California Coverage for Interns under the Affordable Care Act

Description

How to fill out Coverage For Interns Under The Affordable Care Act?

If you want to full, obtain, or print lawful document web templates, use US Legal Forms, the largest selection of lawful types, that can be found online. Use the site`s simple and easy handy search to discover the files you will need. Different web templates for company and specific purposes are sorted by groups and states, or search phrases. Use US Legal Forms to discover the California Coverage for Interns under the Affordable Care Act in a few click throughs.

If you are presently a US Legal Forms customer, log in to your accounts and click on the Down load option to obtain the California Coverage for Interns under the Affordable Care Act. You can even access types you formerly acquired from the My Forms tab of the accounts.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the proper city/region.

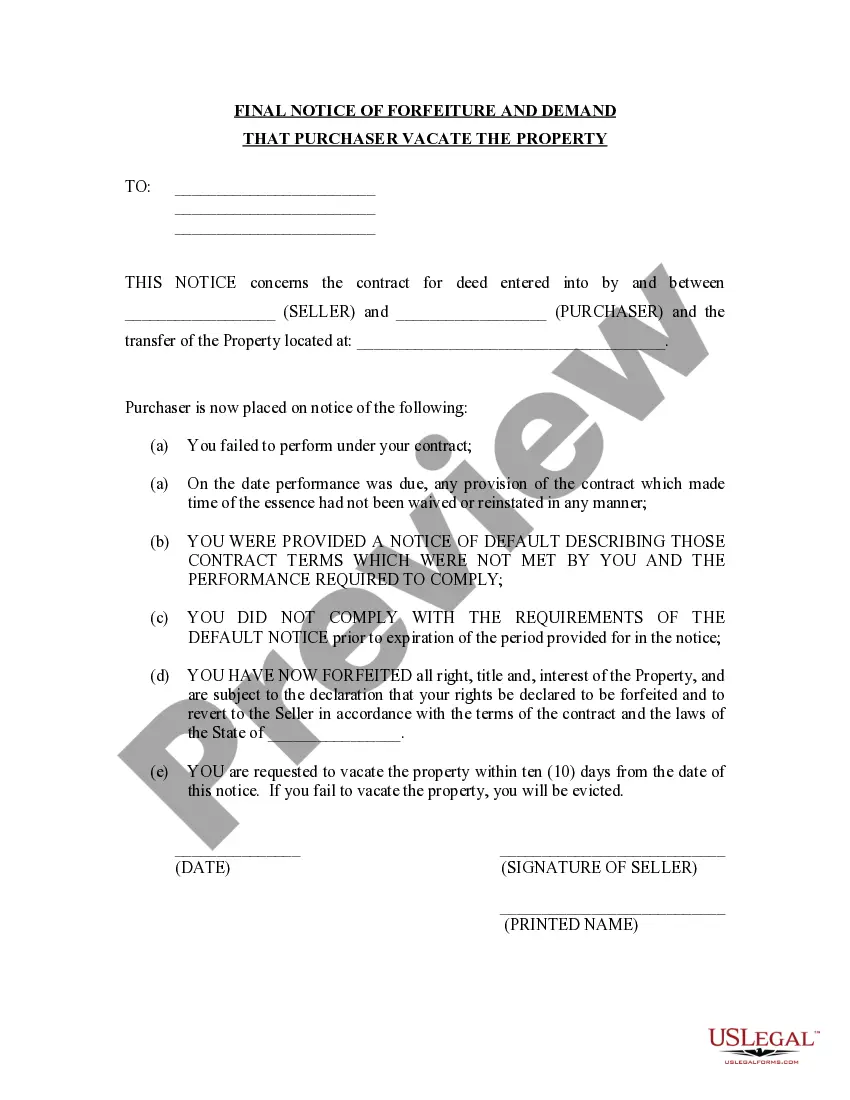

- Step 2. Make use of the Preview solution to look through the form`s information. Never overlook to learn the explanation.

- Step 3. If you are not satisfied with the develop, utilize the Research field towards the top of the screen to discover other versions of the lawful develop format.

- Step 4. After you have found the shape you will need, click on the Buy now option. Select the rates strategy you favor and add your credentials to register to have an accounts.

- Step 5. Approach the transaction. You should use your bank card or PayPal accounts to complete the transaction.

- Step 6. Pick the format of the lawful develop and obtain it on your own gadget.

- Step 7. Comprehensive, revise and print or indicator the California Coverage for Interns under the Affordable Care Act.

Every single lawful document format you acquire is your own forever. You have acces to each and every develop you acquired in your acccount. Select the My Forms area and decide on a develop to print or obtain again.

Contend and obtain, and print the California Coverage for Interns under the Affordable Care Act with US Legal Forms. There are thousands of skilled and status-particular types you may use for your company or specific requires.

Form popularity

FAQ

The internship must take place as part of an educational program, requiring participation in school or something similar. The intern is prohibited from receiving any employee benefits, including insurance and workers' compensation insurance.

Unless all of the following criteria are met, the intern is legally an employee, who must be paid the minimum wage, earn overtime, and receive all of the other protections guaranteed by state and federal employment laws.

However, when it comes to legal matters, there is often confusion about the distinction between interns and employees. In California, the law is clear: unpaid interns are not considered employees and therefore cannot be eligible for workers' compensation benefits. Continue reading to learn more.

In most cases, unpaid interns would be reclassified as nonexempt employees. This means that you would also be entitled to recover: unpaid overtime, and.

While workers' compensation is rather comprehensive, some individuals are exempt from workers' comp in California. Under California Labor Code, Division 4, Part 1, Chapter 2, Section 3352, these workers include the following: Sole Proprietors and business owners (excluding roofers) Business owners.

Unpaid interns aren't considered employees in California, so they aren't eligible for workers' compensation benefits. However, if your company isn't following the rules regarding unpaid internships, you might be classified as an employee under the law.

California businesses with at least one part-time or full-time employee must get workers' compensation insurance. The state defines an employee as a person working for a company, whether the arrangement is: Expressed or implied. Oral or written.

Any intern that meets the ACA definition of a full time employee should receive a Form 1095-C. No Form 1095-C is required if an intern terminates employment before 1) meeting the plan's waiting period (if coverage would otherwise be offered) or 2) completing the initial measurement period.