US Legal Forms - among the biggest libraries of legal varieties in America - delivers a variety of legal document themes you may obtain or print out. While using internet site, you can find a large number of varieties for organization and individual purposes, sorted by groups, claims, or keywords and phrases.You can get the most up-to-date types of varieties like the California Security Agreement in Accounts and Contract Rights in seconds.

If you have a registration, log in and obtain California Security Agreement in Accounts and Contract Rights from the US Legal Forms local library. The Down load button can look on each and every form you look at. You get access to all in the past downloaded varieties from the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, here are simple directions to help you get started out:

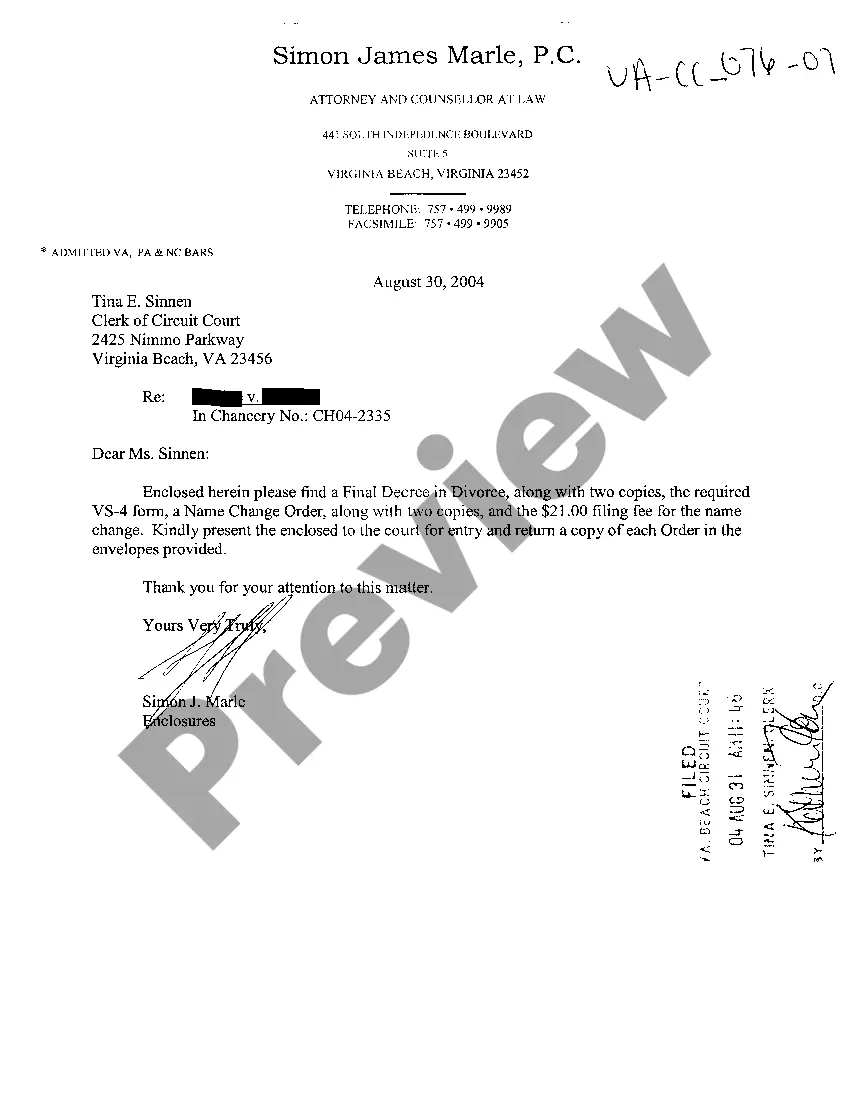

- Make sure you have selected the correct form for the town/region. Go through the Review button to examine the form`s content material. Browse the form explanation to actually have chosen the correct form.

- In the event the form does not satisfy your specifications, take advantage of the Look for area towards the top of the display screen to discover the one who does.

- Should you be content with the shape, verify your option by clicking on the Purchase now button. Then, pick the prices strategy you prefer and give your references to register for an accounts.

- Method the purchase. Make use of your charge card or PayPal accounts to finish the purchase.

- Select the file format and obtain the shape on your gadget.

- Make adjustments. Fill out, modify and print out and sign the downloaded California Security Agreement in Accounts and Contract Rights.

Each design you put into your bank account lacks an expiration time which is yours eternally. So, in order to obtain or print out an additional copy, just check out the My Forms section and click about the form you need.

Obtain access to the California Security Agreement in Accounts and Contract Rights with US Legal Forms, the most extensive local library of legal document themes. Use a large number of professional and state-specific themes that meet up with your small business or individual needs and specifications.