California Lease of Recreation or Athletic Equipment

Description

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

How to fill out Lease Of Recreation Or Athletic Equipment?

Have you ever found yourself in a position where you need documents for either business or personal purposes almost all the time.

There are numerous legal document templates available online, but sourcing reliable ones is quite challenging.

US Legal Forms offers thousands of form templates, such as the California Lease of Recreation or Athletic Equipment, designed to meet state and federal regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the California Lease of Recreation or Athletic Equipment anytime you need. Just click on the relevant form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the California Lease of Recreation or Athletic Equipment template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for your specific city/county.

- Use the Preview button to examine the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that suits you and your requirements.

- Once you locate the right form, click Buy now.

- Select the pricing plan you prefer, fill in the required details to create your account, and complete the purchase using your PayPal or credit card.

Form popularity

FAQ

Leasing recreational or athletic equipment provides several benefits, including lower upfront costs and flexibility in updating equipment as needs change. Additionally, a California Lease allows you to use high-quality equipment without the long-term financial commitment of purchasing. Using USLegalForms, you can easily manage your lease agreements, ensuring that you maximize these advantages efficiently.

Determining a good equipment lease rate for a California Lease of Recreation or Athletic Equipment depends on several factors, including the type of equipment, its value, and the lease duration. Generally, rates can vary between 1% to 3% of the equipment’s value per month. Research current market rates and utilize resources from USLegalForms to craft a competitive lease agreement.

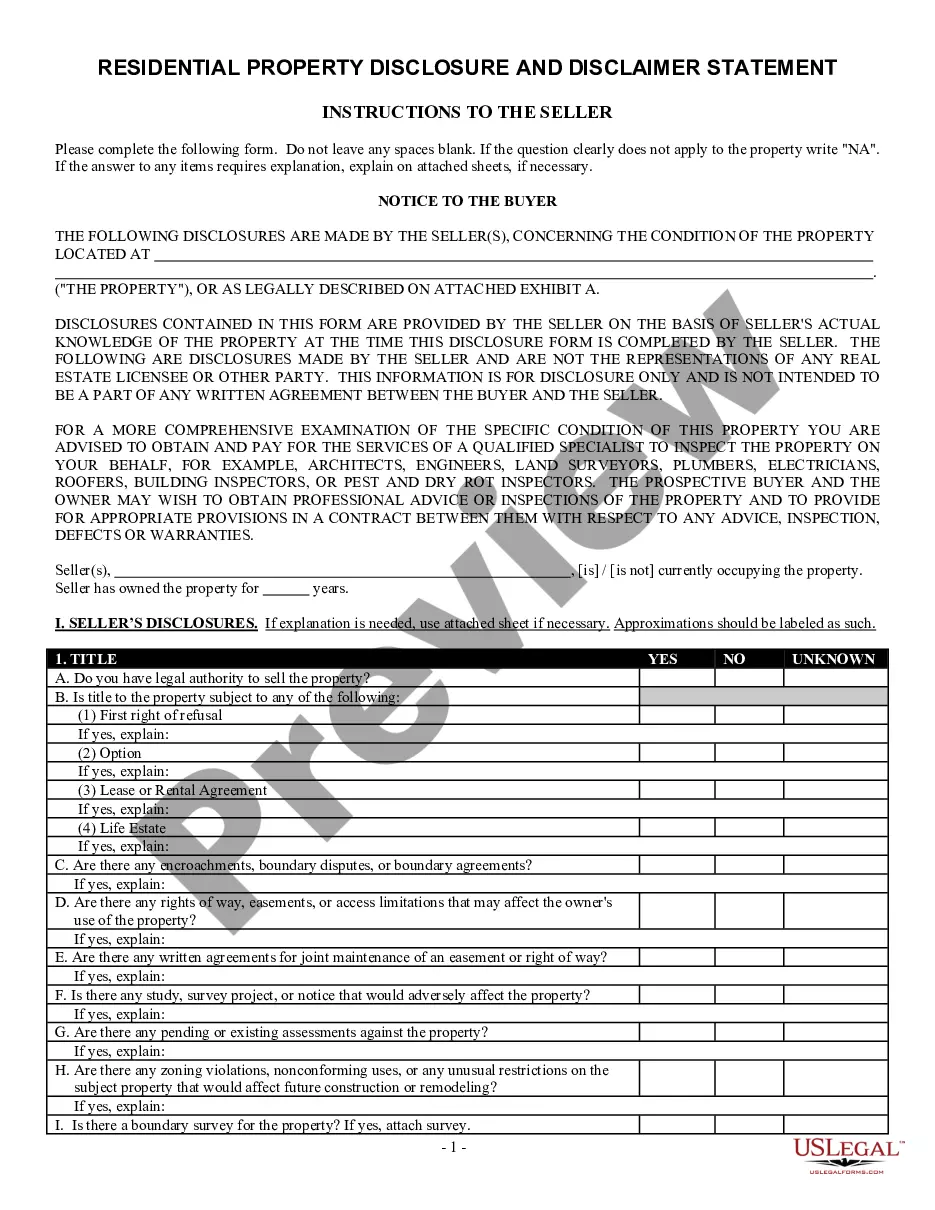

Setting up a California Lease of Recreation or Athletic Equipment involves a few simple steps. First, identify the equipment you want to lease and the duration of the lease. Next, draft an agreement that outlines the terms, payment schedule, and responsibilities of both parties. You can use platforms like USLegalForms to ensure you have a legally sound document that meets all necessary requirements.

In California, installation services related to equipment are typically subject to sales tax. Therefore, if you are obtaining California Lease of Recreation or Athletic Equipment, be aware of any additional charges for installation. It's essential to factor these costs into your budget. Staying informed will help you avoid unexpected expenses.

Leased equipment is generally treated as an expense rather than an asset on your balance sheet. In the case of California Lease of Recreation or Athletic Equipment, you can deduct rental payments as a business expense. This approach can positively impact your taxable income. Again, be sure to keep accurate records for effective tax reporting.

Certain types of income, such as rental income from real estate, may not be subject to self-employment tax. Contributions from California Lease of Recreation or Athletic Equipment may fall under this category if you are not actively participating. Understanding what qualifies is crucial for proper reporting. Always consider consulting a tax professional for further clarity on your income streams.

Equipment leasing is often not considered a passive activity if you are actively managing it. In cases of California Lease of Recreation or Athletic Equipment, your involvement determines whether the income is classified as passive. Passive activities typically involve limited participation. Assess your role carefully to ensure accurate tax treatment.

Leases can be subject to self-employment tax if you operate a business from the leased equipment. With California Lease of Recreation or Athletic Equipment, your tax obligations depend on your level of involvement in the management. If your activity qualifies as a trade or business, then you may face self-employment tax. It's recommended to seek expert advice to ensure compliance.

Rental income can be considered self-employment income if you are actively involved in the management of your rental properties. However, when you engage in California Lease of Recreation or Athletic Equipment without significant day-to-day involvement, it might not qualify as self-employment income. Always analyze your specific involvement for accurate tax reporting. Consulting a tax professional can clarify your position.

In California, the rental of equipment is generally subject to sales tax. This includes California Lease of Recreation or Athletic Equipment used for business purposes. It's wise to review the current tax regulations, as they may change. Budgeting for taxes ensures you remain compliant.