California Sample Letter regarding Cancellation of Deed of Trust

Description

How to fill out Sample Letter Regarding Cancellation Of Deed Of Trust?

Have you been within a situation the place you will need papers for possibly organization or personal uses virtually every time? There are a lot of lawful file layouts available online, but finding ones you can trust isn`t easy. US Legal Forms offers a huge number of type layouts, like the California Sample Letter regarding Cancellation of Deed of Trust, which are published to meet state and federal demands.

Should you be currently acquainted with US Legal Forms site and also have a merchant account, simply log in. Afterward, you are able to obtain the California Sample Letter regarding Cancellation of Deed of Trust format.

Should you not come with an bank account and need to start using US Legal Forms, follow these steps:

- Find the type you will need and make sure it is for your correct metropolis/county.

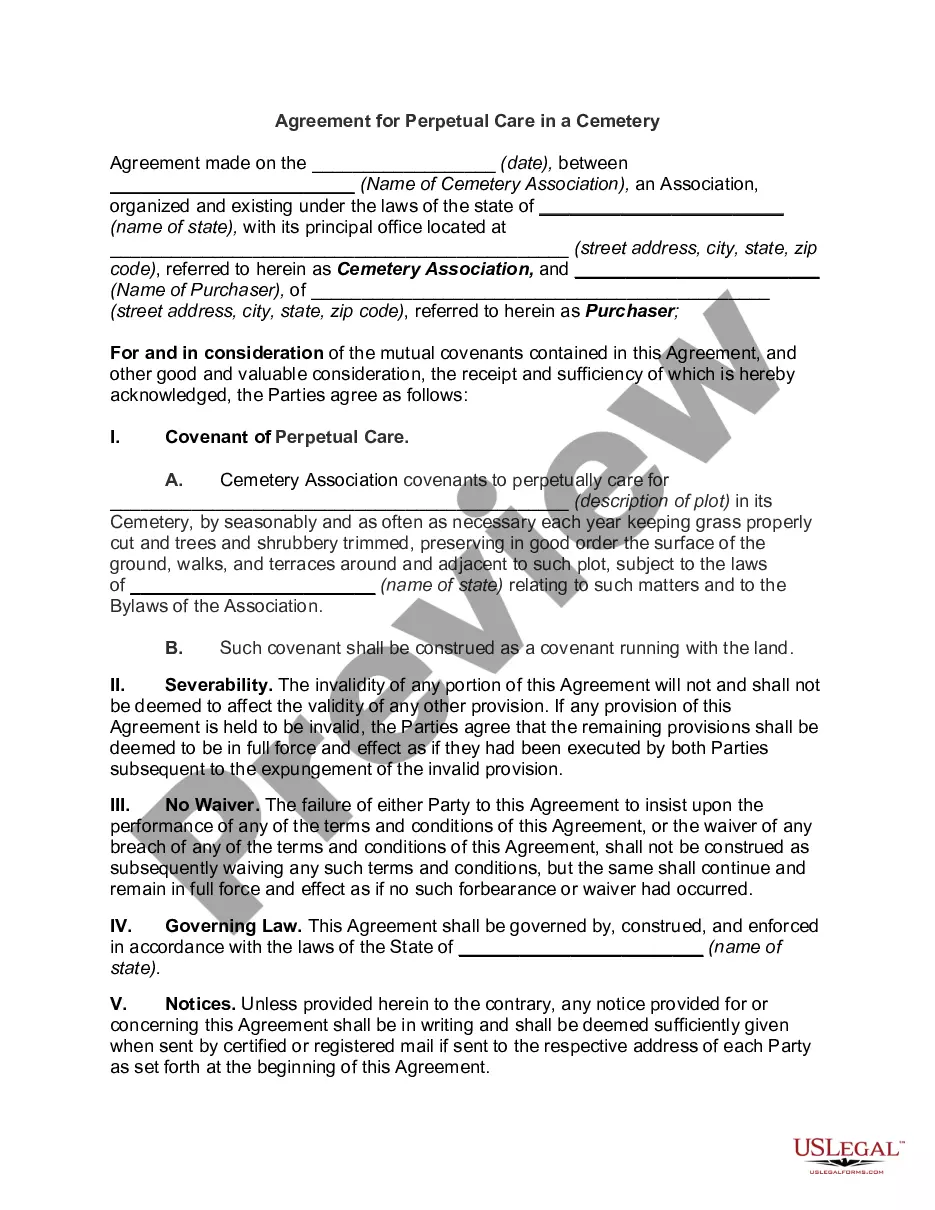

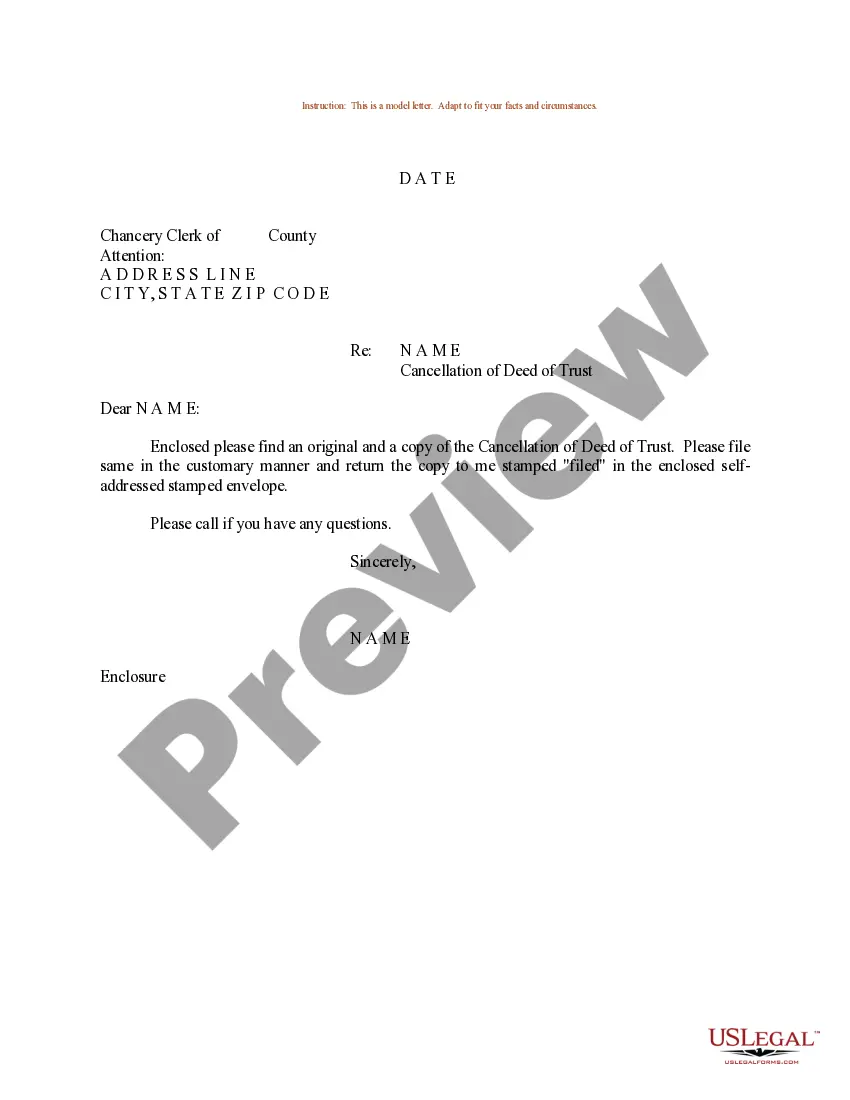

- Use the Preview key to check the shape.

- Read the outline to actually have selected the correct type.

- If the type isn`t what you`re trying to find, utilize the Lookup industry to get the type that suits you and demands.

- Whenever you discover the correct type, just click Buy now.

- Opt for the rates prepare you want, complete the desired information to make your account, and pay money for the transaction using your PayPal or charge card.

- Pick a convenient document file format and obtain your version.

Find all of the file layouts you may have bought in the My Forms food selection. You can obtain a more version of California Sample Letter regarding Cancellation of Deed of Trust at any time, if required. Just click the required type to obtain or printing the file format.

Use US Legal Forms, one of the most comprehensive collection of lawful kinds, in order to save time and avoid mistakes. The services offers skillfully manufactured lawful file layouts which you can use for a selection of uses. Generate a merchant account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

What is a trustor vs trustee? In a deed of trust, a trustor is the borrower and the trustee is a third party that holds the property's title. The trustee is entrusted with the title and the right to sell the property if the trustor defaults on the loan.

Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee.

The ?Trustor? is the person who borrowed the money (the Payor of the Note) The ?Beneficiary? is the person who is lending the money (the Payee of the Note) The ?Trustee? is the neutral 3rd party who will issue the release of the loan once it is paid in full.

Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

There's a significant difference between being a beneficiary or trustee of a trust. If you're named as a beneficiary then you stand to benefit from the assets in the trust. On the other hand, if you're the trustee it's your job to manage those assets ing to the wishes of the trust creator.