California Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

You might spend time on the web looking for the proper legal document format that meets the federal and state requirements you have.

US Legal Forms provides thousands of legal templates that are reviewed by professionals.

It is easy to obtain or print the California Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner from the platform.

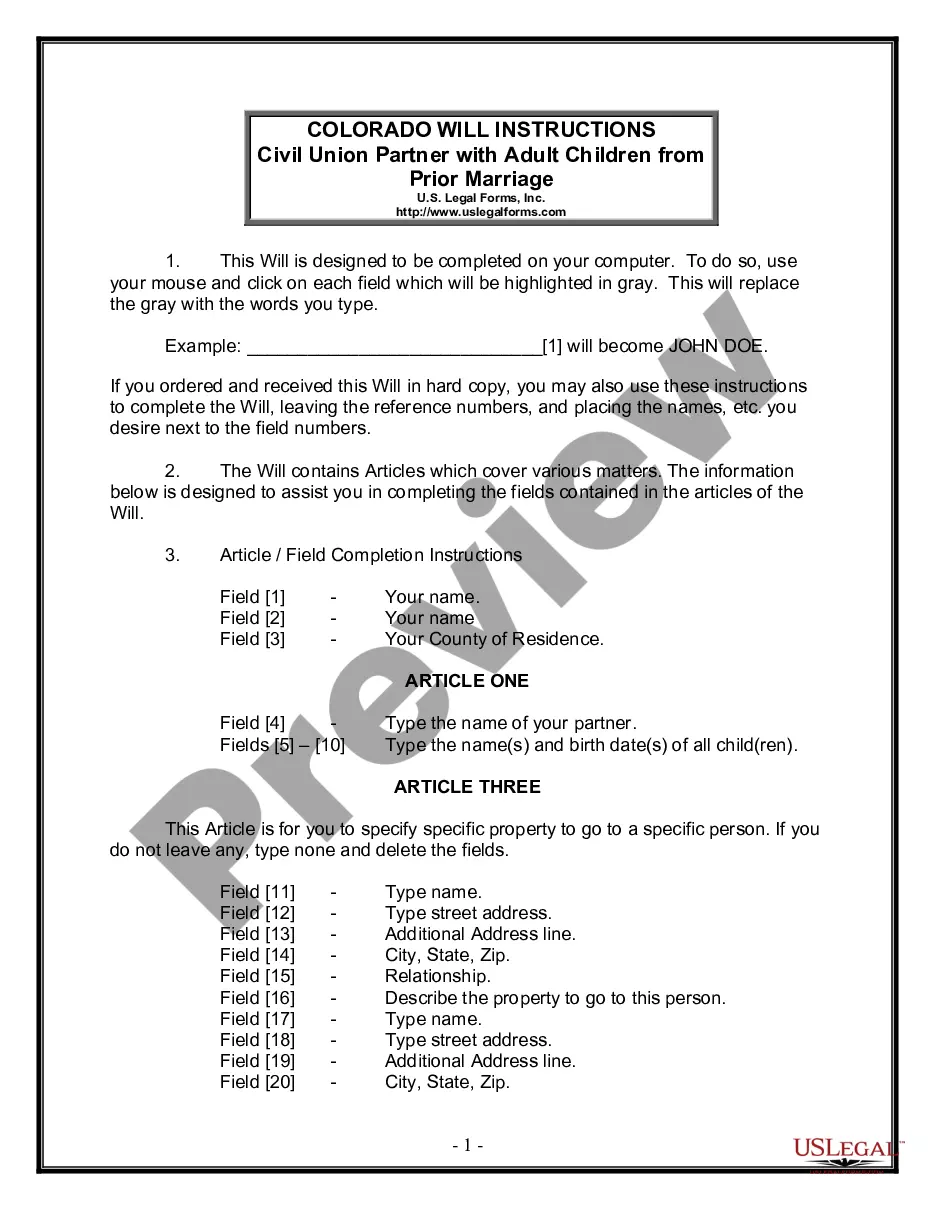

If available, use the Preview button to review the format as well.

- If you already have a US Legal Forms account, you can Log In and tap the Obtain button.

- Then, you can fill out, modify, print, or sign the California Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner.

- Every legal document you download is yours permanently.

- To get another edition of a download, go to the My documents section and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow these simple steps.

- First, ensure you have selected the correct format for the location of your choice.

- Check the template description to make sure you have chosen the right document.

Form popularity

FAQ

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.

Section 37 of the UPA provides that unless otherwise agreed, the partners who have not wrongfully dissolved the partnership or the legal representative of the last surviving solvent partner have the right to wind up the partnership affairs, provided, however, that any partner, his legal representative, or his assignee

How to Dissolve a California Business PartnershipReview the Partnership Agreement.Vote or Take Action to Dissolve.Pay Remaining Debts & Distribute Remaining Assets.File a Dissolution Form with the State.Notify Concerned Parties.Resolve Remaining Tax Issues.Complete Any Out-of-State Regulations.

On the death of a partner, the partnership ceases to exist. But the firm may not cease to exist as the other remaining partners may decide to continue the business. In case of death of a partner, the treatment of various items is similar to that at the time of retirement of the partner.

Section 42(c) of the partnership Act can appropriately be applied to a partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Under RUPA, California allows at-will partnerships to dissolve at the express (or written) will of at least half the partners, including those who may have left the partnership within the preceding 90 days. If approved, those remaining can then continue the partnership without those that want to leave.

There is no filing fee. Under California law, other people generally are considered to have notice of the partnership's dissolution ninety (90) days after filing the Statement of Dissolution.

Where under a contract between the partners the firm is not dissolved by the death of a partner, the estate of a deceased partner is not liable for any act of the firm done after his death.