California Receipt Template for Small Business

Description

How to fill out Receipt Template For Small Business?

Are you currently in a position that requires documents for occasional business or personal needs frequently.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the California Receipt Template for Small Business, designed to comply with state and federal regulations.

Once you locate the appropriate form, click on Purchase now.

Select the pricing plan you want, fill in the required details to create your account, and pay for your order using PayPal or credit card.

- If you're already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then you can download the California Receipt Template for Small Business format.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Obtain the form you require and verify it is for the correct region/county.

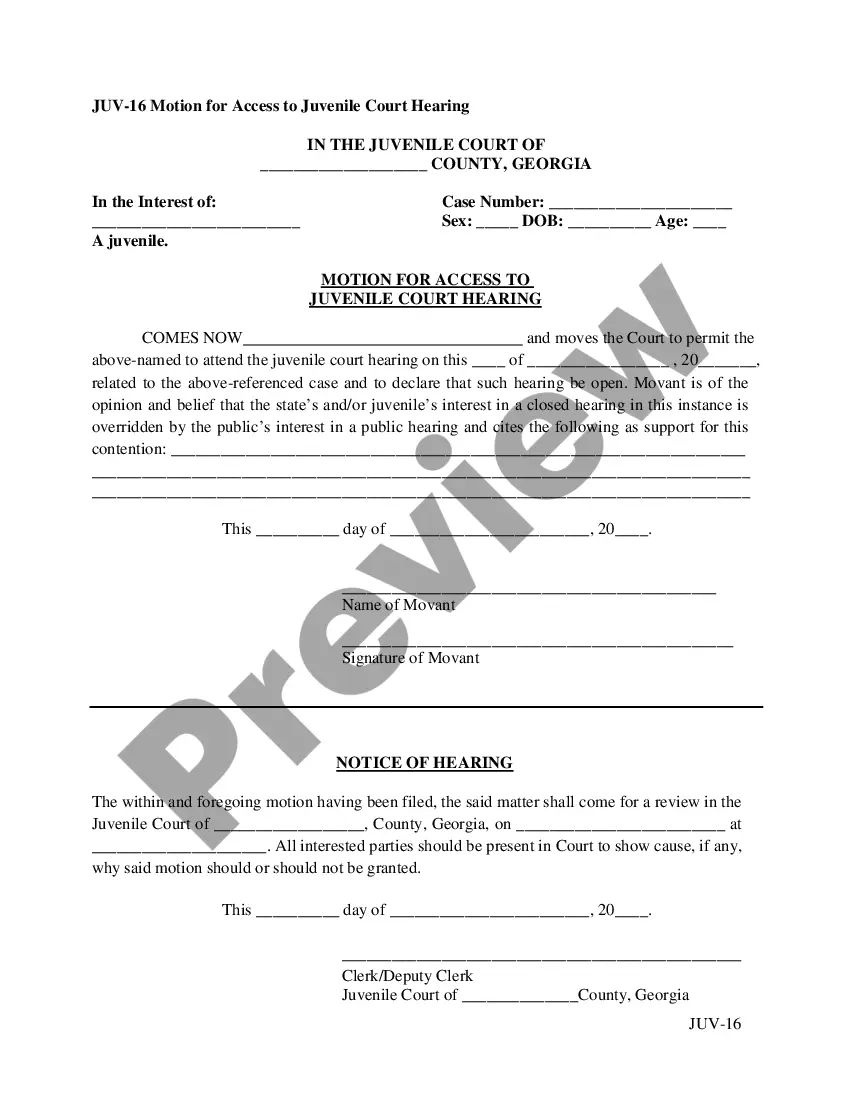

- Utilize the Preview button to review the document.

- Read the description to ensure you have selected the correct form.

- If the form does not meet your needs, use the Search section to find the template that suits you.

Form popularity

FAQ

Creating a receipt for your small business involves selecting a template or designing your own document. You can use tools like Google Docs, Microsoft Word, or even specialized platforms like USLegalForms to find compliant templates. A well-crafted California Receipt Template for Small Business is advantageous, as it ensures that your receipts are legally sound and aesthetically pleasing.

Yes, Google Docs provides several receipt templates that users can customize. These templates cater to various business needs, allowing you to tailor them specifically for your small business. Utilizing a California Receipt Template for Small Business will help you maintain professionalism while ensuring compliance with state regulations.

To create a receipt in Google Docs, start by selecting a suitable template from the template gallery. After that, customize the template with your business information and details about the transaction. Incorporating a California Receipt Template for Small Business helps ensure that you meet legal requirements specific to California.

Absolutely, Microsoft Word has a variety of receipt templates available. These templates can help streamline your receipt creation process for your small business. Additionally, consider using a California Receipt Template for Small Business to guarantee it meets state regulations while also looking polished.

Yes, Google offers several receipt templates accessible through Google Docs. You can easily find these templates by searching within the template gallery. For a small business in California, using a California Receipt Template for Small Business ensures compliance with local requirements and provides a professional appearance.

Formatting a receipt involves organizing crucial information in a clear and professional manner. Start with your business details, followed by transaction data such as date, items, and total amount. Using a California Receipt Template for Small Business can offer you a guideline to ensure your receipt is both aesthetically pleasing and functional.

To write a receipt properly, be sure to include all transaction details such as the date, items sold, and prices. Organize the information clearly, using a California Receipt Template for Small Business to structure your receipt effectively. Always retain a copy for your records, as it may be necessary for taxation or customer service inquiries.

To fill out a receipt form, start with the date and your business name. Next, input the details of the transaction—such as item descriptions, quantities, and prices. Lastly, include the total amount due, and ensure that the form is easy to read; a California Receipt Template for Small Business can greatly assist you in this process.

When designing a receipt, incorporate your business logo, contact information, and a clear layout for itemization. Utilize a California Receipt Template for Small Business to simplify the design process, ensuring all important elements are included. Make sure to choose readable fonts and a layout that guides the customer’s eyes through the information.

An example of a receipt might include a business name at the top, followed by the date of the transaction. It should detail the items purchased, individual prices, and the overall total. You can reference a California Receipt Template for Small Business to see a practical example that meets legal requirements.