No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

California Rejection of Claim and Report of Experience with Debtor

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

Selecting the appropriate official document template can be a challenge.

Clearly, there are numerous designs accessible online, but how do you locate the official form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the California Rejection of Claim and Report of Experience with Debtor, which can be utilized for business and personal purposes.

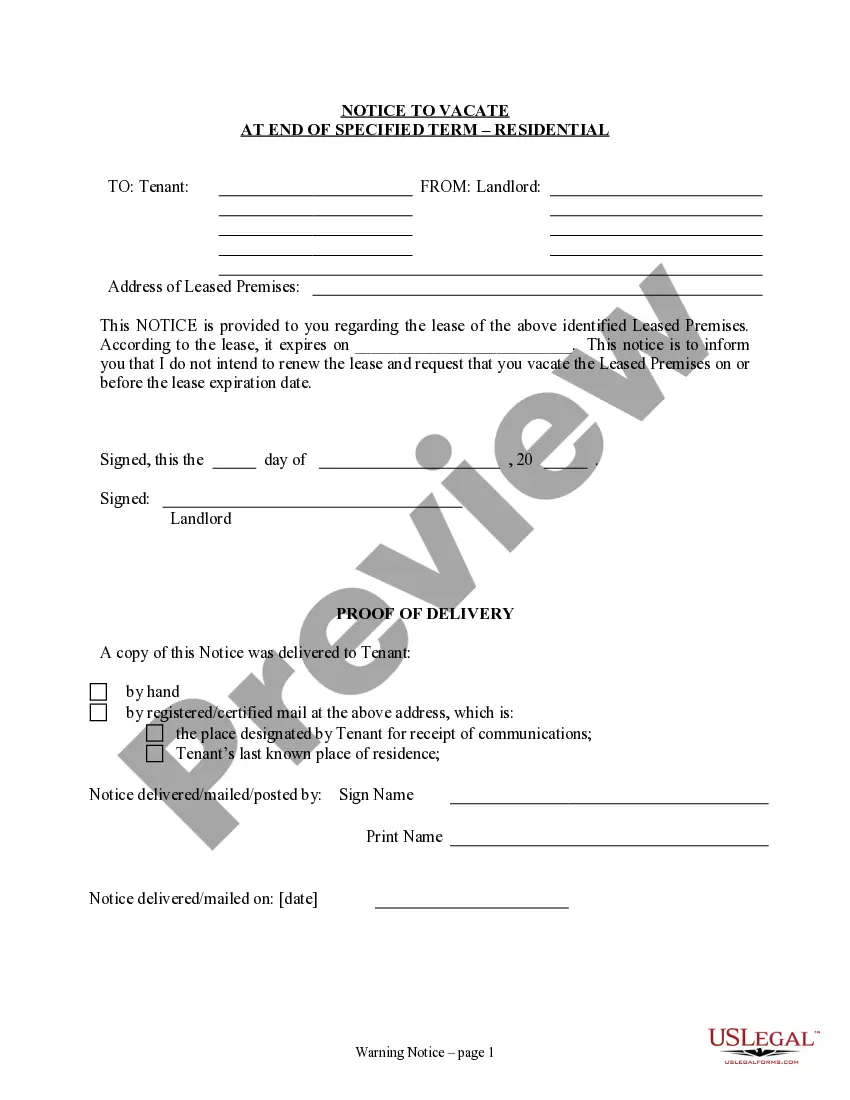

You can view the form using the Review option and read the form description to ensure it is suitable for you. If the form does not meet your needs, utilize the Search field to find the right form. Once you are confident the form is appropriate, click on the Order now button to obtain the form. Select the payment plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal account or credit card. Choose the file format and download the official document template to your device. Complete, modify, print, and sign the received California Rejection of Claim and Report of Experience with Debtor. US Legal Forms boasts the largest collection of official forms from which you can find countless document templates. Take advantage of the service to download expertly created documents that comply with state regulations.

- Each of the forms is reviewed by professionals and meets both state and federal requirements.

- If you are already registered, sign in to your account and select the Download option to obtain the California Rejection of Claim and Report of Experience with Debtor.

- Use your account to search for the official forms you may have previously acquired.

- Go to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your locality/county.

Form popularity

FAQ

Yes, an administrator of an estate can sell property in California, but there are specific rules and requirements to follow. Typically, the administrator must get court approval before making significant sales. This process safeguards the rights of the beneficiaries and creditors. To streamline this process, consider utilizing the California Rejection of Claim and Report of Experience with Debtor, which can offer expertise in managing claims and reporting on debtor experiences.

In California probate, the notice of proposed action is typically sent to all interested parties. This includes heirs, beneficiaries, and creditors who have filed a claim against the estate. The notice ensures that everyone is informed about actions that may affect their rights or interests. Using the California Rejection of Claim and Report of Experience with Debtor feature can help clarify the status of claims and protect your interests during this process.

Heirs at law are those who inherit property under state law when no will exists. California probate law designates certain individuals, typically family members, as heirs at law and specifies their rights to inherit. Understanding the California Rejection of Claim and Report of Experience with Debtor can assist heirs in understanding their positions regarding claims and the estate's assets.

Probate code refers to the set of laws governing the administration of estates after a person passes away. In California, this code outlines the procedures for validating wills, managing the estate, and distributing assets. Familiarity with the California Rejection of Claim and Report of Experience with Debtor is essential for anyone involved in estate administration, especially when dealing with disputed claims.

In the context of California probate law, a beneficiary refers to an individual or entity entitled to receive assets from a deceased person's estate. The relevant probate code provides guidelines on how beneficiaries are designated and the manner in which they may receive their shares. Understanding the California Rejection of Claim and Report of Experience with Debtor can help beneficiaries navigate the claims process effectively.

Notice of a proposed action in California probate must be sent to all interested parties. This includes heirs, beneficiaries, and creditors of the estate. Knowing who receives this notice can be critical, especially in cases related to the California Rejection of Claim and Report of Experience with Debtor. Using USLegalForms can assist you in understanding the requirements and ensure that you are adequately informed throughout the process.

In California, individuals who are entitled to notice of a petition for probate include heirs, beneficiaries, and anyone who may be financially impacted by the estate. Generally, this ensures that all parties with a potential claim have the opportunity to voice their interests. If you have questions regarding the California Rejection of Claim and Report of Experience with Debtor, USLegalForms is a reliable platform to help you navigate these complexities.

In California, all interested parties, including beneficiaries and anyone who may claim an interest in the estate, are entitled to notice of a Heggstad petition. This petition specifically addresses the validity of claims related to a decedent's property. Therefore, if you are involved in a case regarding the California Rejection of Claim and Report of Experience with Debtor, understanding your notice rights is essential. Always consider consulting resources like USLegalForms to ensure you receive proper guidance through this process.

Section 9252 of the probate code details the process of allowing claims against an estate once they are accepted. This section provides a framework for resolving disputes between the estate and creditors. Knowledge of this section is vital for anyone interested in the California Rejection of Claim and Report of Experience with Debtor process. Utilizing platforms like uslegalforms can ensure you have the right resources at your disposal to navigate this aspect effectively.

Section 9100 of the California probate code addresses the general requirements for creditors to file claims against an estate. It ensures that all claims are presented in a timely manner and specifies how to properly notify creditors. Adhering to these guidelines is essential for managing the California Rejection of Claim and Report of Experience with Debtor process smoothly. Consulting with legal resources can clarify these requirements.