California Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Selecting the appropriate authentic document template may be challenging.

Clearly, there exists a multitude of templates accessible online, but how can you obtain the authentic form you require? Utilize the US Legal Forms website.

The platform provides an extensive selection of templates, such as the California Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which can serve both business and personal purposes.

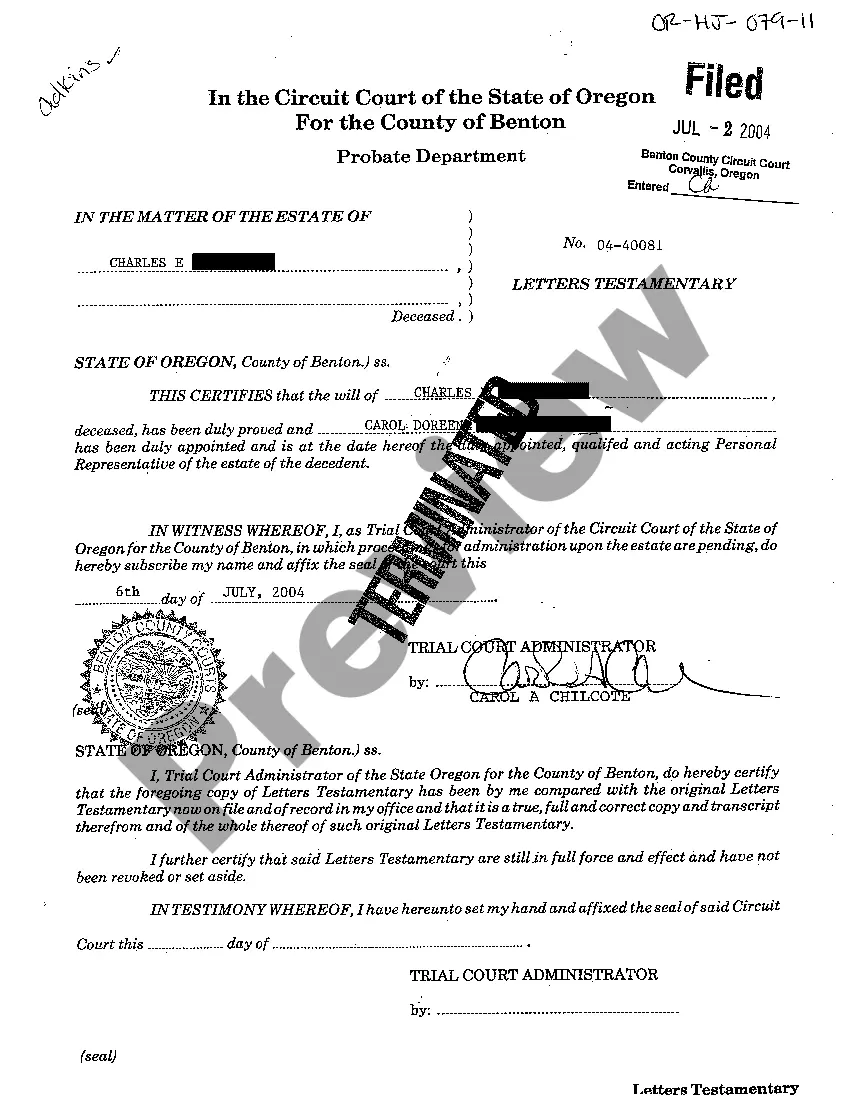

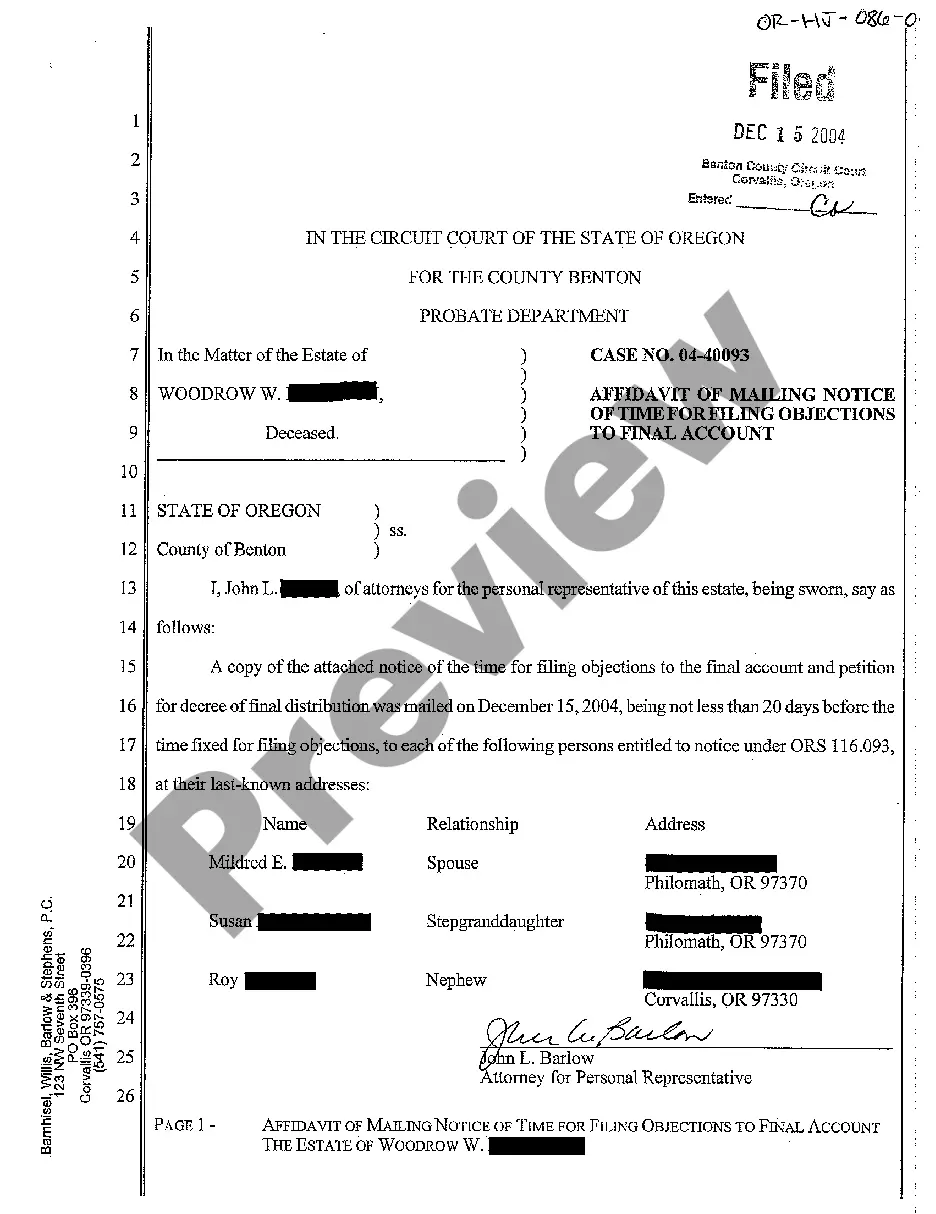

You can view the form using the Review button and read the form description to confirm it is the right choice for you.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the California Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- Use your account to browse the authorized templates you may have previously purchased.

- Visit the My documents section of your account and obtain another copy of the record you need.

- If you are a new user of US Legal Forms, here are some simple instructions to follow.

- First, make sure you have selected the appropriate form for your city/state.

Form popularity

FAQ

Non-residents who earn income from California sources must file a California non-resident tax return. If you sold your principal residence located in California and do not qualify for the California Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, you must also file. Always consult with a tax professional to understand your specific filing requirements.

» California Real Estate Withholding is prepayment of estimated income tax due the State of California on gain from the sale of California real property. If the amount withheld is more than the income tax liability, the state will refund the difference when you file a tax return for the taxable year.

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565.

Your state tax-filing status and the overall amount of income you earned for the year determine at which rate you will be taxed. With California not giving any tax breaks for capital gains, you could find yourself getting hit with a total state tax rate of 13.3% on your capital gains.

Key TakeawaysYou can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you are single and $500,000 if married filing jointly.This exemption is only allowable once every two years.More items...

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file Form 593. Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.

Currently, subject to certain requirements the first $250,000 (and in most cases $500,000 if married filing jointly) of capital gain on the sale of a principal residence is excluded from taxation. As mentioned before, California conforms to (is consistent with) the federal provision.

Withholding is required on sales or transfers of California real property when the total sale price exceeds $100,000 and does not qualify for an exemption on FTB Form 593-C (see Part III Exemptions).

If you're single, you can sell your primary residence and not pay taxes for the first $250,000 of the sale, or the first $500,000 if you're married and filing jointly.

The Capital Gains Tax in California The amount you earned between the time you bought the property and the time you sold it is your capital gain. The IRS charges you a tax on your capital gains, as does the state of California through the Franchise Tax Board, also known as the FTB.