California Affiliate Program Operating Agreement

Description

How to fill out Affiliate Program Operating Agreement?

If you require to calculate, obtain, or produce legal document templates, utilize US Legal Forms, the largest assortment of legal forms, which can be accessed online.

Take advantage of the website's user-friendly and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have selected the form you want, choose the Get now button. Pick the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the California Affiliate Program Operating Agreement. Every legal document template you obtain is yours indefinitely. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

- Use US Legal Forms to acquire the California Affiliate Program Operating Agreement in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and press the Download button to retrieve the California Affiliate Program Operating Agreement.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you have selected the form for your correct region/country.

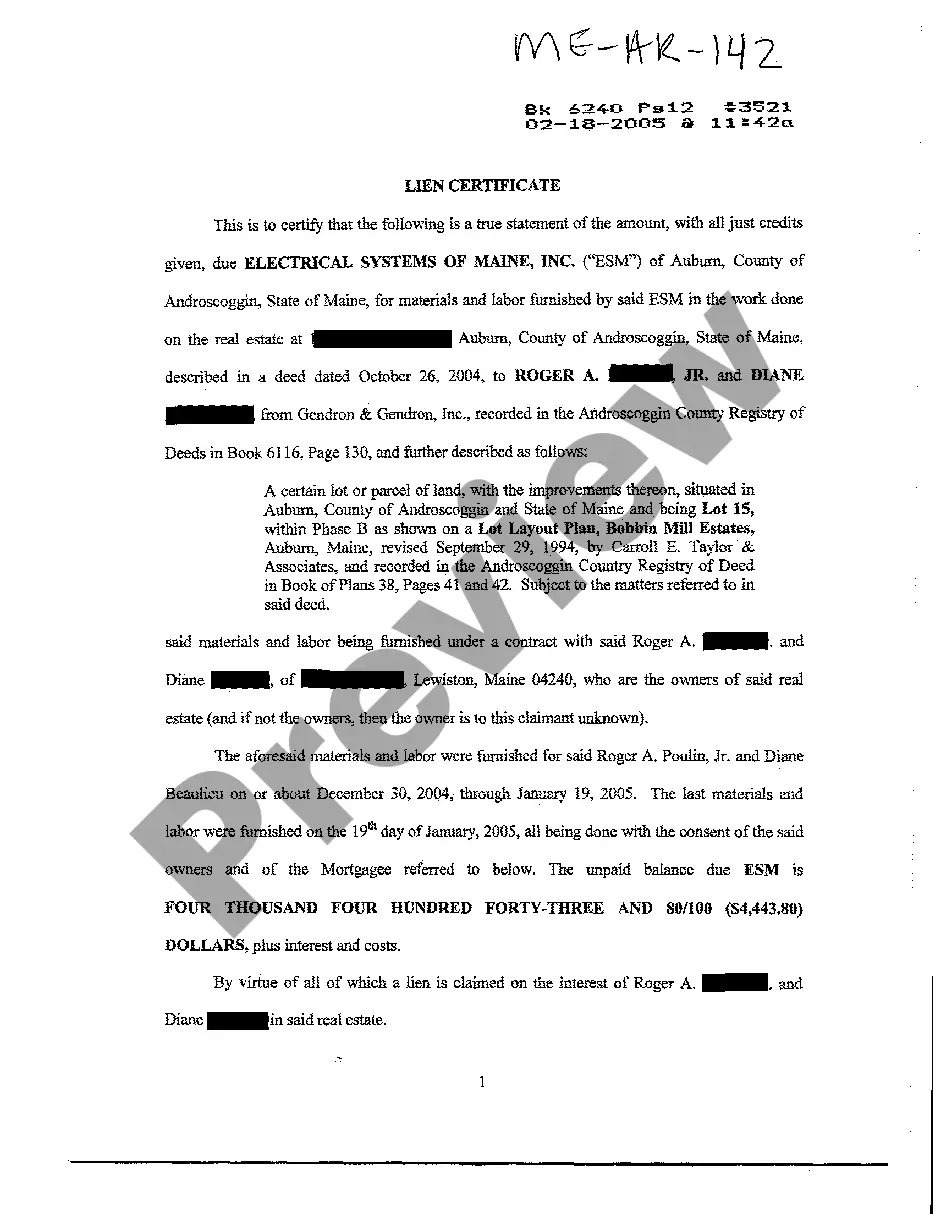

- Step 2. Utilize the Preview option to review the form's content. Remember to check the explanation.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To file form SI 100 in California, begin by gathering the necessary information about your business structure and principles. If you have an established California Affiliate Program Operating Agreement, this will assist in providing accurate details. You can file this form online or by mail, ensuring you comply with California's filing deadlines. For assistance with navigating this process, consider leveraging platforms like uslegalforms to ensure your filing is correct and timely.

CA form 565 is required for certain limited liability companies (LLCs) and partnerships that have multiple members. If your business operates under a California Affiliate Program Operating Agreement and has more than one member, you will need to file this form to report income, deductions, and credits for the tax year. This form ensures that the California Franchise Tax Board receives the necessary information to assess your business taxes accurately. For guidance on filing, uslegalforms can be a valuable resource.

You do not need to file your California Affiliate Program Operating Agreement with the state of California, as it is an internal document. However, having this agreement in place is essential for outlining the management structure and operational guidelines of your affiliate program. It protects your business interests and helps prevent misunderstandings among members. For more clarity on creating and storing your agreement, consider platforms like uslegalforms for drafting assistance.

In California, an operating agreement does not need to be notarized to be valid. However, having a California Affiliate Program Operating Agreement that is signed and dated by all members serves as a clear record of their intent and understanding. While notary services may add an extra layer of formality, it is not a legal requirement. Ensure that all members understand and agree upon the contents for the best results.

If an LLC does not have an operating agreement, it may operate under state default rules, which may not align with the members' intentions. This could lead to confusion and disputes among members regarding roles and responsibilities. A California Affiliate Program Operating Agreement can prevent such issues by providing a clear framework for decision-making and profit distribution. It’s wise to create one to guard your LLC’s interests.

California does not explicitly require LLCs to have an operating agreement, but it is an essential document for internal governance. A California Affiliate Program Operating Agreement can clarify the management structure and duties of each member, which is invaluable for smooth operations. It protects members' interests and provides legal backing in case of disputes. Having one is a recommended practice to enhance your business's credibility.

Obtaining a California Affiliate Program Operating Agreement is straightforward. You can draft one yourself by using templates available online, or you can opt for services like U.S. Legal Forms for professionally prepared documents. This ensures compliance with California regulations and customizes the agreement to meet your unique business needs. Consider this option to ensure you cover all the necessary details efficiently.

While California does not legally mandate an operating agreement for LLCs, having one is highly beneficial. A California Affiliate Program Operating Agreement serves as a foundational document that helps govern your business operations and clarify member relationships. Without it, misunderstandings may arise, leading to potential conflicts. Therefore, it is advisable to have one drafted to streamline your business practices.

In California, an operating agreement is not legally required for LLCs. However, having a California Affiliate Program Operating Agreement provides clear guidelines for your business operations. It outlines the structure, roles, and responsibilities of members, which can help prevent disputes down the line. Investing time in creating this agreement is a wise decision for ensuring clarity within your business.

California does not require LLCs to have an operating agreement, yet it is a beneficial document. A California Affiliate Program Operating Agreement aids in defining the framework of your business management and can help prevent misunderstandings among members. Without it, you may rely on default state rules that may not suit your specific business needs. Therefore, having an agreement is a smart choice for clarity and organization.