California Community Property Agreement

Description

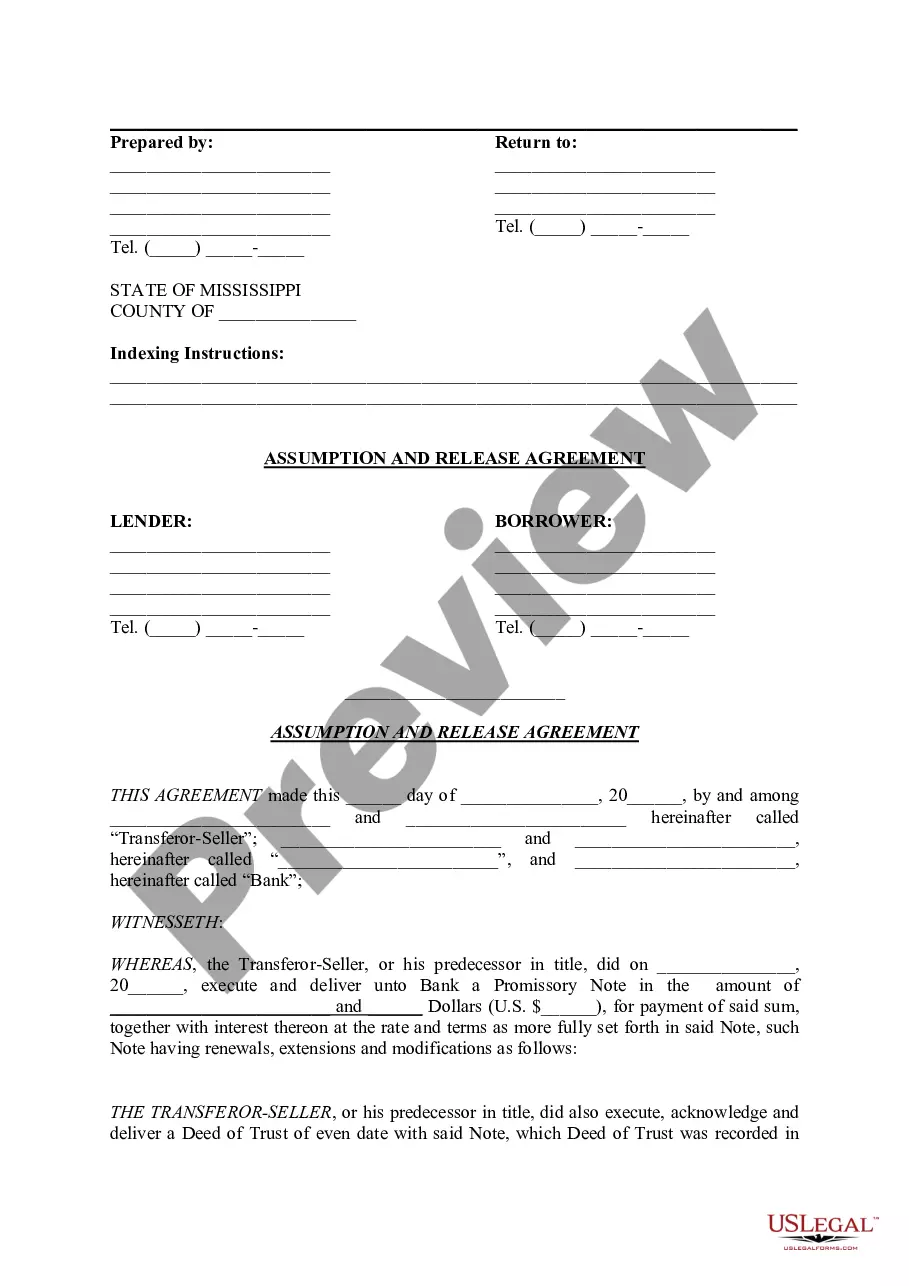

How to fill out Community Property Agreement?

Are you in a situation where you require documents for both professional or specific reasons nearly every day.

There is a multitude of legal document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, such as the California Community Property Agreement, which are drafted to meet state and federal requirements.

Once you find the appropriate form, simply click Acquire now.

Choose the payment plan you desire, provide the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the California Community Property Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the correct document.

- If the form isn’t what you need, use the Search field to find the form that matches your needs.

Form popularity

FAQ

In California, any property acquired during the marriage is generally considered community property, starting from the date of marriage itself. There is no waiting period; assets gained while married will be treated as shared property. Consider using a California Community Property Agreement to clarify your property rights and distribution during or after your marriage.

The 10-year marriage law in California relates primarily to spousal support considerations. If you have been married for at least 10 years, you may have a stronger claim to spousal support after divorce. Incorporating a California Community Property Agreement can further protect your interests and outline expectations for support, providing additional peace of mind.

In a community property state like California, filing for a marital settlement agreement (MFS) involves several steps. You need to complete the necessary court forms that detail your community property and debts. Using a California Community Property Agreement can help ensure thoroughness and clarity, making the process easier for you.

Filling out a marital settlement agreement in California can seem overwhelming, but it simplifies the divorce process by outlining asset divisions and responsibilities. Begin by listing all marital assets and debts, and discuss how you want to divide them. Utilizing a California Community Property Agreement can streamline this process, ensuring both parties understand their rights and obligations.

California recognizes community property laws, which state that assets acquired during the marriage are shared equally. There is no minimum duration for dividing community property; as soon as you marry, assets you acquire together fall under community property rules. A California Community Property Agreement can help clarify asset divisions based on your specific situation.

In California, assets acquired during marriage are generally considered community property, regardless of whose name is on the title. This means that your wife may have a claim to half the value of the house, even if it's solely in your name. To protect your interests, consider creating a California Community Property Agreement that clearly defines ownership and shares of property.

The community property rule in California states that any property or income earned during the marriage is owned equally by both spouses. This rule applies regardless of who earned the income or whose name is on the title. Understanding the California Community Property Agreement helps clarify how assets will be divided in the event of divorce or separation. Utilizing resources like uslegalforms can guide you through creating an effective agreement that meets your needs.

In California, you do not need to be married for a specific duration to claim half of the community property. All assets and debts acquired during the marriage are generally considered community property. This means a California Community Property Agreement can play a crucial role in outlining how assets are divided. Being informed about your rights can help you make better decisions regarding your shared finances.

After ten years of marriage in California, the community property laws become particularly important. Spouses typically have equal rights to shared property accumulated during the marriage. If you face divorce, a California Community Property Agreement can help determine the division of assets fairly. It is wise to consult a legal expert to ensure that your rights are protected.

Community property income examples include wages earned by either spouse during the marriage, rental income from jointly owned property, and dividends from shared investments. Understanding these concepts under the California Community Property Agreement is vital for accurate financial planning. It ensures both partners benefit equally from joint assets. For additional clarity, USLegalForms offers detailed explanations and forms that can aid in managing your community property.