California Employment Verification Letter for Mortgage

Description

How to fill out Employment Verification Letter For Mortgage?

Are you in a circumstance where you require documentation for either business or personal purposes nearly every day? There are numerous credible document templates accessible online, but finding reliable ones isn’t straightforward. US Legal Forms offers thousands of template forms, including the California Employment Verification Letter for Mortgage, which are crafted to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and possess an account, just Log In. After that, you can download the California Employment Verification Letter for Mortgage template.

If you do not have an account and wish to begin using US Legal Forms, follow these instructions: Obtain the form you need and ensure it is for the correct city/county. Use the Preview button to review the form. Check the description to confirm you have selected the correct template. If the form isn’t what you’re seeking, utilize the Search field to find the form that meets your needs and criteria. Once you locate the appropriate form, click Purchase now. Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Access all the document templates you have purchased in the My documents list.

- You can obtain an additional copy of the California Employment Verification Letter for Mortgage at any time, if required.

- Just click on the desired form to download or print the document template.

- Utilize US Legal Forms, one of the most extensive collections of legitimate forms, to save time and avoid errors.

- The service provides well-crafted legal document templates that can be used for various purposes.

- Create your account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

Every lender will perform income and employment verification before a loan goes through the underwriting process.

A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and earning a salary. Providing a proof of income letter is common for those needing to prove they have a job to secure a loan or sign a lease.

Banks can call your employer to verify employment for personal loans. But most banks will simply verify your income through a tax document or bank statement when evaluating your application for a personal loan.

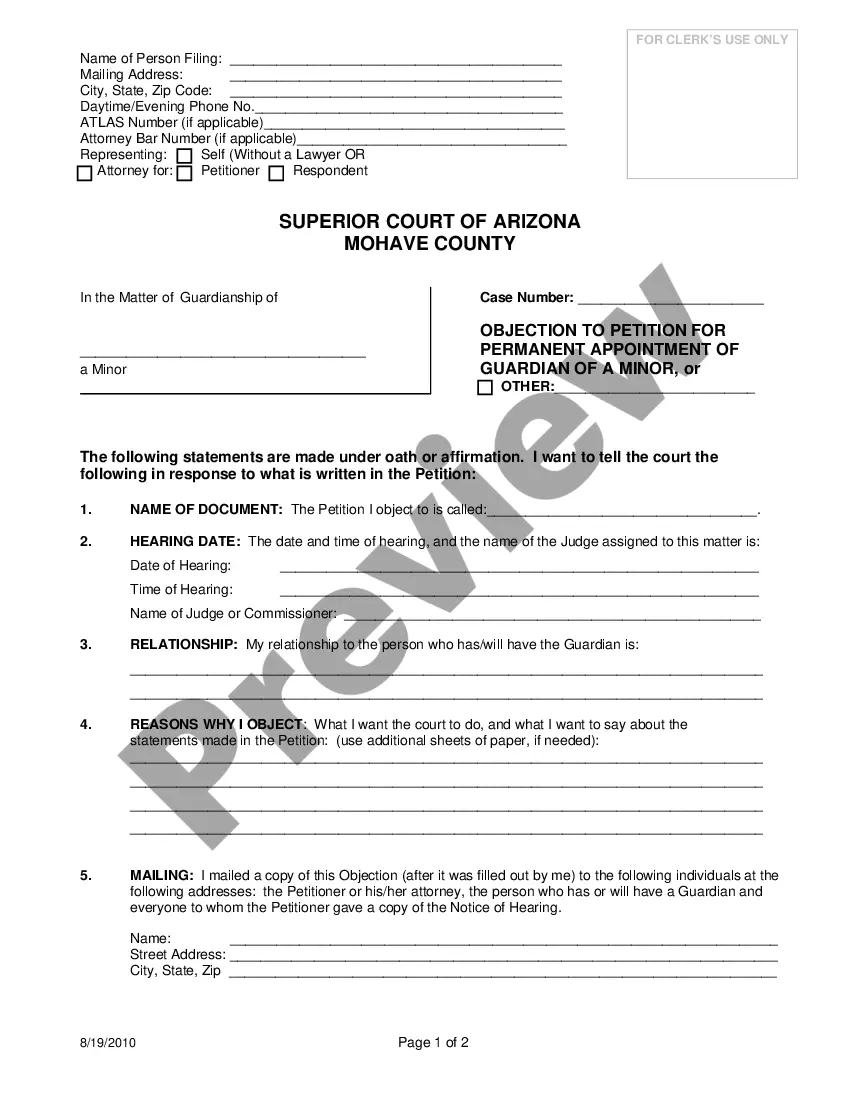

What You Should Know. Most mortgage lenders require your employer to write details about your employment status. The purpose is for lenders to understand your job stability and verify your application. The letter must include things such as job title, salary, years of employment, and more.

Methods of Employment Verification Request written verification be faxed to (916) 376-5393 or sent to DGS - HR, 7th Floor, P.O. Box 989052, MS 402, West Sacramento, CA 95798-9052. Information that can be provided includes: Dates of employment, Title (job classification), ... Written verification has a five-day turn-around.

One of the most essential documents to show your lender is a letter of employment. A letter of employment, also sometimes called a job letter or income verification letter, proves your employment status, shows what kind of work you do, and helps the lender confirm that you have reliable income to pay off your mortgage.

A verification of mortgage (VOM) is an official statement that verifies your existing loan terms and provides a rating of the payment history, including if the loan was current or delinquent for each month listed. It reflects only the most recent 12 months of your loan, excluding the current month.

VOE or Verification of Employment is a type of mortgage program where all of the verification is handled directly with the employer. If you're a salaried worker or a wage earner, this program could work for you as an alternate type of financing.