California Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation

Description

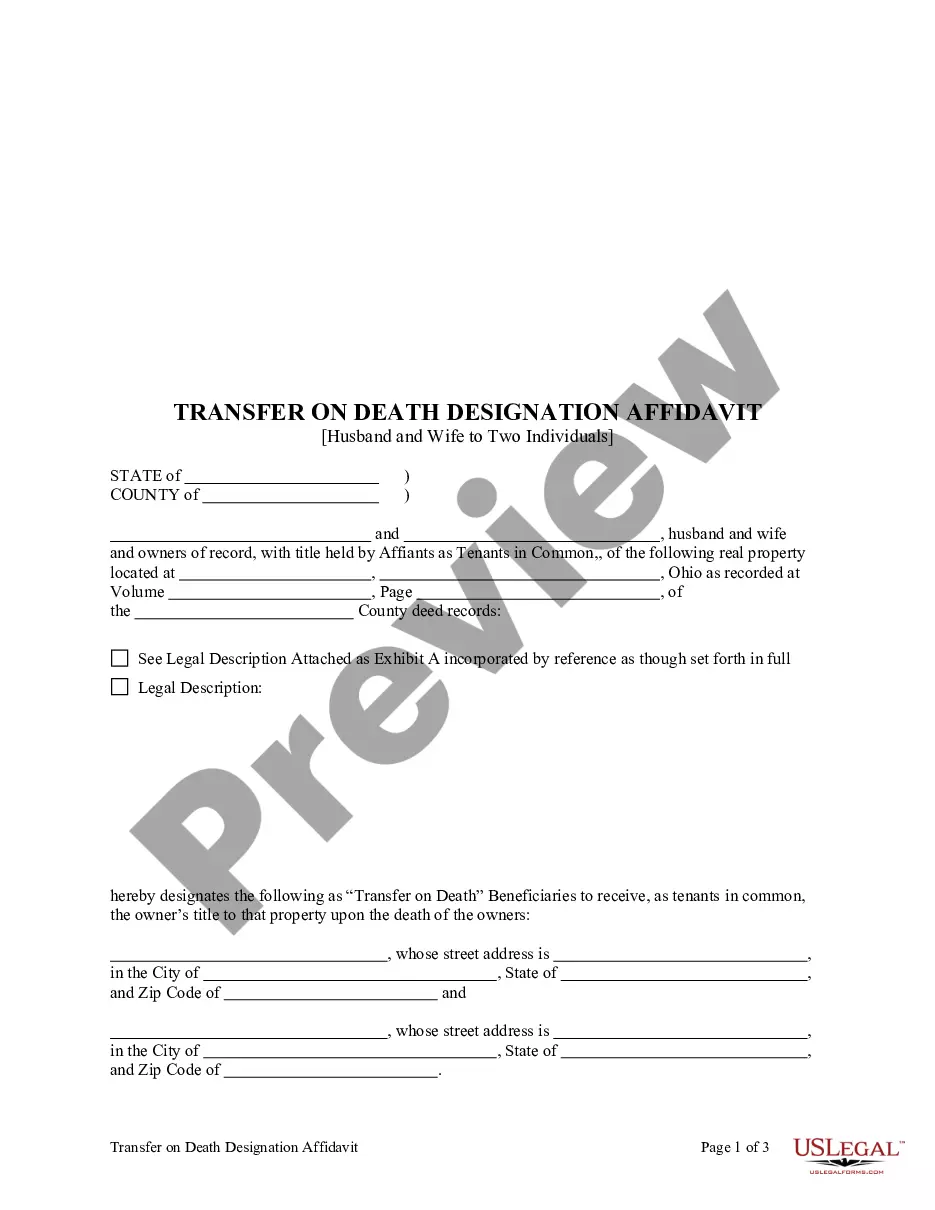

How to fill out Sample Stock Purchase Agreement For Purchase Of Common Stock Of Wholly-Owned Subsidiary By Separate Corporation?

US Legal Forms - one of several greatest libraries of authorized kinds in the United States - gives a wide range of authorized document web templates it is possible to obtain or print. Making use of the site, you will get thousands of kinds for enterprise and personal purposes, categorized by groups, states, or keywords.You can find the latest versions of kinds like the California Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation in seconds.

If you already have a membership, log in and obtain California Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation from your US Legal Forms collection. The Download switch will show up on each and every form you perspective. You have access to all previously saved kinds from the My Forms tab of the bank account.

If you want to use US Legal Forms the very first time, listed below are simple guidelines to help you get started off:

- Be sure to have picked out the correct form to your town/state. Click on the Preview switch to review the form`s content. Browse the form outline to ensure that you have chosen the right form.

- In the event the form doesn`t satisfy your demands, use the Look for area at the top of the monitor to get the one that does.

- Should you be satisfied with the form, verify your decision by simply clicking the Get now switch. Then, choose the costs plan you prefer and give your references to sign up for an bank account.

- Method the transaction. Make use of Visa or Mastercard or PayPal bank account to perform the transaction.

- Find the format and obtain the form on your product.

- Make adjustments. Fill out, change and print and signal the saved California Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation.

Each template you put into your account lacks an expiry day and is the one you have eternally. So, if you want to obtain or print another duplicate, just visit the My Forms area and click on about the form you require.

Gain access to the California Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation with US Legal Forms, one of the most comprehensive collection of authorized document web templates. Use thousands of specialist and condition-particular web templates that meet your organization or personal requires and demands.

Form popularity

FAQ

An asset sale is the purchase of individual assets and liabilities, whereas a stock sale is the purchase of the owner's shares of a corporation. While there are many considerations when negotiating the type of transaction, tax implications and potential liabilities are the primary concerns.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.