California Assignment of Debt

Description

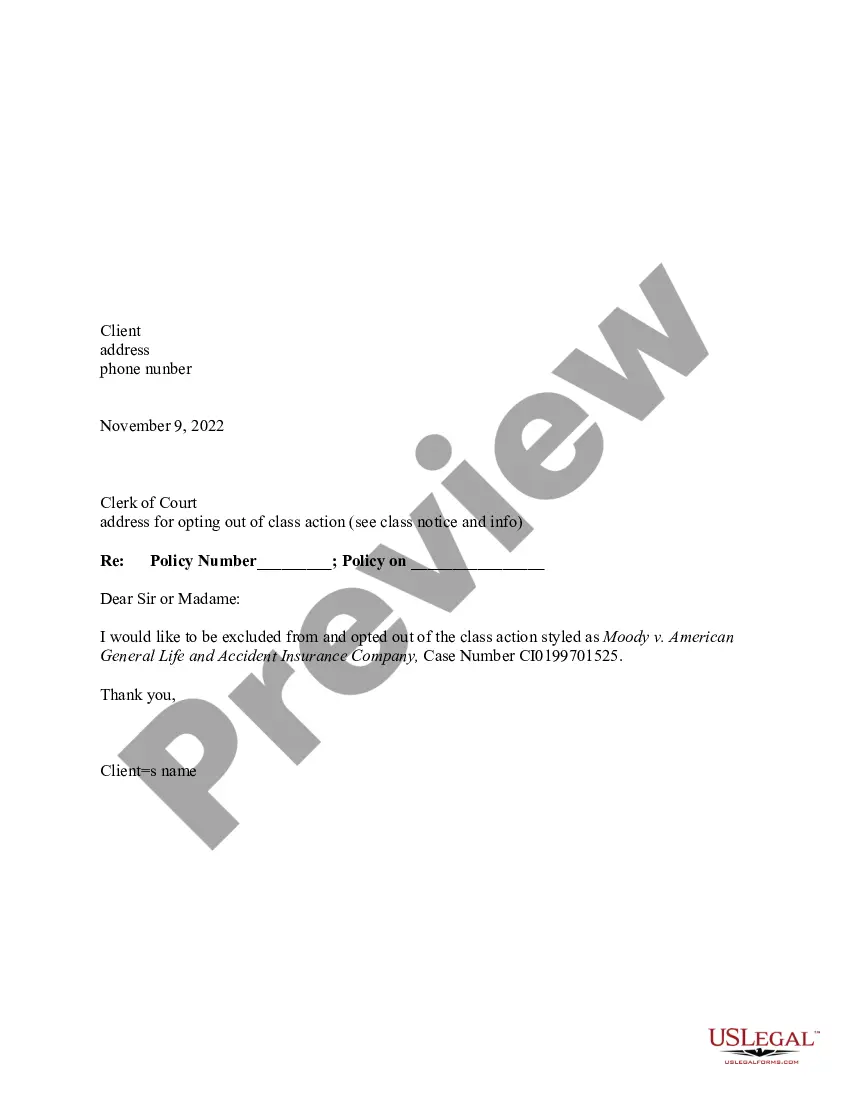

How to fill out Assignment Of Debt?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print.

By utilizing the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will discover the most recent types of forms such as the California Assignment of Debt in just a few minutes.

If you hold a membership, Log In and retrieve California Assignment of Debt from the US Legal Forms library. The Download button will appear on every document you access. You can view all previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Make modifications. Fill out, alter, print, and sign the saved California Assignment of Debt. Every template you add to your account does not expire and is yours indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the form you require. Access the California Assignment of Debt with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form's content.

- Read the form description to confirm you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Acquire now button.

- Then, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

California is often considered a debtor-friendly state due to its various protections for individuals facing financial hardship. For instance, the state offers exemptions that allow you to keep certain assets, even during debt collection. Additionally, laws surrounding the California Assignment of Debt ensure that debtors have pathways to manage their obligations responsibly. Understanding these protections can help you navigate your financial situation more effectively.

In California, creditors have a limited period to collect a debt, known as the statute of limitations. Generally, this period is four years for most debts, including credit cards and personal loans. After this time frame, you can assert the statute as a defense against collection efforts. It is important to understand your rights under the California Assignment of Debt, as it influences how long creditors can pursue you.

California recently enacted new laws that regulate debt collection practices, aiming to protect consumers from aggressive tactics. These laws require collectors to provide clear and accurate information regarding debts owed, including their rights. This transparency is crucial in the context of California Assignment of Debt, making it more straightforward for individuals to navigate their obligations. For the latest updates, consider consulting US Legal Forms to stay informed.

Yes, the assignment of a contract is legal in California, provided that the original contract does not prohibit it. This process allows one party to transfer their rights and obligations to another party. However, it’s essential to document the assignment properly to avoid future disputes. Utilizing resources like US Legal Forms can simplify this process and ensure compliance with California laws.

The process of debt assignment typically starts with the original creditor preparing an assignment document that outlines the terms of the transfer. This document must be signed by both parties, and in most cases, a formal notice should be sent to the debtor. Using platforms such as uslegalforms can simplify the California Assignment of Debt process, ensuring all legal requirements are met.

The notice of assignment procedure requires the original creditor to inform the debtor of the new creditor's identity. This notice should include details about where payments should be directed. Being aware of the notice of assignment procedure is essential within the framework of California Assignment of Debt to ensure proper communication and compliance.

When a debt is assigned, the new creditor assumes responsibility for collecting the debt. The debtor is usually notified about the assignment, which may also include new payment instructions. Understanding how the California Assignment of Debt functions helps all parties to navigate their relationships and obligations clearly.

An acknowledgment of debt must include specific details such as the debtor's name, the amount owed, and the terms of repayment. This document helps clarify responsibilities and serves as proof of the debt. When dealing with California Assignment of Debt, clear acknowledgment is essential to avoid disputes in the future.

Debt assignment refers to the process where a creditor transfers their rights and obligations regarding a debt to another party. This transfer allows the new party to pursue the collection of the debt. Understanding the California Assignment of Debt is crucial, as it affects how debts are managed and collected moving forward.

Assigning a judgment in California involves a formal process. You must execute an Assignment of Judgment form, which you can find online or through legal services like uslegalforms. After execution, you should file the assignment with the court to ensure the new creditor is recognized under the California Assignment of Debt.