California Sample Letter for Free Delivery Limitations Change

Description

How to fill out Sample Letter For Free Delivery Limitations Change?

You can dedicate hours on the web searching for the legal document template that meets the federal and state criteria you need.

US Legal Forms offers thousands of legal forms that are vetted by experts.

You can download or print the California Sample Letter for Free Delivery Limitations Change from our platform.

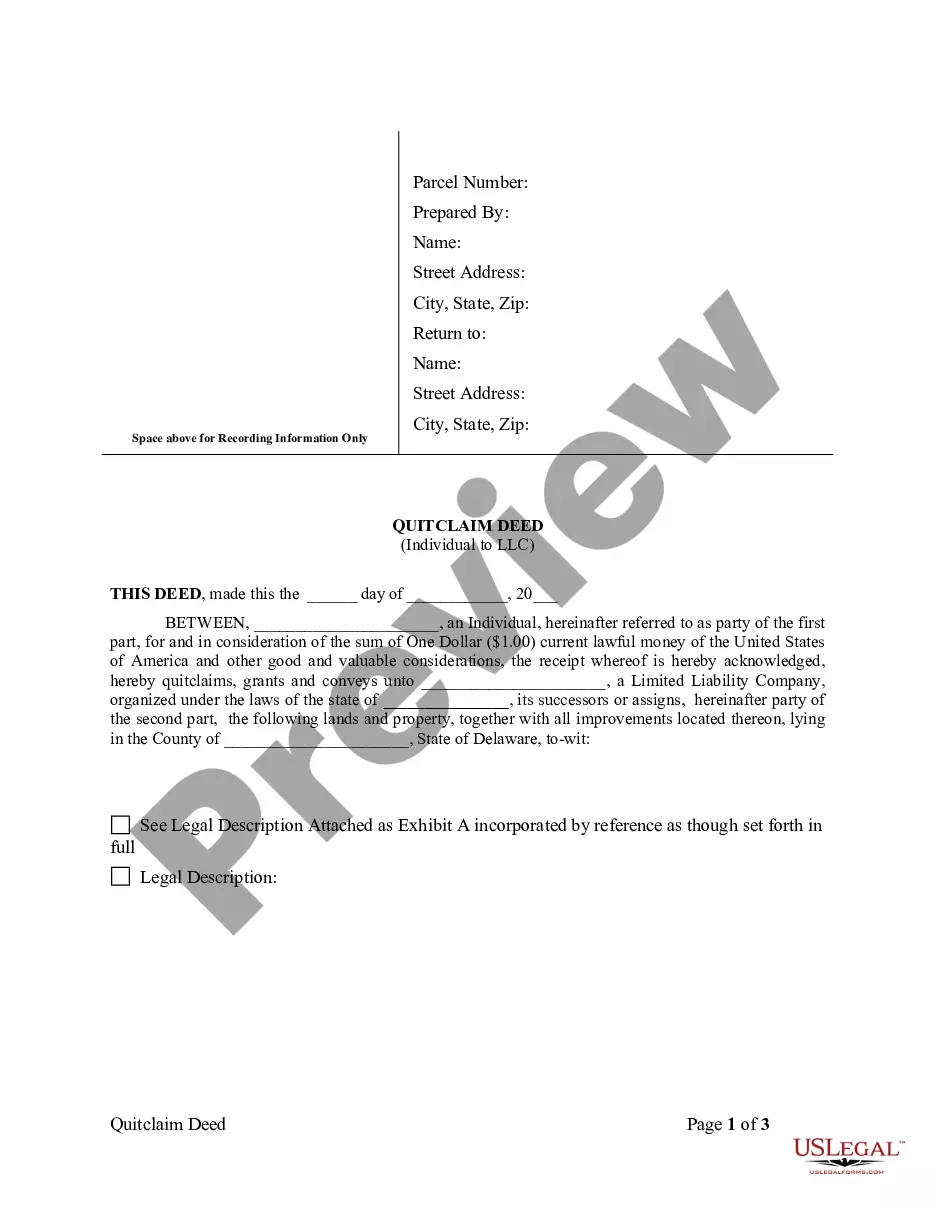

If available, utilize the Review option to examine the document template as well.

- If you already possess a US Legal Forms account, you may sign in and then click the Download button.

- After that, you can complete, alter, print, or sign the California Sample Letter for Free Delivery Limitations Change.

- Every legal document template you obtain is yours indefinitely.

- To retrieve another copy of the purchased form, navigate to the My documents section and click the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the document outline to confirm you have chosen the correct form.

Form popularity

FAQ

No, the California Franchise Tax Board is not the same as the IRS. While both agencies deal with taxation, the IRS operates at the federal level, handling taxes for the entire country. The Franchise Tax Board focuses specifically on California state taxes, providing guidance and oversight for tax-related matters within the state.

To contact the State of California Franchise Tax Board, you can visit their official website for resources or call their customer service. They provide various contact methods, including email and live chat options. Make sure to have your identification and any relevant documents ready for a smoother interaction.

Yes, a single member LLC in California generally needs to file a tax return. This is typically done as part of your personal income tax return using Schedule C. However, ensure you also remain compliant with any required state filings. For clarity on requirements, consider checking the resources within the uslegalforms platform, which offers easy access to essential documents.

You can avoid the $800 LLC fees in California by ensuring your business qualifies for certain exemptions. For instance, if your LLC is bringing in little to no revenue, you may seek to apply for an exemption. Additionally, being aware of all available deductions could lessen your overall tax burden. The uslegalforms platform provides templates and guidance to help navigate these options.