Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Declaration of Gift Over Several Year Period

Description

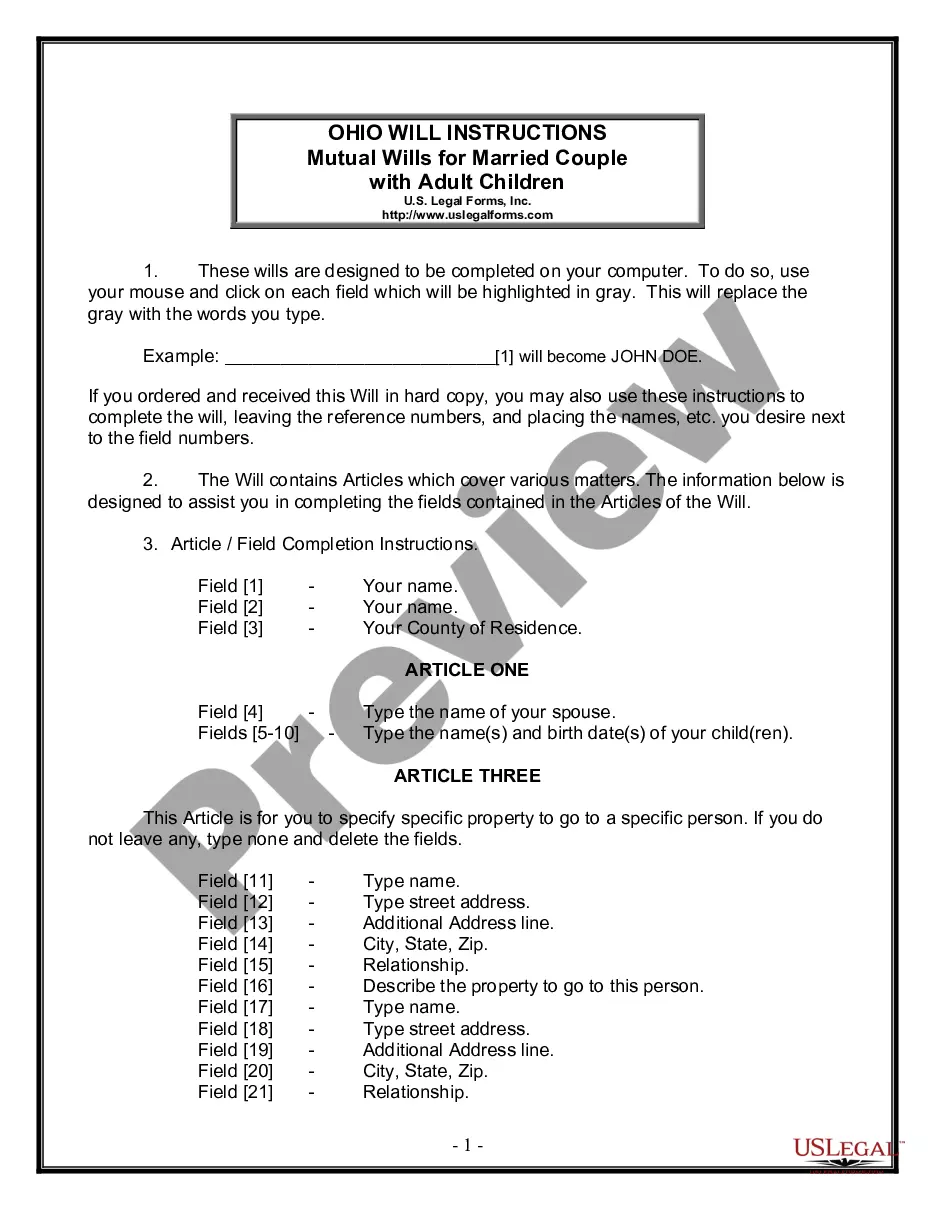

How to fill out Declaration Of Gift Over Several Year Period?

Are you in a situation where you require documents for either professional or particular purposes almost every business day? There are numerous credible document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms provides a wide variety of document templates, including the California Declaration of Gift Over Several Year Period, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the California Declaration of Gift Over Several Year Period template.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the California Declaration of Gift Over Several Year Period at any time, if necessary. Simply click on the desired template to download or print the document format.

Utilize US Legal Forms, one of the most extensive collections of legitimate documents, to save time and avoid mistakes. The service provides properly formatted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit simpler.

- If you do not yet have an account and would like to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it corresponds to the correct city/region.

- Use the Preview button to review the document.

- Check the summary to confirm you have chosen the right template.

- If the document isn't what you want, utilize the Search field to find a template that fits your criteria and needs.

- Once you find the correct template, click Get now.

- Select the pricing plan you prefer, enter the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

Form 700 must be filled out by specified public officials, including elected representatives and key employees within California's public agencies. These individuals are responsible for reporting their financial dealings, ensuring adherence to the California Declaration of Gift Over Several Year Period. Ensuring your compliance with these regulations is essential for maintaining ethical governance.

On Form 700, you need to report any gifts you have received, your investments, business positions, and any real estate interests. This reporting supports the principles outlined in the California Declaration of Gift Over Several Year Period. By accurately filling out this form, you help uphold the transparency expected from public officials.

Yes, California state employees can accept gifts, but they are subject to strict limits and disclosure requirements. These regulations are designed to prevent conflicts of interest and ensure compliance with the California Declaration of Gift Over Several Year Period. Understanding these rules is vital to maintaining ethical standards in public service.

Filing a statement of economic interest is essential to promote transparency and public confidence in government. By submitting this statement, you adhere to the California Declaration of Gift Over Several Year Period. It allows the public to scrutinize the economic interests of state officials, creating a more trustworthy political environment.

Code filers for Form 700 include elected officials, candidates, and designated employees in California. They are mandated to report any gifts received to comply with the California Declaration of Gift Over Several Year Period. This requirement helps safeguard public trust by ensuring that those in positions of power remain transparent about their financial honors.

Form 700 is used by California state officials to report their financial interests, which includes gifts received. This form ensures transparency regarding gifts over a specific value, aligning with the California Declaration of Gift Over Several Year Period. By requiring this disclosure, California maintains accountability and integrity within its government.

If you exceed the $15,000 limit when gifting, you are required to report the excess on your tax return using Form 709. This can affect your lifetime gift tax exemption, which is crucial in the context of significant gifts over time. The California Declaration of Gift Over Several Year Period allows for organized planning and tracking of your gifts. Consulting with professionals can help you manage your tax obligations efficiently.

California has specific regulations regarding gift certificates to protect consumers. Generally, gift certificates cannot expire within five years and must disclose any fees associated with redemption. Additionally, under the California Declaration of Gift Over Several Year Period, it's important to document gifts accurately to maintain compliance with both state and federal laws. Understanding these laws ensures a smooth gifting process.

Gifting more than the annual exclusion can lead to tax implications. The IRS may impose gift taxes on any excess amounts that surpass the exclusion limit, which is currently $15,000 for individuals. However, through the California Declaration of Gift Over Several Year Period, you can strategically plan your gifts to maximize your exemptions. Seeking professional guidance can also help navigate these complexities.

The IRS typically learns about gifts through required reporting. Donors must file Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, if they gift amounts exceeding the annual exclusion limit. This includes gifts outlined in the California Declaration of Gift Over Several Year Period, which requires careful documentation. Therefore, keeping accurate records is essential to ensure compliance.