This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare

Description

How to fill out Agreement Between Professional Corporation And Non-Profit Corporation To Treat People Who Cannot Afford Healthcare?

Are you presently in a situation where you require documents for either business or personal purposes nearly every workday.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms provides thousands of document templates, including the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals who cannot Afford Healthcare, tailored to meet federal and state regulations.

Select the pricing plan you prefer, complete the required information to create your account, and pay for your order using PayPal or a credit card.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can obtain the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat Individuals who cannot Afford Healthcare template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is suited for your particular city/state.

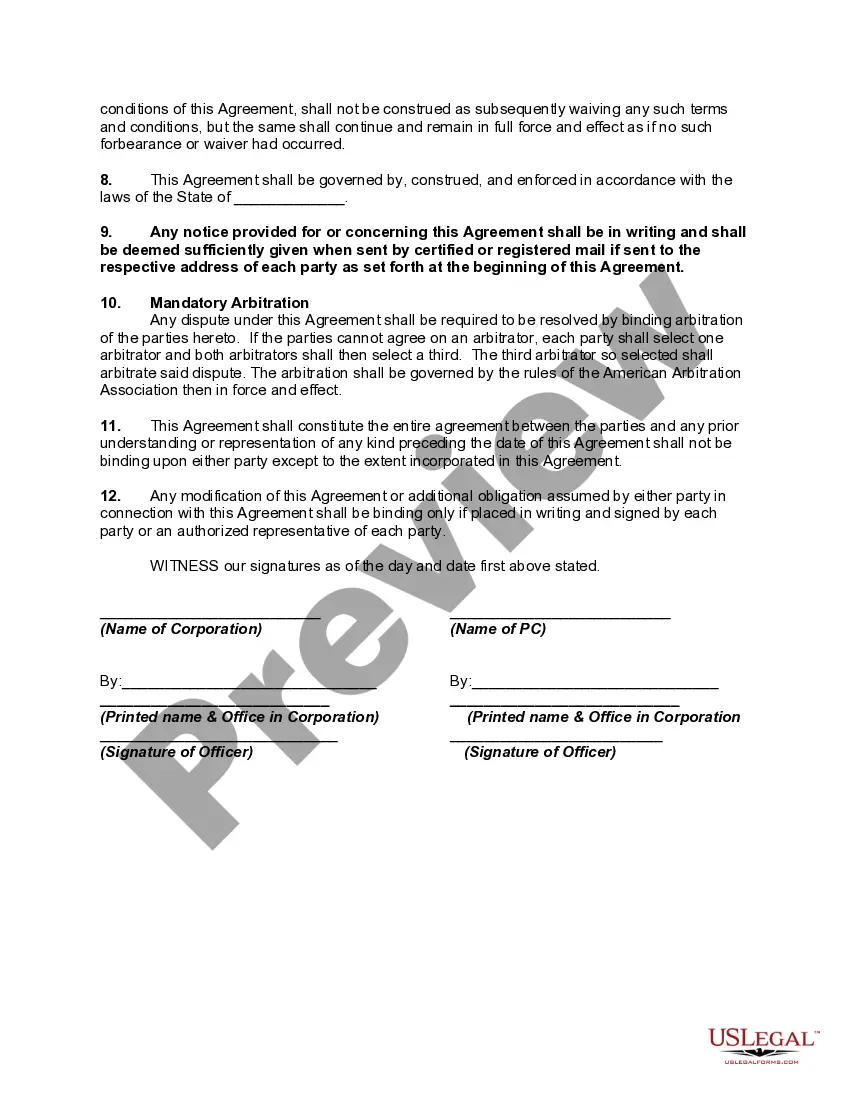

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the correct document.

- If the document is not what you're looking for, utilize the Search field to find the form that meets your needs.

- Once you have the correct document, simply click Purchase now.

Form popularity

FAQ

The Nonprofit Integrity Act aims to promote transparency and accountability within nonprofit organizations. This law requires nonprofit boards to establish proper governance practices and financial controls. When working with the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, adherence to this act can strengthen trust with your community and ensure ethical operations.

Yes, the California Consumer Privacy Rights Act (CPRA) applies to nonprofits under certain conditions. If a nonprofit collects personal data from California residents, they must comply with the CPRA's regulations. Understanding this is crucial, especially when considering the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, as it ensures the protection of personal information while serving communities.

Indeed, California mandates that nonprofits adopt bylaws as part of their organizational framework. These bylaws help establish essential rules for operation and align with the objectives of the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. By maintaining bylaws, nonprofits can operate smoothly and uphold accountability.

The CPOM (Corporate Practice of Medicine) law restricts how medical practices can be owned and operated in California. This law is particularly important when discussing arrangements like the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. Understanding CPOM ensures that healthcare providers follow legal guidelines while serving underserved populations.

Yes, California law requires nonprofits to have bylaws to define their structure and governance. These bylaws are essential for compliance and transparency, supporting the mission outlined in the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. Clear bylaws can help nonprofits operate effectively and maintain trust with their community.

Yes, corporations can own medical practices in California, provided they comply with specific legal requirements. This ownership is especially relevant for those involved in the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. By operating within the law, these corporations can contribute to healthcare access for individuals in need.

Yes, a California corporation must have bylaws as they dictate the rules for governance. Bylaws help establish procedures for meetings, voting, and other operational aspects crucial for the organization, including those guided by the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. Having clear bylaws promotes a properly functioning corporate structure.

The 33% rule refers to the allocation of funds which suggests that no more than 33% of a nonprofit's budget should come from a single source. This rule helps maintain financial diversity and stability, especially for organizations influenced by the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. By following this guideline, nonprofits can minimize risk and enhance sustainability.

Nonprofits generally need to share their bylaws with members and stakeholders to ensure transparency. This practice aligns with the expectations set forth in the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare. Sharing bylaws fosters trust and can help in building strong relationships with the community.

The corporate practice of medicine ban in California prohibits non-licensed entities from controlling medical practices or directly employing physicians. This ban is crucial for safeguarding patient care and the integrity of medical decisions in the state. For organizations involved in the California Agreement Between Professional Corporation and Non-Profit Corporation to Treat People who cannot Afford Healthcare, understanding this ban is essential for compliance and operational success.