This form is an irrevocable trust established to provide funds in order to continue a family tradition of giving birthday presents to members of grantor's immediate family and is to continue after grantor's death. The term heirs as used in this trust are those people who would inherit the estate of a deceased person by statutory law if the deceased died without a will. When a person dies without a will, the heirs to their estate are determined under the rules of descent and distribution. The term heirs-at-law is used to refer to those who would inherit under the state statute of descent and distribution if a decedent dies intestate (without a will), and they may or may not be beneficiaries under a will.

California Trust to Provide Funds for the Purchase of Birthday Presents for Members of Grantor's Family to Continue after Grantor's

Description

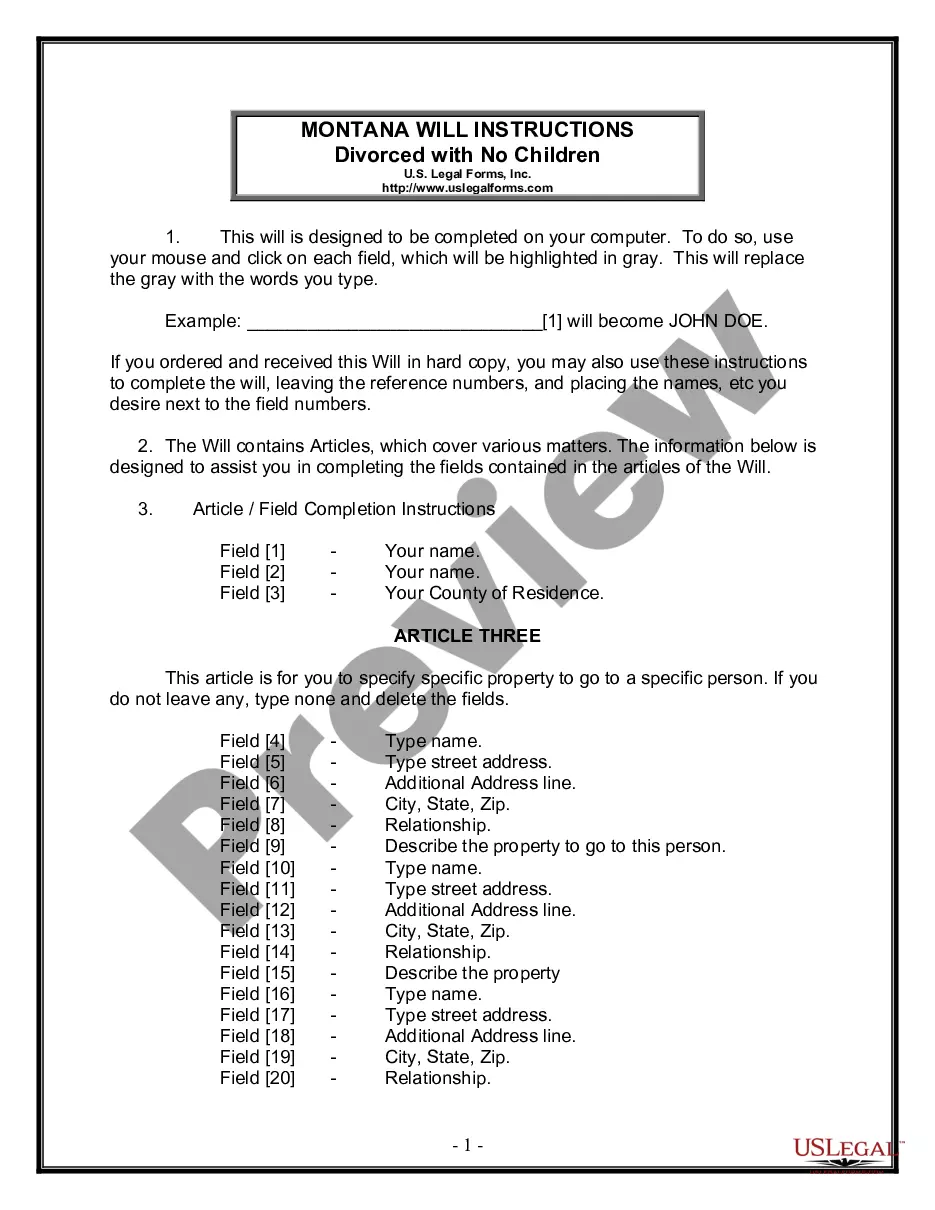

How to fill out Trust To Provide Funds For The Purchase Of Birthday Presents For Members Of Grantor's Family To Continue After Grantor's?

Selecting the optimal legal document web template can be a challenge. Certainly, there are numerous layouts accessible on the web, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers an extensive collection of layouts, such as the California Trust to Provide Funds for the Purchase of Birthday Gifts for Members of Grantor's Family to Continue after Grantor's Donation, which can be utilized for both business and personal purposes.

All of the forms are reviewed by professionals and meet state and federal standards.

If the form does not meet your requirements, use the Search field to find the appropriate form. When you are confident that the form is suitable, click the Buy now button to purchase the form. Select the pricing plan you wish and enter the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired California Trust to Provide Funds for the Purchase of Birthday Gifts for Members of Grantor's Family to Continue after Grantor's Donation. US Legal Forms has the largest library of legal forms where you can find a range of document layouts. Use the service to obtain professionally created documents that comply with state requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the California Trust to Provide Funds for the Purchase of Birthday Gifts for Members of Grantor's Family to Continue after Grantor's Donation.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab in your account and download another copy of the document you seek.

- If you are a new US Legal Forms customer, here are simple steps you can follow.

- First, ensure you have selected the correct form for your locale/state.

- You can browse the form using the Preview button and read the form details to ensure it is the right one for you.

Form popularity

FAQ

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

A gift in trust is a special legal and fiduciary arrangement that allows for an indirect bequest of assets to a beneficiary. The purpose of a gift in trust is to avoid the tax on gifts that exceed the annual gift tax exclusion limit. This type of trust is commonly used to transfer wealth to the next generation.

The Irrevocable Trust is often used to make gifts in the following circumstances: 1. Life Insurance. Making gifts of life insurance policies (and the periodic amounts necessary to pay the premiums) to an irrevocable trust allows the life insurance death benefit, to pass without estate tax.

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want.

Yes. If the grantor desires the gift to qualify for the annual gift tax exclusion, the trustee must follow the Crummey withdrawal notice procedure each time a gift is made to the trust.

The IRS does not levy gift taxes on trusts, nor does it consider payments from the trust to a beneficiary as a gift (it may be taxable income to the beneficiary, however).

According to the federal tax laws revised in 2013, you can give any part of your estate under a revocable trust as a gift to a person other than your spouse, provided the gift is less than $15,000 within a calendar year. Any gift worth more would require you to file a living trust gift tax report with Form 709.

Each year, a person can make transfers of $14,000 to the trust without any gift tax consequences. Moreover, the annual gift tax exclusion applies to each recipient, so multiple gifts in that amount can be made to as many children, grandchildren, or other individuals as the donor wishes.