California Sworn Statement of Identity Theft

Description

1. Obtains, records, or accesses identifying information that would assist in accessing financial resources, obtaining identification documents, or obtaining benefits of the victim.

2. Obtains goods or services through the use of identifying information of the victim.

3. Obtains identification documents in the victim's name.

Identity theft statutes vary by state and usually do not include use of false identification by a minor to obtain liquor, tobacco, or entrance to adult business establishments. The types of information protected from misuse by identity theft statutes includes, among others:

-Name

-Date of birth

-Social Security number

-Driver's license number

-Financial services account numbers, including checking and savings accounts

-Credit or debit card numbers

-Personal identification numbers (PIN)

-Electronic identification codes

-Automated or electronic signatures

-Biometric data

-Fingerprints

-Passwords

-Parent's legal surname prior to marriage

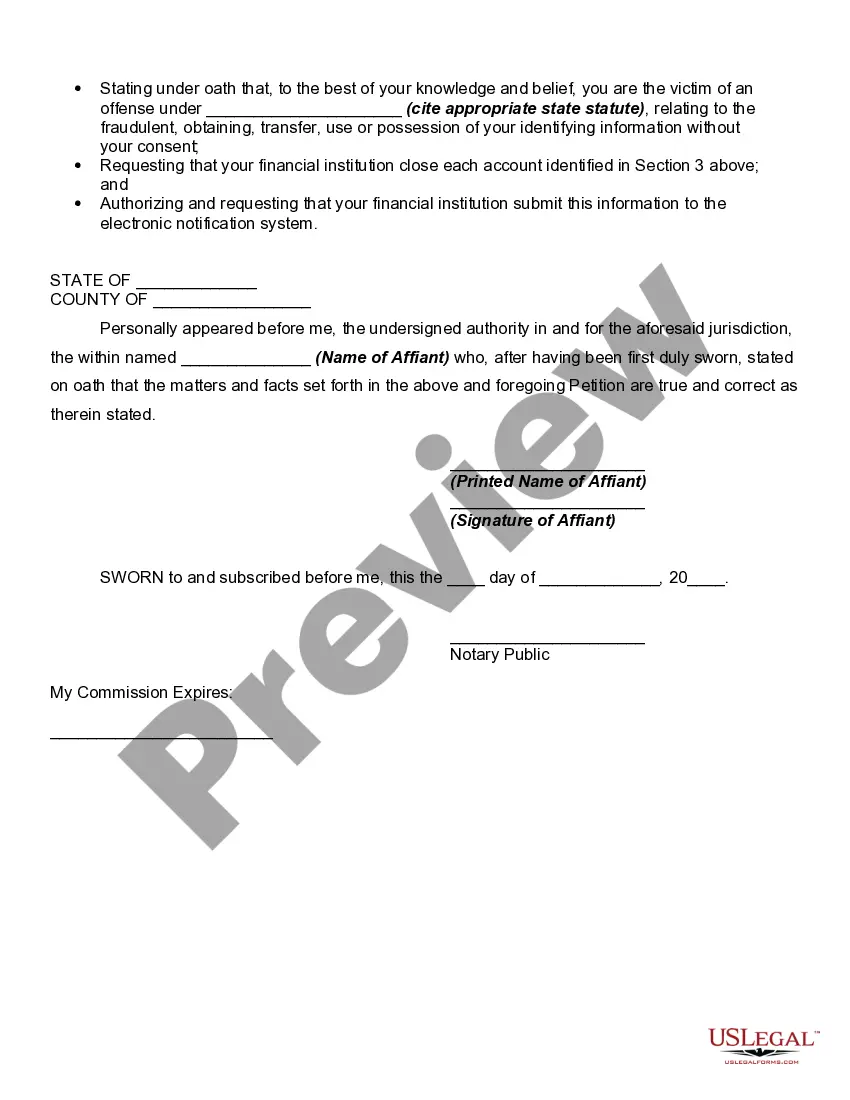

How to fill out Sworn Statement Of Identity Theft?

Are you presently in a position where you need paperwork for both business or individual uses virtually every day time? There are plenty of legitimate document themes available online, but finding ones you can trust is not easy. US Legal Forms gives a huge number of form themes, like the California Sworn Statement of Identity Theft, which can be written to meet state and federal specifications.

If you are previously knowledgeable about US Legal Forms website and also have your account, just log in. After that, you may acquire the California Sworn Statement of Identity Theft web template.

If you do not have an account and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is for that correct town/county.

- Utilize the Review key to examine the form.

- Look at the outline to actually have selected the correct form.

- In the event the form is not what you`re seeking, make use of the Look for area to obtain the form that suits you and specifications.

- If you obtain the correct form, simply click Acquire now.

- Opt for the pricing prepare you would like, fill out the necessary info to make your money, and purchase an order making use of your PayPal or bank card.

- Choose a practical paper file format and acquire your version.

Find each of the document themes you may have bought in the My Forms food list. You can aquire a extra version of California Sworn Statement of Identity Theft anytime, if needed. Just select the needed form to acquire or produce the document web template.

Use US Legal Forms, probably the most considerable collection of legitimate forms, to save time and avoid mistakes. The service gives skillfully produced legitimate document themes that you can use for a range of uses. Produce your account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report.

Take precautions. The IRS wants you to submit Form 14039 when you believe someone has unauthorized access to your personal information.

A copy of your FTC Identity Theft Report. A government-issued ID with a photo. Proof of your address (mortgage statement, rental agreement, or utilities bill) Any other proof you have of the theft?bills, Internal Revenue Service (IRS) notices, etc.

In most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.

Get copies of documents related to the th eft of your identity, like transaction records or applications for new accounts. You must include a copy of your police report and an identity theft affidavit with your written request to the company that has the documents.

If you believe you're a victim of identity theft If you did not receive a notice but believe you've been the victim of identity theft, contact the IRS Identity Protection Specialized Unit at 800-908-4490, extension 245 right away so we can take steps to secure your tax account and match your SSN or ITIN.

A person convicted of misdemeanor identity theft faces up to one year in county jail, a fine of up to $1,000, or both. A person convicted of felony identity theft faces up to three years in California state prison, a fine of up to $10,000, or both. Federal law prohibits identity theft more severely than California law.

I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.