California Accounts Receivable - Assignment

Description

How to fill out Accounts Receivable - Assignment?

You can spend time online trying to locate the legal document template that fulfills the state and federal regulations you need.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

You can easily download or print the California Accounts Receivable - Assignment from the service.

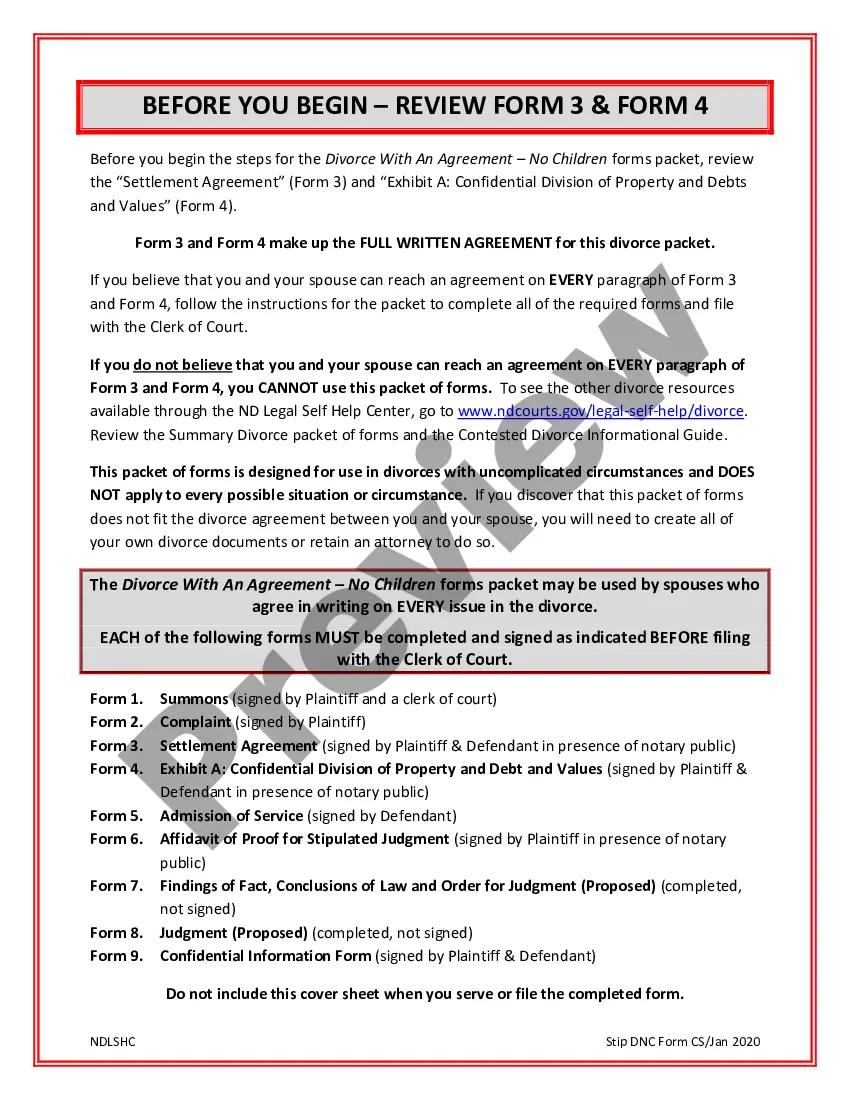

If available, utilize the Preview button to view the document template as well. To find an additional version of the document, use the Search field to locate the template that meets your needs and specifications. Once you have found the template you want, click Get now to proceed. Select the pricing plan you prefer, enter your information, and register for an account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to your document if needed. You can fill out, edit, sign, and print the California Accounts Receivable - Assignment. Download and print thousands of document templates using the US Legal Forms website, which offers the widest selection of legal forms. Use professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can fill out, modify, print, or sign the California Accounts Receivable - Assignment.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of a purchased document, visit the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for your state/region of choice.

- Review the document summary to confirm you have selected the appropriate form.

Form popularity

FAQ

The 5 C's of accounts receivable management are Character, Capacity, Capital, Collateral, and Conditions. Understanding these elements helps businesses effectively assess the creditworthiness of their clients in the context of California Accounts Receivable - Assignment. By evaluating character, you gain insight into a client's reliability. Capacity measures their ability to repay, while capital looks at their financial resources. Collateral serves as a safety net, and conditions refer to the overall economic environment affecting repayment.

To set up an effective accounts receivable process, start by defining your credit policies and terms. Next, implement a system for invoicing that ensures timely and accurate billing. You should also track outstanding invoices closely, sending reminders as necessary. Utilizing a platform like US Legal Forms can streamline this process, allowing you to manage your California Accounts Receivable - Assignment efficiently.

Consent to assignment of receivables is a legal agreement where the original debtor acknowledges and agrees to the assignment of their debt to a new party. This consent is essential for the new assignee to collect payments effectively. Ensuring proper consent helps maintain clarity in financial transactions. For detailed templates and information on California Accounts Receivable - Assignment, refer to US Legal Forms.

Accounts receivable factoring is a source of debt financing available to businesses that sell on credit terms. The borrower assigns or sells its accounts receivable (or specific invoices) in exchange for cash today.

Firstly, factoring is a financial service of selling and purchasing, which implies consideration, unlike assignment, which may take place either with or without consideration. In addition, non-matured or future accounts receivable can be subject to factoring.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.

Assignment of receivables would mean sale of the lease rentals, not the asset. In that case, the leased asset still remains the property of the assignor ? that is, the assignor has retained the residual interest in the asset. However, it would be different if the lessor sells the asset that has been leased out.

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 ? 60 days. They are classified on the Balance Sheet as current assets.

However, pledging is general because all accounts receivable serve as collateral security for the loan. On the other hand, assignment is specific because specific accounts receivable serve as collateral security for the loan. Assignment may be done either on a nonnotification or notification basis.