This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

California Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty

Description

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease With Mortgage Securing Guaranty?

If you have to comprehensive, obtain, or printing legitimate document web templates, use US Legal Forms, the most important variety of legitimate varieties, that can be found on the Internet. Use the site`s simple and easy convenient research to discover the paperwork you need. Various web templates for organization and person functions are sorted by groups and states, or search phrases. Use US Legal Forms to discover the California Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty in just a number of click throughs.

Should you be presently a US Legal Forms consumer, log in in your profile and click on the Download option to have the California Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty. You may also gain access to varieties you earlier downloaded within the My Forms tab of your profile.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form to the correct metropolis/nation.

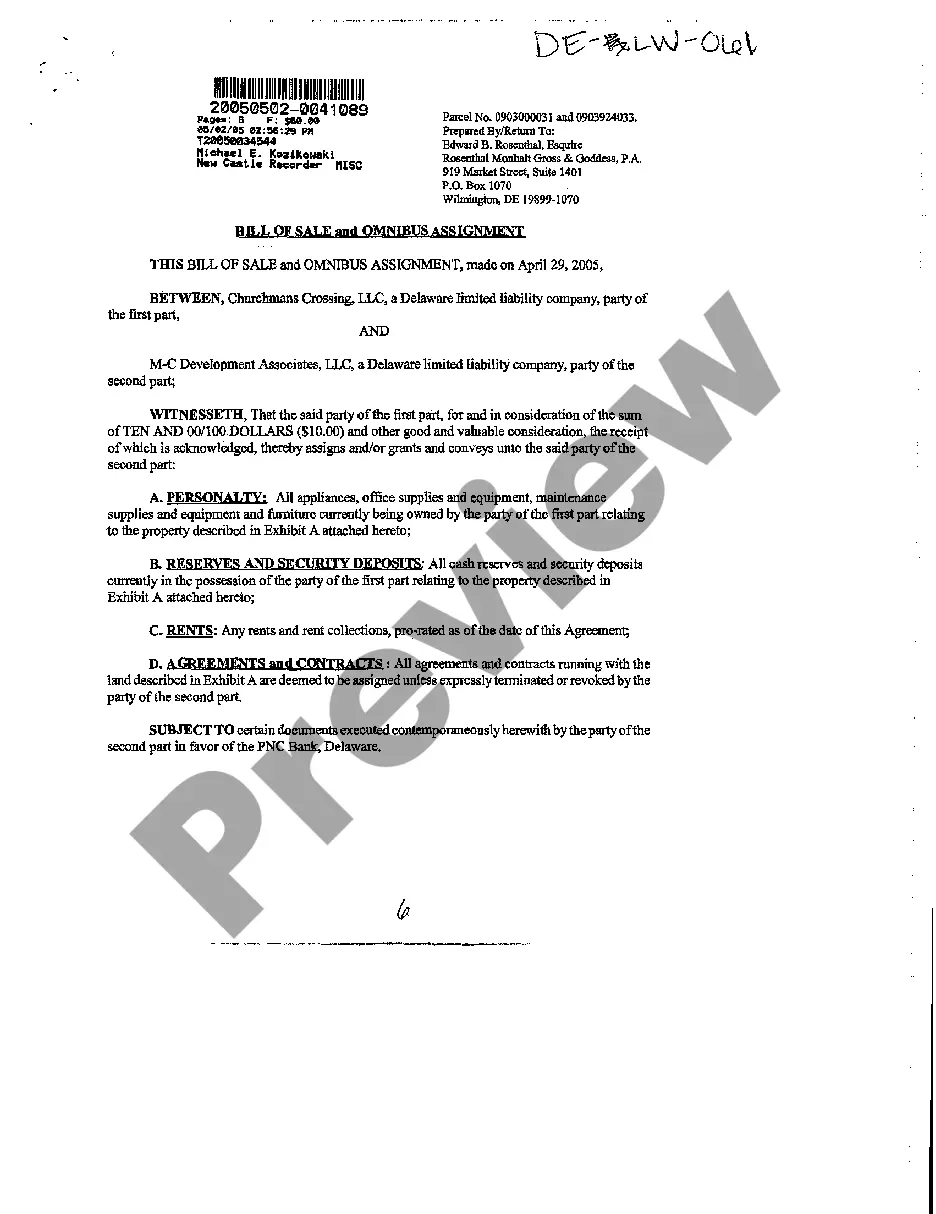

- Step 2. Utilize the Review method to look through the form`s content material. Do not forget about to read through the explanation.

- Step 3. Should you be not satisfied together with the kind, take advantage of the Research field at the top of the screen to get other variations of the legitimate kind format.

- Step 4. Once you have found the form you need, go through the Get now option. Opt for the costs plan you favor and put your qualifications to register for an profile.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal profile to perform the transaction.

- Step 6. Choose the format of the legitimate kind and obtain it on the product.

- Step 7. Total, revise and printing or indication the California Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty.

Each and every legitimate document format you buy is your own property permanently. You possess acces to every kind you downloaded within your acccount. Go through the My Forms section and decide on a kind to printing or obtain yet again.

Be competitive and obtain, and printing the California Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with Mortgage Securing Guaranty with US Legal Forms. There are many specialist and status-particular varieties you can utilize to your organization or person demands.

Form popularity

FAQ

As guarantor you agreed to guarantee the lease. You have no basis to sue the tenants whose lease you guaranteed because your guarantee was used.

In a finance or lending context, a guarantor would be forced to answer for the debt or default of the debtor to the creditor, if a debtor does not fulfill an obligation on their part to repay their debt.

The "guarantor" is the person guarantying the debt while the party who originally incurred the debt is the "principle" and the creditor is the "guaranteed party." Under California law, if properly drafted, a guaranty is a fully enforceable obligation which allows the guaranteed party to proceed directly against the ...

A guarantor is a person who will co-sign an apartment lease alongside a tenant, guaranteeing to pay the rent if the tenant fails to do so. The guarantor is usually a parent, family member, or close friend who is willing to be legally responsible for the rental apartment.

In California, a complaint for breach of guaranty requires: (1) the existence of a contract; (2) plaintiff's performance or excuse for non-performance under the contract; (3) defendant's breach under the contract; and (4) damages. Acoustics, Inc. v. Trepte Constr.

In California, even though the ?main? contract/loan might be with the corporation or limited liability company, a personal guaranty allows the creditor to sue the guarantor if the contract is breached or the loan becomes past due.

A guarantee is entitled to receive the payment as a creditor to whom a guaranty is made. A guarantee holds the right to receive payment as a creditor first from the debtor, then from the creditor. Also, a guarantee could be an alternative spelling of the word guaranty, the promise to the creditor, itself.

Also known as a guaranty of recourse obligations or nonrecourse carveout guaranty. A typical loan document in a real estate loan. It is often signed and delivered by the borrower or the borrower's guarantor, or both.