California Sample Letter for Return Authorization

Description

How to fill out Sample Letter For Return Authorization?

It is feasible to spend a number of hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that are assessed by experts.

You can easily download or print the California Sample Letter for Return Authorization from my services.

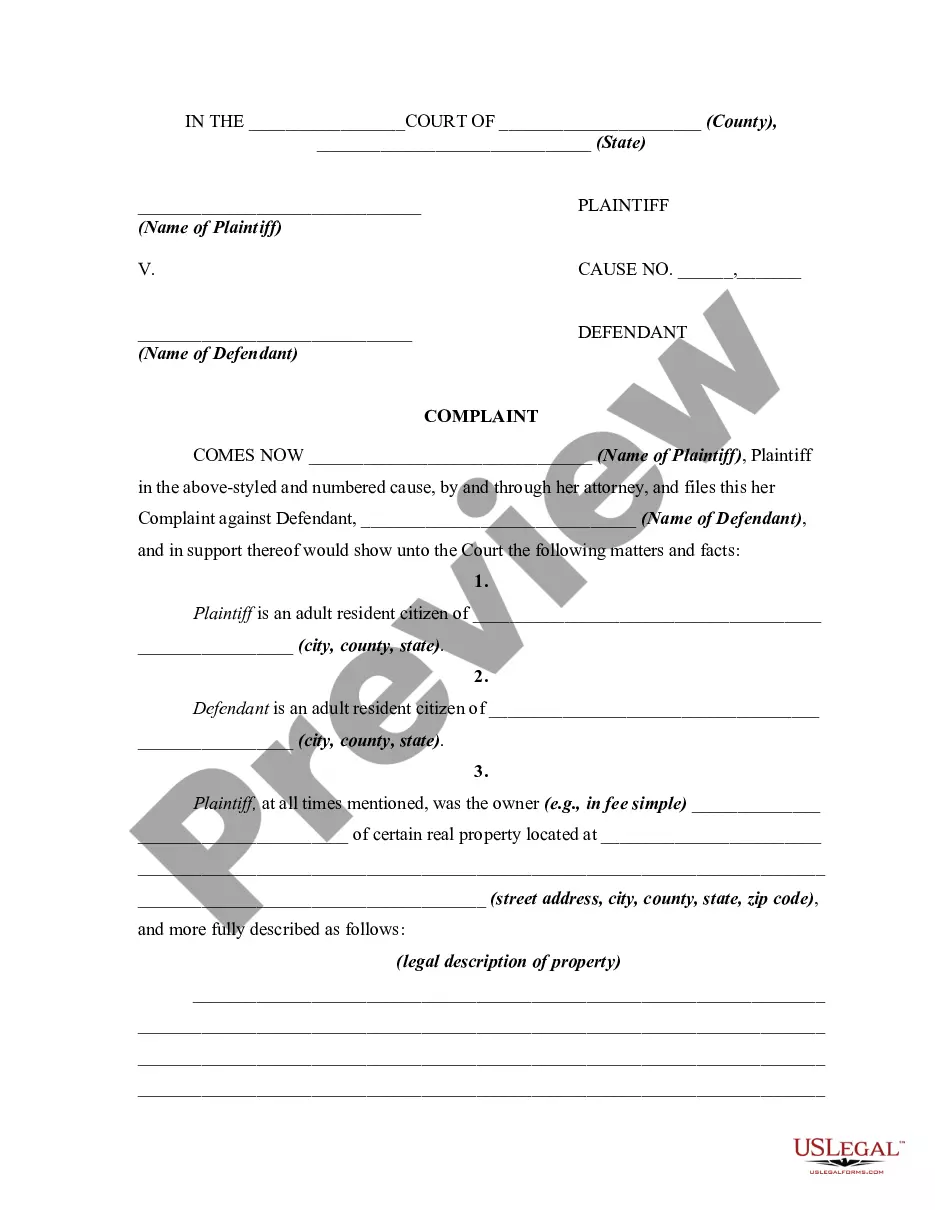

If available, utilize the Preview button to view the document template simultaneously.

- If you possess a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the California Sample Letter for Return Authorization.

- Each legal document template you obtain is yours indefinitely.

- To acquire another copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the state/region of your choice.

- Review the form description to confirm you've chosen the right form.

Form popularity

FAQ

Efile authorization is a process that allows an authorized e-file provider to submit your tax return electronically on your behalf. This authorization ensures that the provider can represent you and handle communications with tax authorities. Providing a California Sample Letter for Return Authorization can help streamline this process, granting permission for your e-file provider to act on your behalf while ensuring all your information remains secure.

California requires most taxpayers to e-file their state tax returns if they meet certain income thresholds. E-filing provides a faster way to receive your refund and helps reduce errors compared to paper filing. Additionally, your e-file provider might need a California Sample Letter for Return Authorization, which allows them to handle your tax matters efficiently.

The address for mailing your California state tax return depends on whether you are enclosing a payment. If you are, you should send it to the address listed for payments, otherwise, it goes to a specific address for returns without payments. It is advisable to check the California Franchise Tax Board’s website for the most current addresses. This also applies if you need to include a California Sample Letter for Return Authorization with your return.

An authorized e-file provider is a business or individual approved by the IRS to electronically submit tax returns on behalf of taxpayers. These providers often help simplify the filing process and ensure compliance with current tax laws. Utilizing a California Sample Letter for Return Authorization can be crucial when you are filing your taxes through an e-file provider.

The California withholding allowance certificate is a form that helps employers determine how much state income tax to withhold from your paychecks. By accurately filling out this certificate, you can optimize your tax withholdings. Applying this correctly can save you time and ensure you are adhering to California tax laws, including any relevant California Sample Letter for Return Authorization.

To reissue a California state tax refund check, you first need to contact the California Franchise Tax Board. They will guide you through the process, which may include submitting forms and identification. A California Sample Letter for Return Authorization may be useful to ensure that all your details are accurately presented.

Mailing form 8453 is often necessary if your e-filed return includes additional documents that require physical submission. However, if all your documents are submitted online and you have an approved authorization, mailing may not be required. A California Sample Letter for Return Authorization can provide clear instructions on what documents need to be mailed.

The 8453 OL form is designated for e-filed returns that require authentication. This form is crucial for confirming that your online submission is valid and accurate. Including a California Sample Letter for Return Authorization can help clarify your intentions during the e-filing process for your records.

California form 8453 OL is a specific form for individuals who submit their tax returns online. This form allows online filers to authenticate their returns electronically. Utilizing a California Sample Letter for Return Authorization helps streamline the filing process and ensures your submission is properly documented.

The California e-file return authorization for Individuals allows taxpayers to approve their e-filed tax returns. Using this authorization, taxpayers confirm that they authorize the e-filing of their returns, which can include a California Sample Letter for Return Authorization for clarity and compliance.