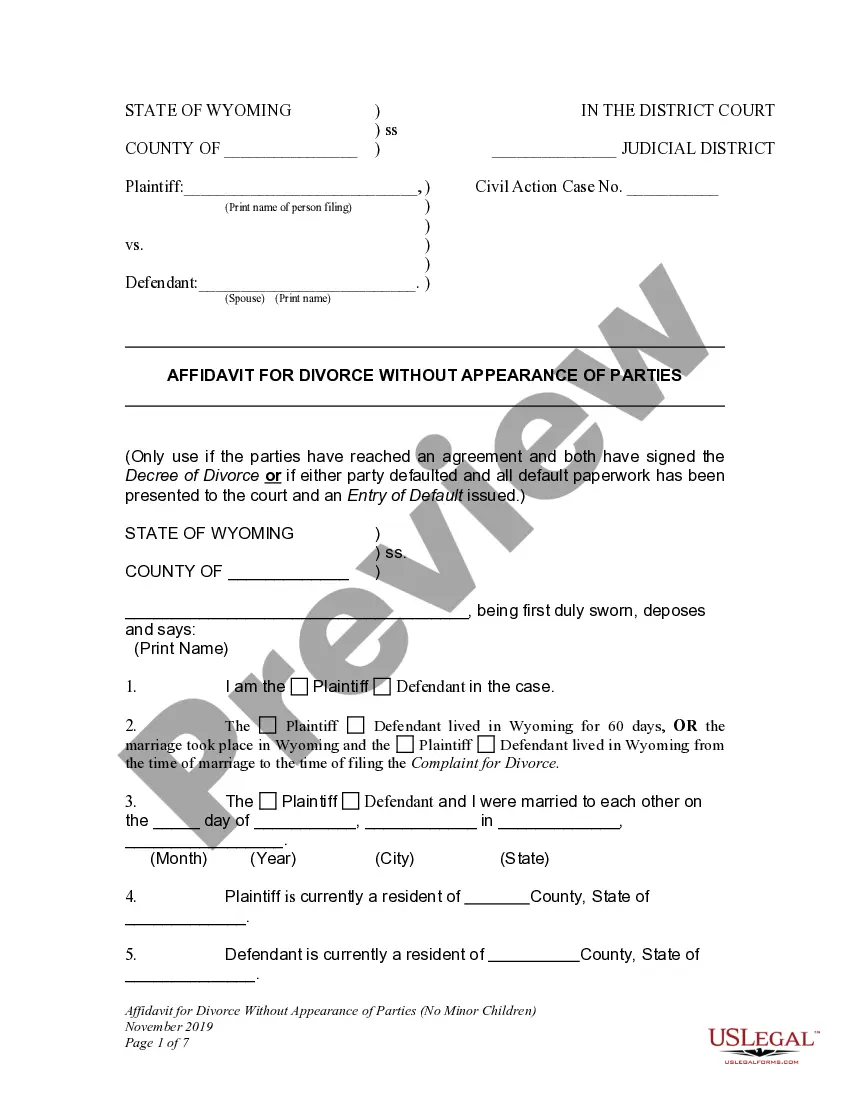

California Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

You have the ability to spend hours online attempting to locate the appropriate legal document format that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal templates that are reviewed by professionals.

You can conveniently download or print the California Exchange Addendum to Contract - Tax Free Exchange Section 1031 from your service.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the California Exchange Addendum to Contract - Tax Free Exchange Section 1031.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the region/city of your choice.

Form popularity

FAQ

California regulations employ a Claw back provision that requires any gain in property value accrued in California at be subject to California state taxes, regardless of whether or not that property was exchanged for one in another state.

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

A 1031 exchange gets its name from Section 1031 of the U.S. Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a property or properties of like kind and equal or greater value.

The main requirements for a 1031 exchange are: (1) must purchase another like-kind investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any boot); (4) must be the same title holder and taxpayer; (5) must identify new

The main requirements for a 1031 exchange are: (1) must purchase another like-kind investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any boot); (4) must be the same title holder and taxpayer; (5) must identify new

California recognizes 1031 Exchanges which allows an investor to defer capital gains taxes as long as you are purchasing another like-kind property to replace the one you are selling. California does recognize it if you purchase your upleg in another state, but beware of the above Clawback rule.

Investors will never have to pay the California taxes due under the California Claw-Back Provisions as long as they continue to 1031 Exchange from property to property throughout their lifetime.