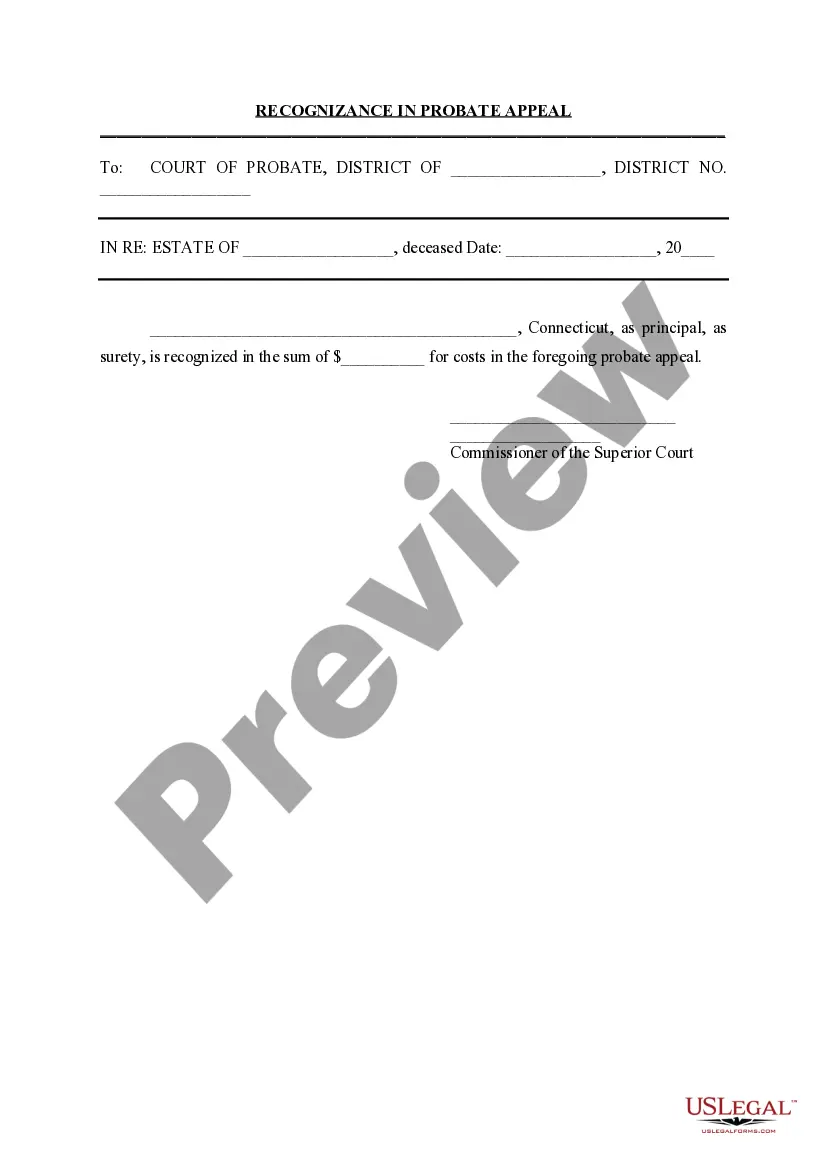

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased

Description

How to fill out Bill Of Sale And Assumption Of Debt Secured By The Personal Property Being Purchased?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates available for download or printing.

By using the website, you can find thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can access the latest document templates such as the California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased within minutes.

Examine the form description to make sure you have selected the correct document.

If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

- If you already hold a subscription, Log In and download the California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased from the US Legal Forms library.

- The Download button will be displayed for each form you review.

- You can access all previously saved documents under the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct template for your city/county.

- Click the Preview button to review the content of the template.

Form popularity

FAQ

A bill of sale becomes legally binding when it includes certain components, such as clear identification of the buyer, the seller, and the item being sold. Additionally, both parties must sign the document to signify agreement on the terms. The California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased exemplifies how these elements come together to protect both parties in the transaction.

Yes, a bill of sale is legally binding in California as long as it meets the necessary requirements. The California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased serves as proof of transfer between the buyer and seller when it includes essential elements like signatures and item descriptions. Ensuring clarity in your document can help prevent misunderstandings.

In California, a bill of sale does not require notarization to be valid. However, having your California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased notarized can provide an extra layer of protection and authenticity. This can be particularly useful if disputes arise in the future.

A personal property tax return is a document individuals file with their local tax assessor that reports the value of personal property. This return is essential for assessing the amount of personal property tax owed. Using forms related to a California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased can assist in accurately reporting your obligations.

Certain items are not classified as personal property within real estate, including items permanently affixed to the land, such as buildings or fixtures. Additionally, land itself is not considered personal property. It's vital to differentiate between real and personal property when preparing a California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

Examples of personal use property include your primary residence, vehicles used for personal travel, and household items like furniture or appliances. These items are utilized primarily for your personal enjoyment rather than for business purposes. A California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased may help establish ownership of such personal use property.

Personal use of property refers to utilizing the property for non-business activities, such as living in a home or driving a personal vehicle. This distinction is essential, particularly when it comes to tax obligations. When drafting a California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, you may need to clarify the intended use of the property.

The four main types of personal property are tangible property, intangible property, consumables, and trade fixtures. Tangible property includes items like cars and furniture, while intangible property consists of stocks and bonds. Understanding these categories can help you when using a California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

The sale of personal property can be taxable in California, depending on the type of property and the transaction. Generally, sales tax applies to sales of tangible personal property unless a specific exemption applies. To ensure compliance, familiarize yourself with your responsibilities when creating a California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

In California, personal property includes items that are movable and not fixed to land or buildings. Examples include vehicles, furniture, and equipment. Understanding what qualifies as personal property can be crucial when drafting legal documents such as a California Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.