California Partial Re conveyance is a legal process that allows a borrower to pay off a portion of their mortgage balance. This is most commonly used when a borrower has used a home equity line of credit (HELOT) to pay off part of their mortgage. In this case, the lender will file a Partial Re conveyance with the county recorder's office to show that the borrower has satisfied part of the loan obligation. The Partial Re conveyance document will include the amount of the partial payment, the date of the payment, and the loan information. There are two types of California Partial Re conveyance. The first type is a standard Partial Re conveyance, which is typically used when the borrower has used a HELOT or other loan to pay off part of their mortgage. The second type is a Deed of Re conveyance, which is typically used when the borrower has paid off their mortgage in full. The Deed of Re conveyance will include the full amount of the loan, the date of the payment, and the loan information.

California Partial Reconveyance

Description

Definition and meaning

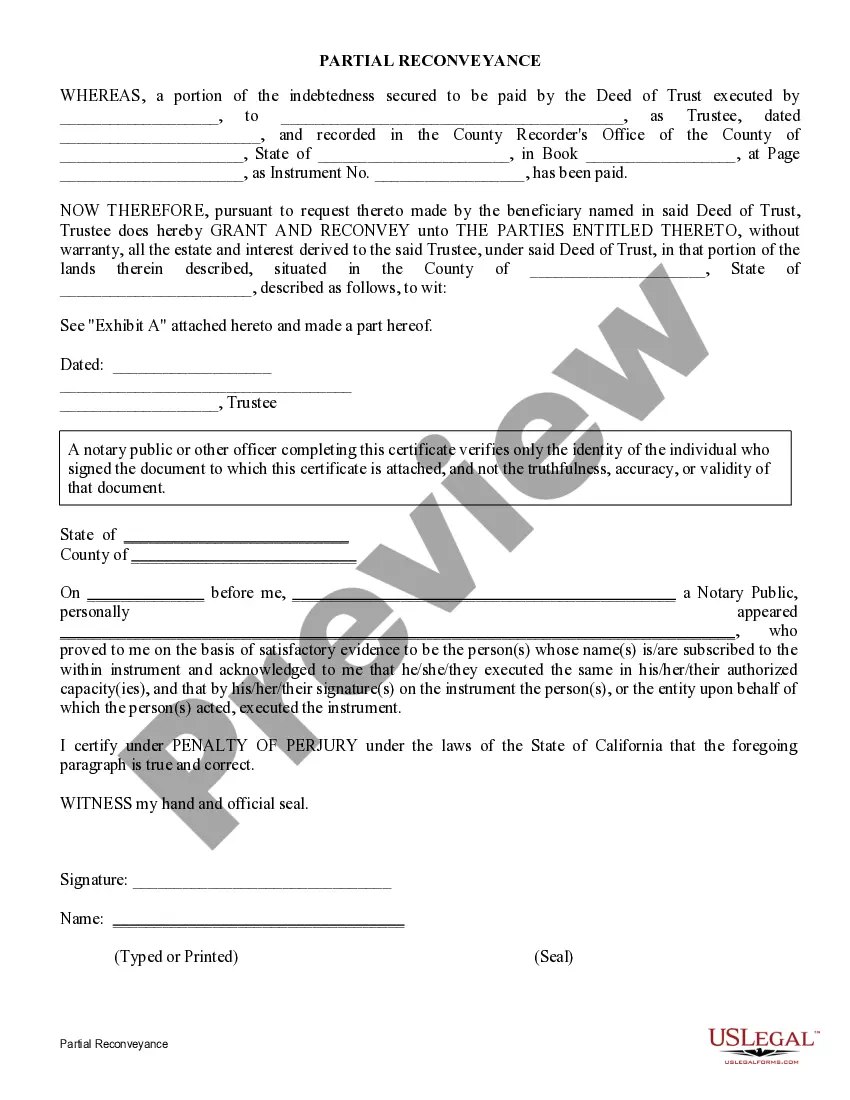

A California Partial Reconveyance is a legal document used to release a portion of the property from a deed of trust. This occurs when part of the debt secured by the deed has been paid off. The trustee, upon request from the beneficiary of the trust, executes the partial reconveyance to transfer the real estate interest described in the deed back to the borrower or another designated party.

How to complete a form

To complete the California Partial Reconveyance form, follow these steps:

- Fill in the name of the trustor (the person who took out the loan).

- Provide the name of the beneficiary (the lender) and the trustee.

- Enter the date the deed of trust was executed and recorded.

- Specify the county and state where the property is located.

- Detail the specific property description and attach Exhibit A, if necessary.

- Sign and date the form in the appropriate sections.

Ensure all information is accurate to avoid complications during processing.

Who should use this form

The California Partial Reconveyance form is ideal for individuals and entities who have partially paid off their mortgages and want to release a portion of their property from the deed of trust. This includes property owners who wish to sell part of their land or grant interest to another party. It may also be useful for those involved in estate planning or property transfers.

Legal use and context

This form is primarily used in California real estate transactions. It allows for the partial release of a property secured by a deed of trust, thereby clarifying ownership interests. It's important to understand the legal implications of using this form, as it affects the rights of all parties involved. Properly filing a Partial Reconveyance is a critical step in maintaining clear property titles and ensuring legal compliance.

Key components of the form

Key components of the California Partial Reconveyance form include:

- The names and contact information of the trustor, beneficiary, and trustee.

- The legal description of the property being reconveyed.

- The specific debts that have been paid off.

- The signature of the trustee.

- A notary section to verify the identity of the signer.

Accurate completion of these components ensures the validity of the form.

Benefits of using this form online

Utilizing online legal forms offers several advantages, including:

- Convenience: Accessible anytime and anywhere, allowing users to fill out forms at their own pace.

- Time savings: Instant download and printing capabilities reduce wait times compared to traditional methods.

- Guided completion: Many online platforms offer step-by-step instructions and tips to ensure correct filing.

- Cost-effective: Online forms typically come at a lower price than hiring an attorney.

These benefits make using online forms a practical choice for many users.

How to fill out California Partial Reconveyance?

If you’re searching for a way to properly complete the California Partial Reconveyance without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every private and business scenario. Every piece of documentation you find on our online service is drafted in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Follow these straightforward instructions on how to get the ready-to-use California Partial Reconveyance:

- Make sure the document you see on the page corresponds with your legal situation and state laws by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and choose your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Register for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your California Partial Reconveyance and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Practically, lenders and servicers may want to consider including in payoff demand statements an additional $150 in recording fees for a Substitution of Trustee and Full Reconveyance ($75.00 for each document ?title?), necessary for the release of the loan.

To record the reconveyed deed, the property owner must go to the office of the Registrar-Recorder in which the property is located. For example, if the property is located in Los Angeles County, the reconveyed deed must be taken to the Los Angeles County Recorder's Office.

The beneficiary is usually the lender or carry back seller. The beneficiary receives no legal interest in the property through the trust deed. Because of his secured relationship to the property, the beneficiary acquires an equitable interest to the extent permitted under the title rights given to the trustee.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

California Civil Code section 2941 (b)(1) requires the beneficiary, upon payoff, to ?execute and deliver to the trustee the original note, deed of trust, request for a full reconveyance?.? The trustee then executes and records the full reconveyance within 21 days of receipt of the documents from the beneficiary,