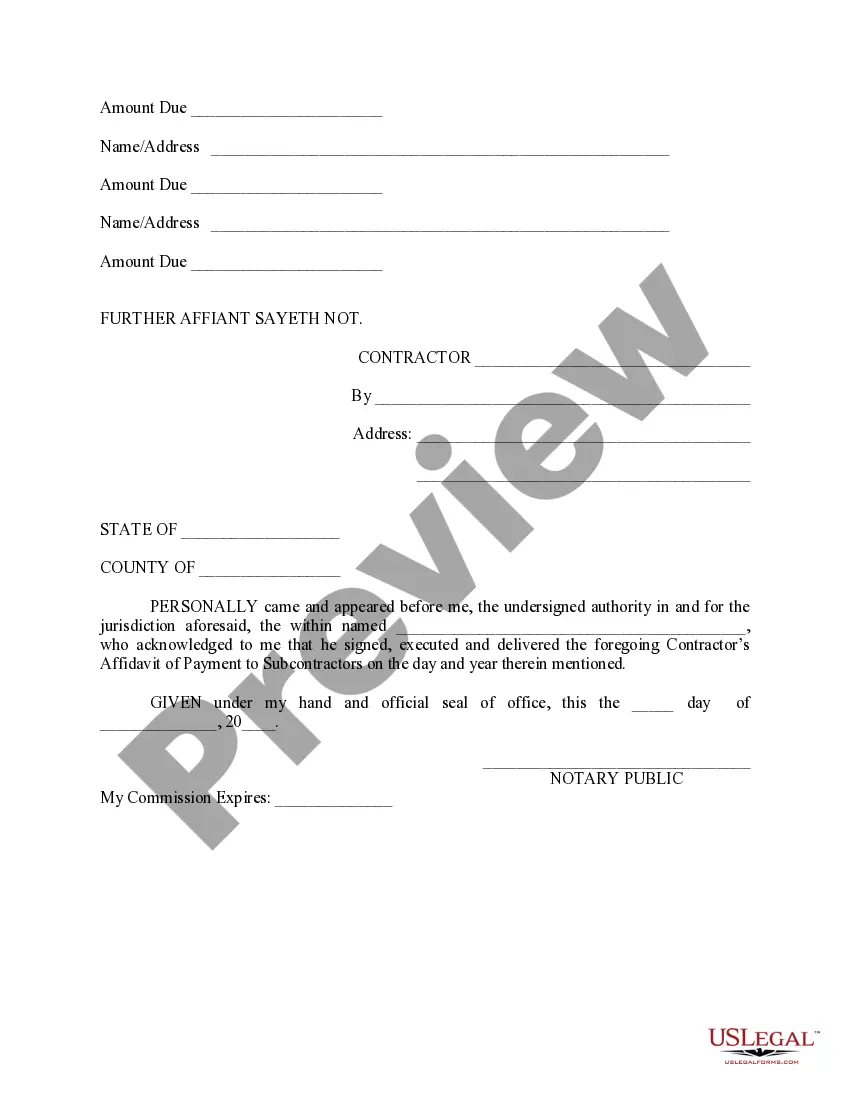

California Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

You might spend hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms which are reviewed by experts.

You can easily download or print the California Contractor's Affidavit of Payment to Subs from the service.

If this is your first time using the US Legal Forms website, follow the simple instructions below: First, ensure that you have selected the correct document template for your region/area of choice. Review the form details to confirm you have chosen the right form. If available, use the Review button to check the document template as well. If you wish to find another version of your form, utilize the Search section to locate the template that fulfills your requirements and needs. Once you have found the template you want, click Get now to proceed. Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make adjustments to the document if permissible. You can complete, modify, sign, and print the California Contractor's Affidavit of Payment to Subs. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Subsequently, you will be able to complete, modify, print, or sign the California Contractor's Affidavit of Payment to Subs.

- Every legal document template you receive is yours permanently.

- To obtain an additional copy of any acquired form, navigate to the My documents tab and click on the appropriate button.

Form popularity

FAQ

AIA Document G70621221994 requires the contractor to list any indebtedness or known claims in connection with the construction contract that have not been paid or otherwise satisfied.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

On private construction projects, the owner must pay direct contractors within 30 days of the contractor's request for payment.

Avoid paying in cash. Contractors cannot ask for a deposit of more than 10 percent of the total cost of the job or $1,000, whichever is less. (This applies to any home improvement project, including swimming pools.)

Notwithstanding any other provision of law, a prime contractor or subcontractor shall pay to any subcontractor, not later than 10 days of receipt of each progress payment, the respective amounts allowed the contractor on account of the work performed by the subcontractors, to the extent of each subcontractor's interest

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

The first payment provides half the money held upon the subcontractor's completion of their portion of the work. This is known as the first moiety of retention. The second moiety of retention is paid once the defects liability period has ended. This period can last anywhere from six months to over a year.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

The California Prompt Payment Act subjects a state agency that acquires property or services pursuant to a contract with a business to a late penalty payment, if it fails to make payment to the person or business on the date required by the contract.