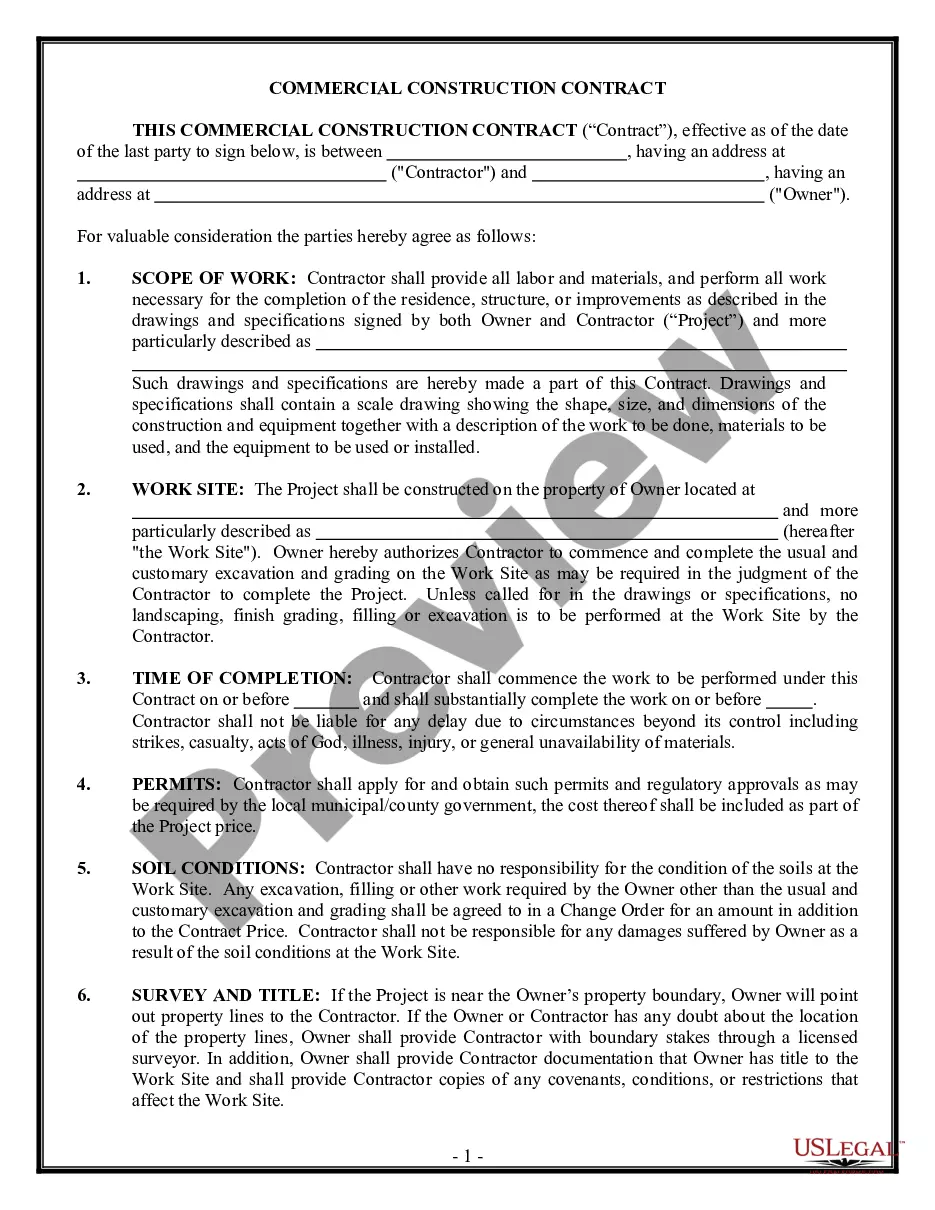

- Utilize the Preview option to examine the form.

- Browse the information to ensure that you have selected the correct develop.

- In the event the develop is not what you`re looking for, make use of the Lookup industry to get the develop that fits your needs and requirements.

- When you get the right develop, click on Buy now.

- Choose the costs prepare you need, complete the specified details to create your money, and purchase the order utilizing your PayPal or charge card.

- Choose a hassle-free file structure and obtain your copy.

Find every one of the document web templates you might have bought in the My Forms food list. You can get a extra copy of California Supplemental Executive Retirement Plan - SERP anytime, if necessary. Just select the required develop to obtain or print the document template.

Use US Legal Forms, the most considerable variety of legitimate varieties, to save lots of efforts and avoid faults. The service delivers professionally manufactured legitimate document web templates which you can use for an array of purposes. Produce a free account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

SERPs do not have contribution limits. Employers often fund a SERP by taking out a cash value life insurance policy on you.

A supplemental retirement plan gives your top employees a chance to save more once they've maxed out their contribution to a qualified plan, which can increase engagement and retention.

A SERP is a non-qualified deferred compensation plan offered to a company's key employees, including CEOs, CFOs and high-ranking officials. They are typically used to retain talent, but are tied to both employee and company performance.

Although SERPs could be paid out of cash flows or investment funds, most are funded through a cash value life insurance plan. The employer buys the insurance policy, pays the premiums, and has access to its cash value. The employee receives supplemental retirement income paid for through the insurance policy.

A Supplemental Executive Retirement Plan (SERP) is a deferred compensation agreement between the company and the key executive whereby the company agrees to provide supplemental retirement income to the executive and his family if certain pre-agreed eligibility and vesting conditions are met by the executive.

A supplemental executive retirement plan (SERP) is a set of benefits that may be made available to top-level employees in addition to those covered in the company's standard retirement savings plan. A SERP is a form of a deferred-compensation plan.

SERP withdrawals are taxed as regular income, but taxes on that income are deferred until you start making withdrawals. Much like other tax-deferred retirement plans, SERP funds grow tax-free until retirement. If you withdraw your SERP funds in a lump sum, you'll pay the taxes at all once.

SERPs are paid out as either one lump sum or as a series of set payments from an annuity, with different tax implications for each method, so choose carefully.

A supplemental executive retirement plan is a deferred compensation agreement between the company and the key executive whereby the company agrees to provide supplemental retirement income to the executive and his family if certain pre-agreed eligibility and vesting conditions are met by the executive.

Risk of forfeiture. Forfeiture can occur if the employee has not met the requirements to ?earn? or ?vest? in the future SERP payout. This usually occurs when the employee leaves the company prior to retirement. This also can happen when leaving the company prior to vesting or not achieving performance thresholds.