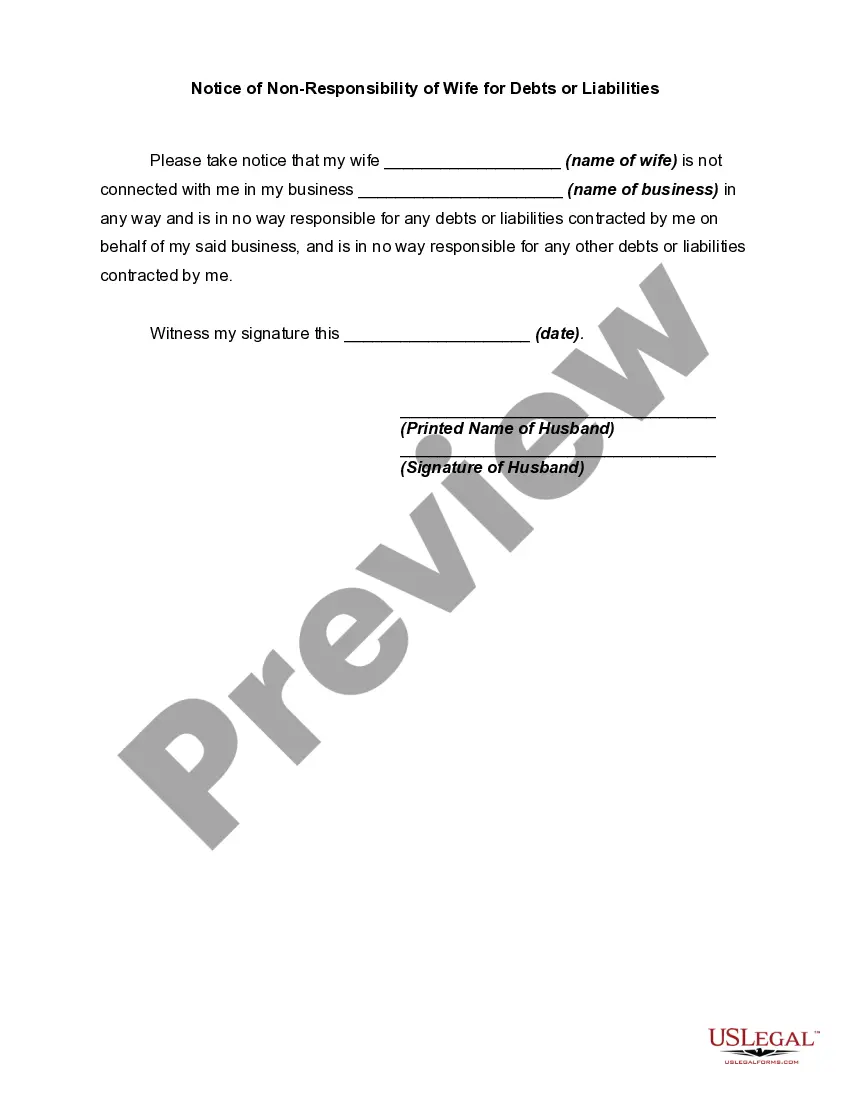

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

How to fill out Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost daily.

There is a multitude of legal document templates available online, but finding ones you can rely on can be challenging.

US Legal Forms offers thousands of form templates, including the California Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse, designed to meet federal and state requirements.

Once you find the correct form, click on Buy now.

Select a payment plan you prefer, fill in the necessary details to create your account, and complete the purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the California Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to look over the form.

- Check the description to confirm that you have chosen the right form.

- If the form isn’t what you are looking for, utilize the Search field to locate the form that meets your requirements.

Form popularity

FAQ

To serve a notice of belief of abandonment in California, you must complete the notice and identify the property in question. The next step involves delivering the notice to the last known address of the person you believe has abandoned the property. Additionally, you may also need to send a copy to the county recorder’s office. Services like US Legal Forms can provide you with the necessary templates and guidance to ensure compliance with California law.

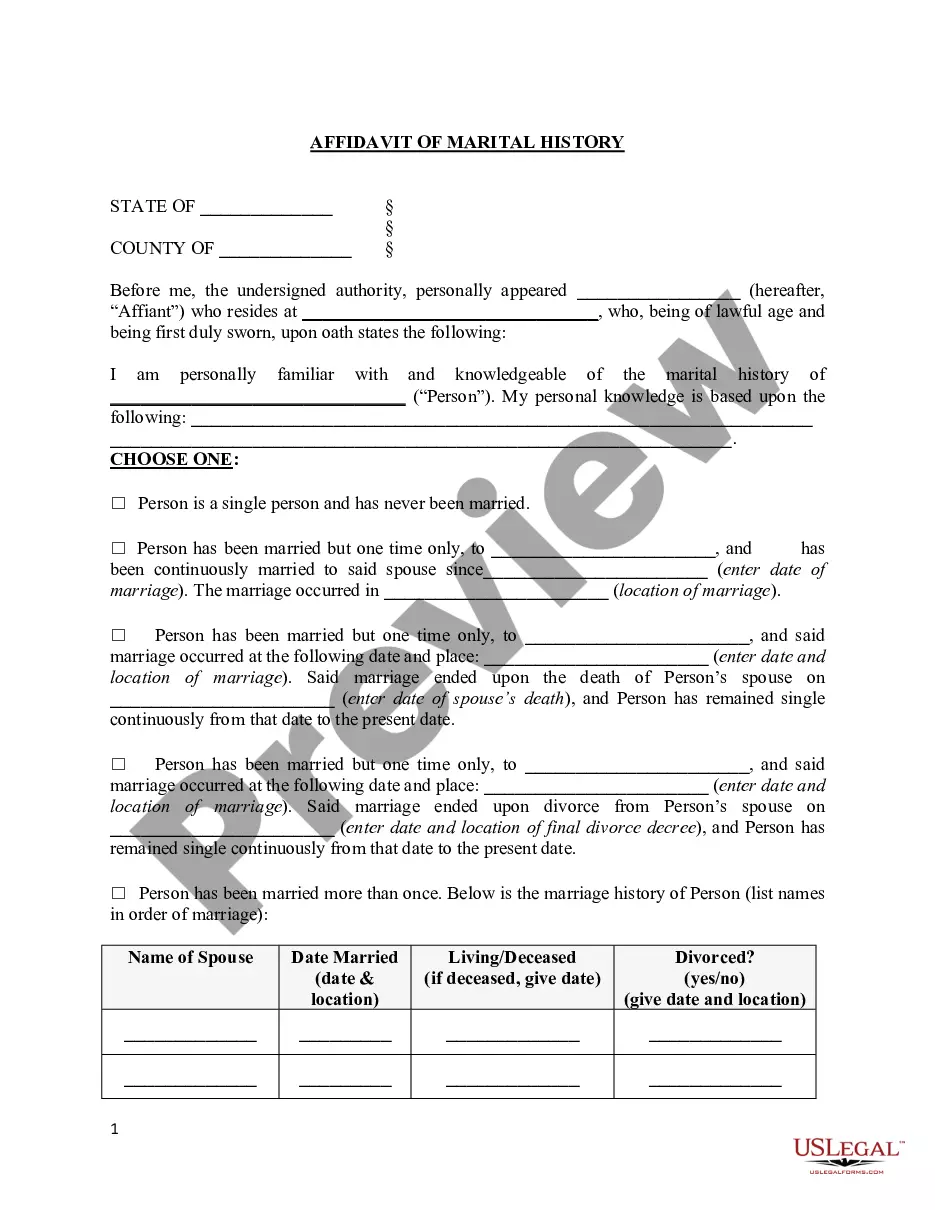

Filing a California Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse requires a few steps. First, you must prepare the notice, providing essential details such as names, addresses, and the nature of the liability. Then, you need to file the notice with the county recorder's office where your property is located. This process safeguards your assets from your spouse's debts, ensuring clarity on your financial obligations.

In California, a spouse may generally be held responsible for debt incurred during the marriage, but this does not include debts related to a California Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. This means that if one spouse incurs business or personal debt without the other’s knowledge or consent, the other spouse may not be liable. Understanding the implications of this distinction can protect your financial interests.

In California, debt does not automatically combine upon marriage. Debts incurred before the marriage typically remain with the individual who incurred them, while debts taken on during the marriage may be considered community property. To clarify your position regarding your spouse's debts, consider using the California Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse for your legal protection.

The 10-year rule in California refers to spousal support or alimony considerations after a marriage lasts for at least ten years. In this case, the courts might evaluate the marriage differently when determining the duration or amount of spousal support if the marriage ends. Understanding this rule can be important as it relates to financial responsibilities, especially concerning the California Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse.

When you get married in California, debts incurred before the marriage generally remain the responsibility of the individual who took them on. However, debts acquired during the marriage can be treated differently, as California is a community property state. To safeguard against any liabilities related to your spouse's debts, consider filing a California Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse.

In California, you may be held responsible for your spouse's IRS debt, especially if the debt was incurred during the marriage. However, if you want to protect yourself, you can use a California Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. This legal document can help clarify that you are not responsible for certain debts that your spouse accrued independently.

In California, you are generally not responsible for your spouse's debt if they pass away, particularly if you did not jointly incur those debts. However, the estate may be responsible for settling these debts before any inheritance is distributed. Understanding your rights and obligations in such situations is essential; uslegalforms can provide resources to help clarify your legal position.

A finding of non-responsibility in California indicates that a party is not liable for debts or obligations incurred by another party, such as a spouse. This legal determination protects you from creditors pursuing you for your partner's financial responsibilities. Understanding this concept can help shield your assets and clarify legal standings. For filing such notices, uslegalforms offers valuable tools to ensure compliance with local laws.

To file a notice of non-responsibility in California, you must complete the appropriate form and file it with the county recorder's office. This notice must be posted on the property within 10 days of becoming aware of the indebtedness, thereby limiting your liability. It's advisable to consult legal resources for assistance, and uslegalforms can provide the necessary forms to make this process easier.