California Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate

Description

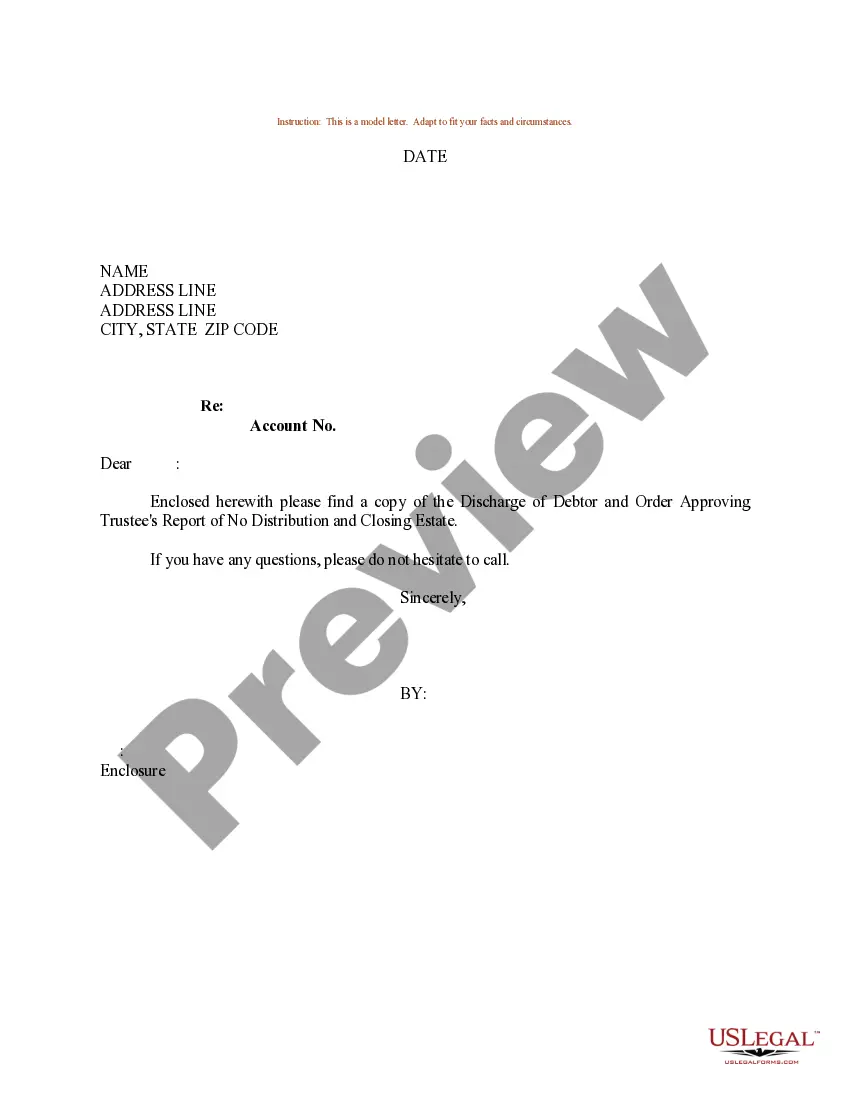

How to fill out Sample Letter Regarding Discharge Of Debtor And Order Approving Trustee's Report Of No Distribution And Closing Estate?

If you want to total, down load, or print authorized papers templates, use US Legal Forms, the biggest selection of authorized kinds, that can be found on the Internet. Make use of the site`s simple and easy practical search to get the papers you need. Various templates for organization and person functions are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to get the California Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate in a few clicks.

In case you are currently a US Legal Forms client, log in to your bank account and click the Acquire option to have the California Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate. Also you can gain access to kinds you earlier delivered electronically inside the My Forms tab of your respective bank account.

If you work with US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for the proper city/nation.

- Step 2. Utilize the Preview choice to examine the form`s information. Never forget about to learn the information.

- Step 3. In case you are not happy using the develop, make use of the Search discipline on top of the display to discover other versions from the authorized develop format.

- Step 4. Upon having found the shape you need, go through the Acquire now option. Choose the pricing program you prefer and put your accreditations to register on an bank account.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Pick the structure from the authorized develop and down load it in your system.

- Step 7. Full, modify and print or sign the California Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate.

Every single authorized papers format you buy is your own permanently. You have acces to each develop you delivered electronically with your acccount. Click the My Forms segment and select a develop to print or down load again.

Remain competitive and down load, and print the California Sample Letter regarding Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate with US Legal Forms. There are millions of expert and status-particular kinds you may use for the organization or person requirements.

Form popularity

FAQ

In a typical probate case, you should expect the process to take between six months and a year. You should make your plans ingly, and not make any major financial decisions until you know the money is on its way. This six-month to one-year time frame is just a guideline, of course.

The Personal Representative is required to file a petition for final distribution or a verified report on the status of the estate within one year after Letters are issued (or 18 months if a federal estate tax return is required).

An order for final distribution in California probate is conclusive to the rights of heirs and devisees in a decedent's estate. The order also releases the personal representative from claims by heirs and devisees, unless, of course, there is fraud or misrepresentation present.

California law rules that the personal representative should have completed probate within 1 year of being appointed executor, administrator, or personal representative of an estate. However, as a general rule of thumb - the probate process will take anywhere from 9-18 months, with some exceptions.

California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

Q: What Happens After Probate Is Closed in California? A: When the final petition is filed, and the court approves the closing of probate, the administrator distributes the estate to the beneficiaries or heirs of the will. Recipients must sign a receipt that confirms the distribution of the estate assets.

When can an executor release funds? An executor may only release funds after creditors have been paid. This includes the CRA, who will give the executor a certificate of release when all taxes, interest, and fees have been properly paid by the estate.

If accounts have not been passed after two years, a beneficiary can again apply to the court to require passing of the executor's accounts. The executor will need to explain why the estate has not yet been settled.