California Lease of Machinery for use in Manufacturing

Description

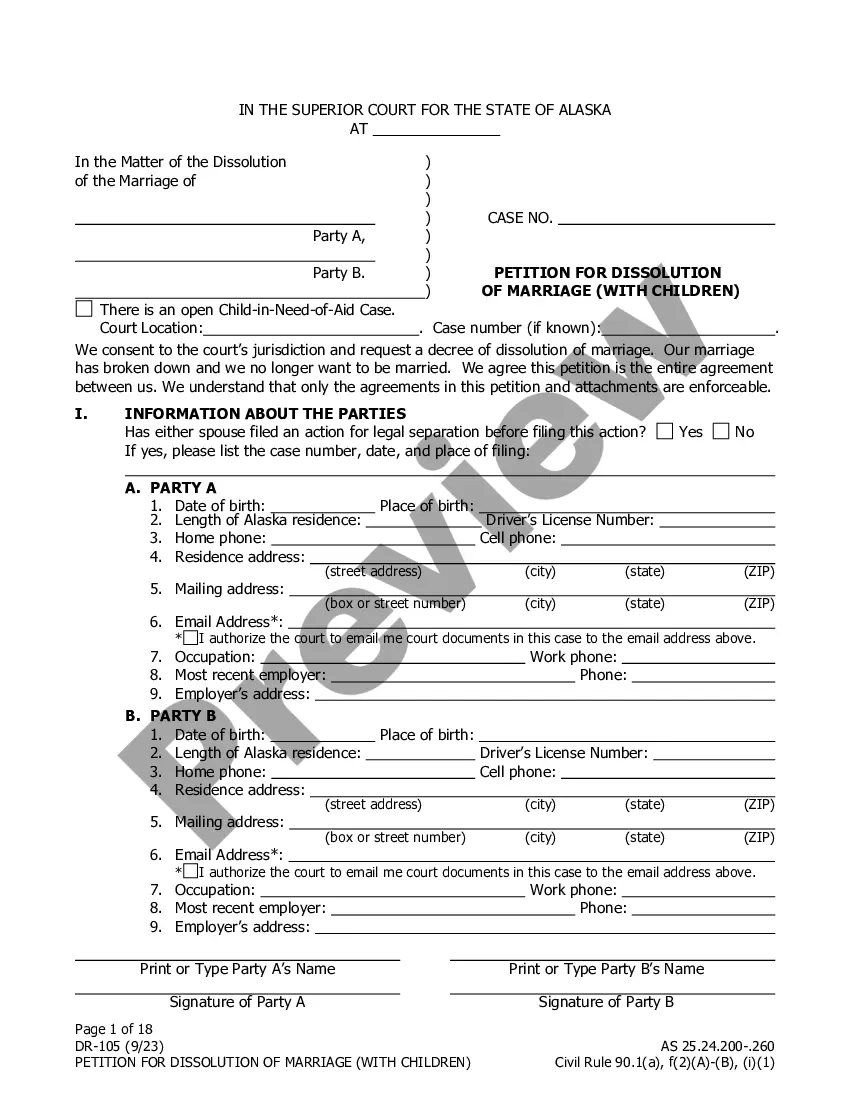

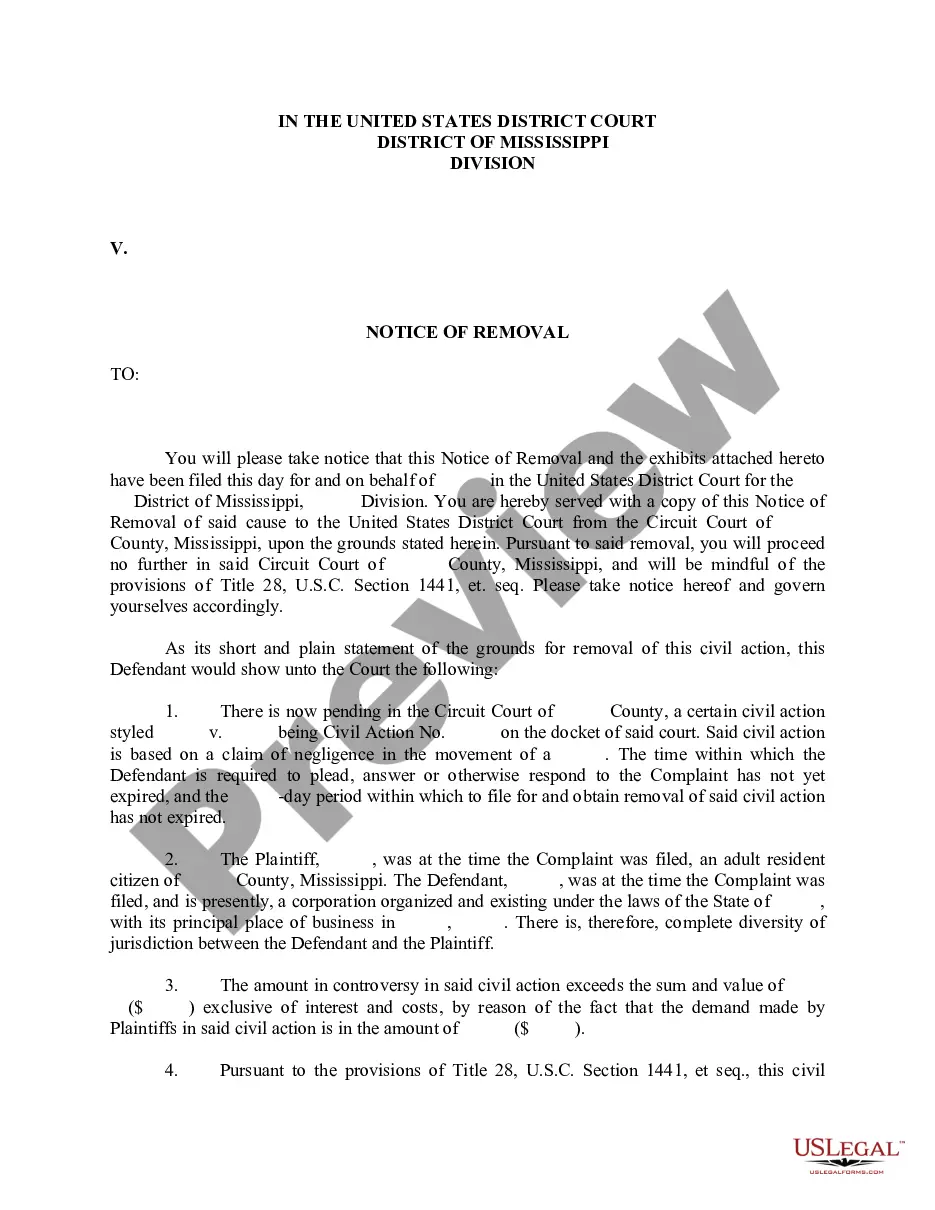

How to fill out Lease Of Machinery For Use In Manufacturing?

Selecting the appropriate authorized document template can be a challenge.

Naturally, there are numerous templates accessible online, but how can you obtain the legal document you desire.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the California Lease of Machinery for utilization in Manufacturing, suitable for both business and personal purposes.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure that you have selected the correct form for your city/state. You can preview the form using the Review option and read the form description to confirm it is suitable for your needs. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click on the Purchase now button to acquire the document. Select the pricing plan you wish to choose and enter the requested information. Create your account and complete the purchase using your PayPal account or Visa/Mastercard. Choose the file format and download the authorized document template to your computer. Complete, modify, print, and sign the obtained California Lease of Machinery for utilization in Manufacturing. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally-crafted documents that comply with state regulations.

- All templates are reviewed by professionals.

- Meet state and federal requirements.

- If you are already registered, Log In to your account.

- Click on the Obtain option to find the California Lease of Machinery document.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab to download another copy of the document you need.

Form popularity

FAQ

An equipment lease can be classified as either an operating lease or a capital lease, depending on specific criteria. In the context of the California Lease of Machinery for use in Manufacturing, a capital lease typically transfers ownership benefits to the lessee. Generally, if the lease meets certain accounting criteria, like the term or the present value of payments, it may be treated as a capital lease. Evaluating the lease type is crucial for financial accounting and tax considerations.

Yes, leased equipment is typically taxable in California. This includes machinery used for manufacturing purposes. When engaging in a California Lease of Machinery for use in Manufacturing, understanding your tax responsibilities can help you make informed decisions and better manage your operational costs.

Leases in California are generally subject to sales tax based on the rental payment. The tax rate can vary based on the location and nature of the leased equipment. When planning a California Lease of Machinery for use in Manufacturing, it is essential to calculate these taxes to ensure accurate financial forecasting.

The California Capital Investment Incentive (CCFA) offers a partial tax exemption for qualifying applicants. This exemption can significantly reduce your tax burden when leasing equipment for manufacturing. Understanding how a California Lease of Machinery for use in Manufacturing aligns with CCFA criteria may provide additional benefits.

In California, the installation of equipment is generally considered a taxable service. Therefore, when you arrange for the installation of machinery under a California Lease of Machinery for use in Manufacturing, you should anticipate tax charges. It is advisable to clarify tax obligations with the service provider to avoid surprises.

Yes, manufacturing equipment is typically taxable in California. When you lease machinery specifically for manufacturing activities, you should expect applicable taxes on that lease. Remember, understanding the tax implications is crucial for properly managing your expenses in a California Lease of Machinery for use in Manufacturing.

In California, the rental of equipment is generally subject to sales tax. This includes equipment used for manufacturing purposes. It is important to factor this tax into your budget when considering a California Lease of Machinery for use in Manufacturing, as it can impact your overall costs. For detailed guidance, consulting a professional may be beneficial.

Certain equipment used in manufacturing may qualify for tax exemption in California, particularly if you lease it under programs like the California Lease of Machinery for use in Manufacturing. The exemption often applies to machinery directly involved in producing tangible goods. A thorough review of your equipment and its use is necessary to determine tax-exempt status.

California applies various taxes to labor, including income tax and payroll taxes, but labor itself is not taxed under sales tax regulations. If you utilize the California Lease of Machinery for use in Manufacturing, ensure your labor services are classified correctly to avoid unexpected tax liabilities. Consult a tax advisor to navigate this landscape confidently.

The manufacturing exemption rate in California can vary based on the specific machinery and equipment used. Generally, businesses can benefit from exemptions when leasing machinery for manufacturing purposes, such as through a California Lease of Machinery for use in Manufacturing. Connecting with a tax professional can help clarify the exemptions applicable to your situation.