California Sample Letter regarding Information for Foreclosures and Bankruptcies

Description

How to fill out Sample Letter Regarding Information For Foreclosures And Bankruptcies?

US Legal Forms - among the largest libraries of legitimate kinds in the States - offers a wide array of legitimate document templates you can obtain or print. While using site, you can find a huge number of kinds for company and individual reasons, categorized by categories, suggests, or key phrases.You will discover the most up-to-date models of kinds much like the California Sample Letter regarding Information for Foreclosures and Bankruptcies in seconds.

If you already have a membership, log in and obtain California Sample Letter regarding Information for Foreclosures and Bankruptcies from the US Legal Forms library. The Obtain option can look on each develop you perspective. You gain access to all in the past saved kinds within the My Forms tab of the accounts.

In order to use US Legal Forms the first time, listed here are straightforward recommendations to get you started:

- Ensure you have selected the correct develop for your city/region. Click on the Review option to review the form`s articles. Browse the develop information to ensure that you have selected the appropriate develop.

- If the develop does not fit your requirements, make use of the Research field towards the top of the monitor to obtain the one which does.

- Should you be pleased with the form, verify your option by clicking the Get now option. Then, choose the rates program you favor and provide your credentials to register on an accounts.

- Procedure the deal. Make use of your bank card or PayPal accounts to accomplish the deal.

- Pick the structure and obtain the form on your own product.

- Make changes. Fill up, modify and print and sign the saved California Sample Letter regarding Information for Foreclosures and Bankruptcies.

Every single web template you included with your money lacks an expiration date which is yours forever. So, in order to obtain or print an additional version, just go to the My Forms portion and then click around the develop you require.

Gain access to the California Sample Letter regarding Information for Foreclosures and Bankruptcies with US Legal Forms, by far the most considerable library of legitimate document templates. Use a huge number of skilled and state-particular templates that fulfill your company or individual requirements and requirements.

Form popularity

FAQ

Judicial foreclosures are rare and occur only when a lender initiates a lawsuit against the borrower. The more common type of foreclosure in California is non-judicial. A non-judicial foreclosure is initiated by the lender when the borrower is in default.

You have 90 days from the date the Notice of Default is recorded to pay what you owe to the lender. If you pay the amount on the Notice of Default, the lender cannot sell your home. Notice of Trustee Sale ? If you don't pay within 90 days, a Notice of Trustee Sale will be recorded against your property.

Under California laws, lenders can pursue a foreclosure case through the courts, but they almost always use non-judicial foreclosure instead. The non-judicial process can be completed in approximately 120 days (4 months). However, the timeline can sometimes be 200 days or more.

The California foreclosure process can last up to 200 days or longer. Day 1 is when a payment is missed; your loan is officially in default around day 90. After 180 days, you'll receive a notice of trustee sale. About 20 days later, your bank can then set the auction.

Key takeaways If you miss four consecutive mortgage payments (120 days), most lenders begin the process of foreclosure on your home. If you miss one mortgage payment, lenders will often issue you a 15-day grace period to pay without incurring a penalty.

Under California laws, lenders can pursue a foreclosure case through the courts, but they almost always use non-judicial foreclosure instead. The non-judicial process can be completed in approximately 120 days (4 months). However, the timeline can sometimes be 200 days or more.

Under federal law, your mortgage lender must wait until you are 120 days overdue on a payment to file an official notice of default at the county recorder's office. A default notice is an official record of the nonpayment of your mortgage.

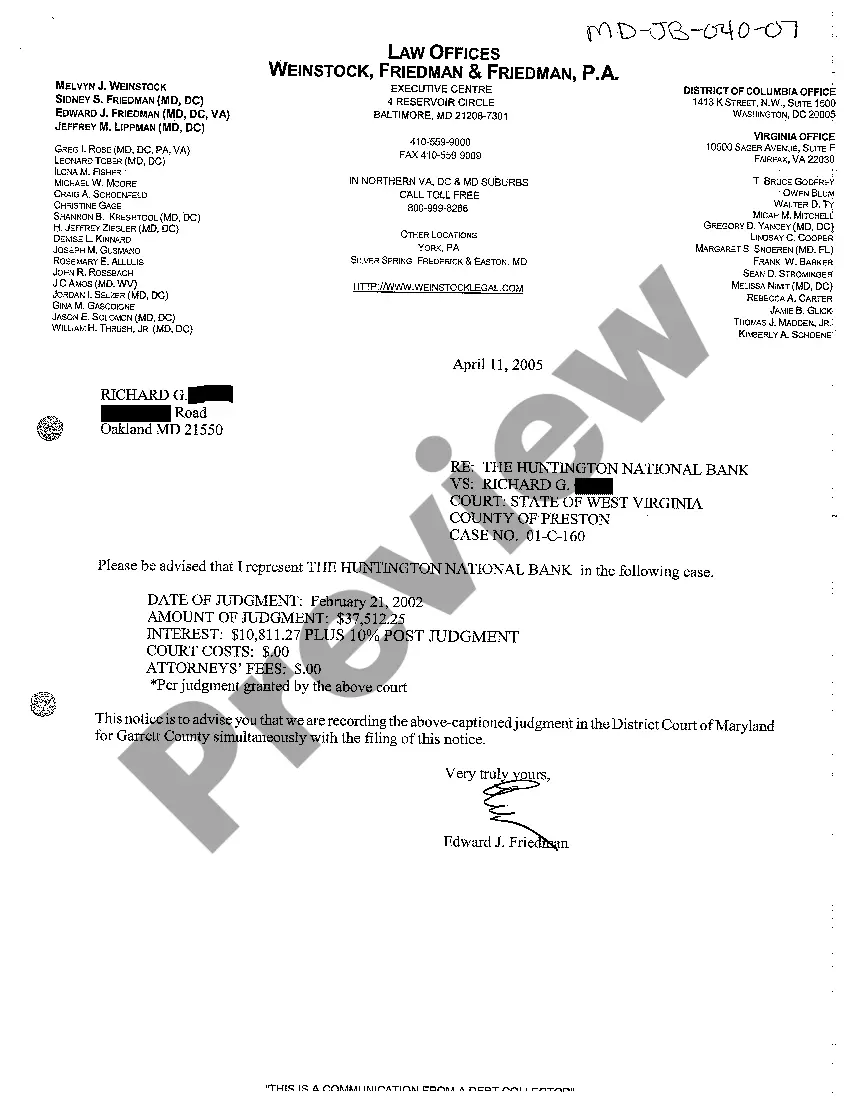

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.