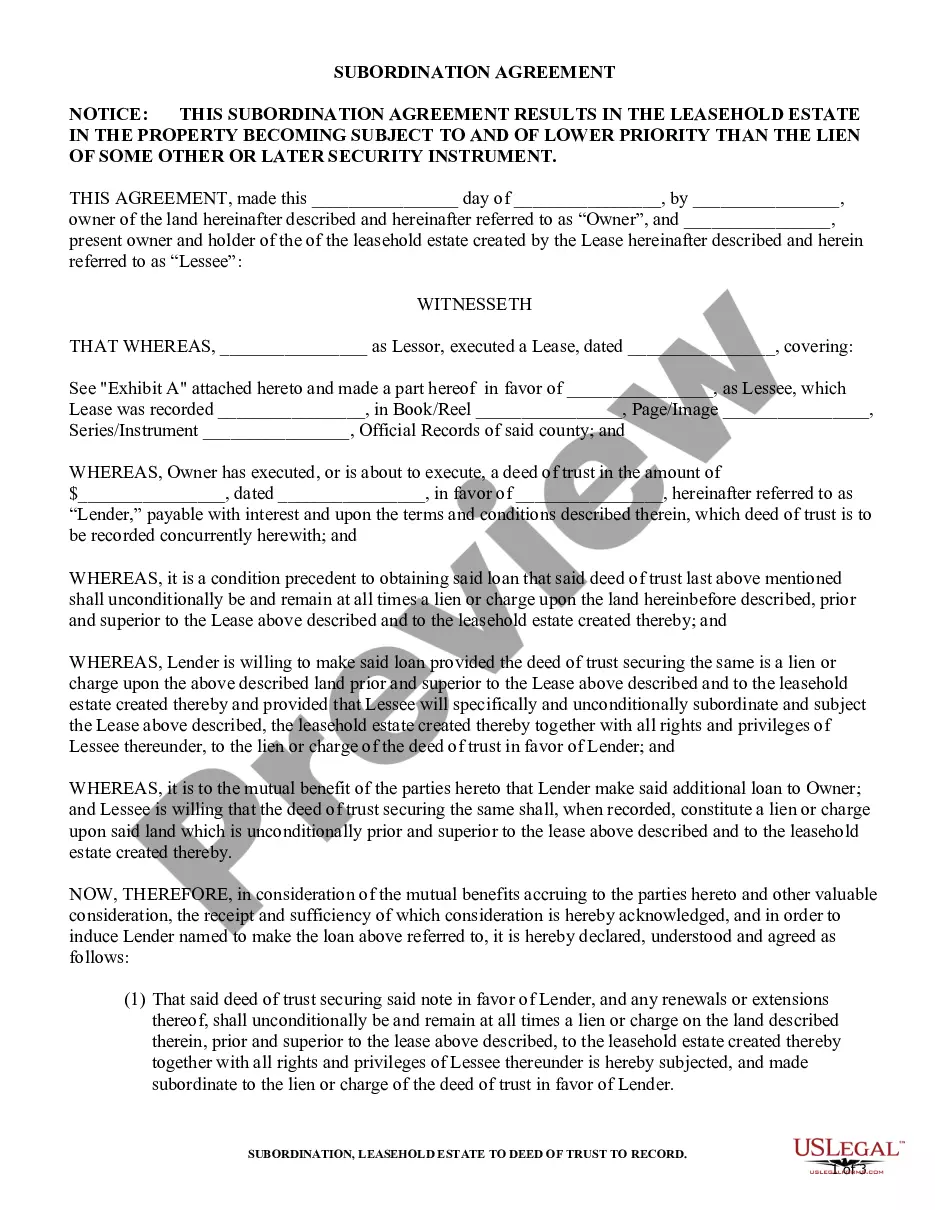

A California Subordination Agreement for Existing Loan is a legal document that is used to allow a new loan to take precedence over an existing loan. It is a common practice for a lender or bank to require this type of agreement when they are providing a new loan that is of greater value or amount than an existing loan. This agreement states that the lender of the existing loan agrees to subordinate their loan to the new loan, meaning that in the event of default, the lender of the new loan will be paid back first. This agreement is typically used in situations where a borrower is taking out a second loan to pay off or refinance an existing loan. There are two types of California Subordination Agreement for Existing Loan: 1) Full Subordination Agreement and 2) Partial Subordination Agreement. A Full Subordination Agreement is used when a borrower wants to fully refinance or pay off an existing loan with a new loan. In this agreement, the lender of the existing loan agrees to subordinate their loan to the new loan and will not receive any money until the new loan is paid in full. A Partial Subordination Agreement is used when a borrower wants to pay off only part of the existing loan with the new loan. In this agreement, the lender of the existing loan agrees to subordinate their loan to the new loan, but will receive a portion of the proceeds from the new loan in order to pay off the remaining balance of the existing loan.

California Subordination Agreement for Existing Loan

Description

Definition and meaning

A California Subordination Agreement for Existing Loan is a legal document that allows an existing leasehold estate to be ranked lower in priority than a newly established security interest, such as a deed of trust. This agreement is essential when a property owner seeks additional financing while holding an existing lease agreement. By subordinating the leasehold interest, the lender can secure their loan with a more potent claim on the property, thus facilitating the loan process.

How to complete a form

Completing the California Subordination Agreement involves several key steps:

- Enter the date when the agreement is being executed.

- Fill in the name of the Owner, who holds the title to the property.

- Input the details of the Lessee, who holds the leasehold interest.

- Provide specifics about the lease, including dates and recording information.

- Detail the loan amount and the lender's name.

- Ensure all parties sign and date the document.

It is advisable to review the completed form for accuracy and clarity before submitting it.

Who should use this form

This form is intended for property owners in California who need to secure an additional loan against their property while an existing lease is in place. It is particularly useful for:

- Property owners seeking refinancing options.

- Real estate investors looking to leverage their property equity.

- Lenders requiring assurance through a subordination agreement.

Both the owner and lessee must agree to the terms laid out in the subordination agreement.

Key components of the form

The California Subordination Agreement typically includes the following key components:

- Parties Involved: Identification of the property owner and lessee.

- Details of the Lease: Specification of the lease terms and recording information.

- Loan Information: Amount and terms of the new loan.

- Subordination Clause: A statement confirming the leasehold estate is subordinate to the deed of trust.

- Signatures: Required signatures from all parties, including a notary acknowledgment.

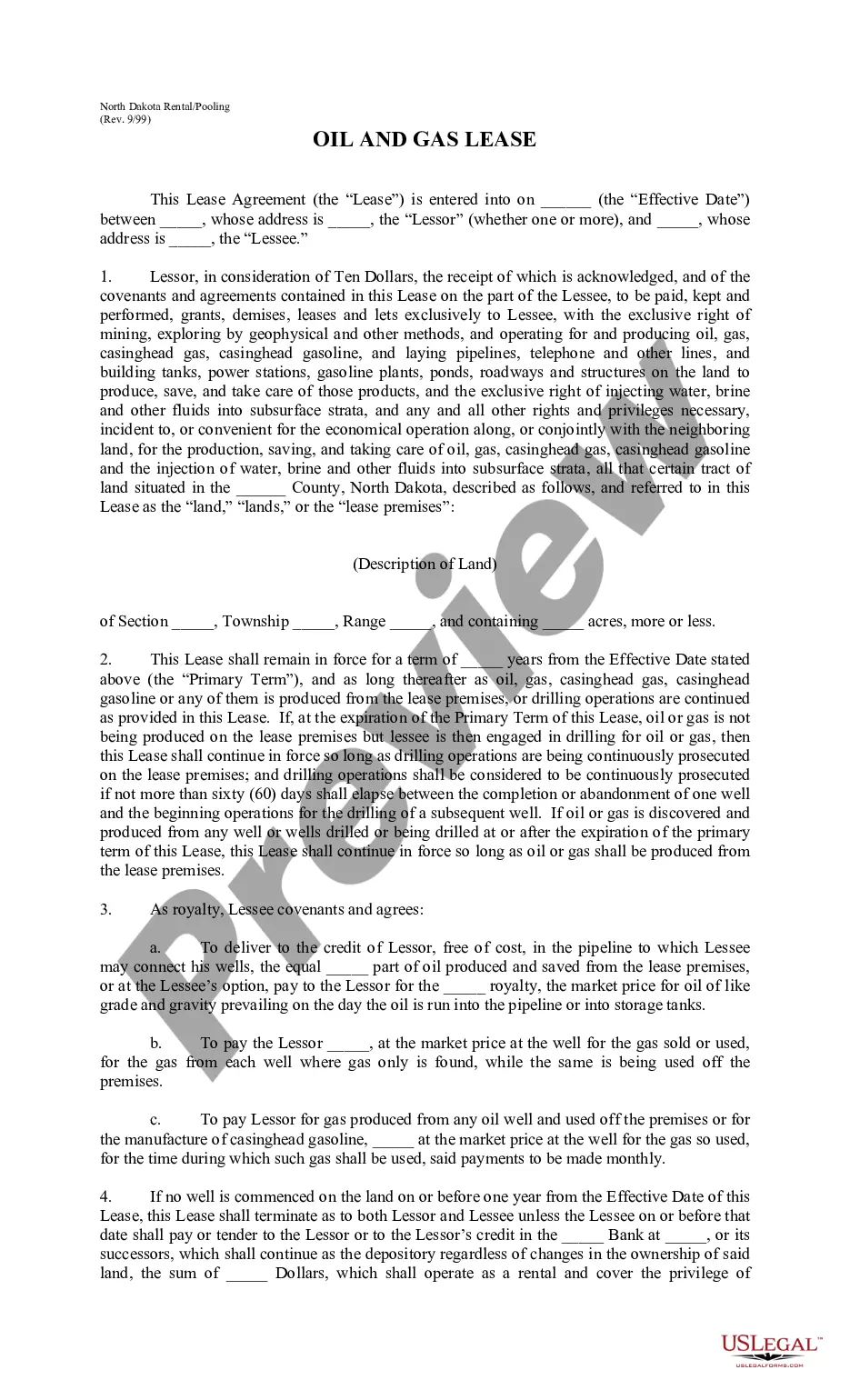

Legal use and context

This agreement is often used in real estate transactions where the property owner desires to obtain a loan that requires the lender to have a superior claim over existing lease agreements. It is a crucial document in ensuring that all parties are aware of their rights and obligations regarding the property in question. It serves as a mechanism to protect the interests of the lender while allowing the owner to access additional finances.

What documents you may need alongside this one

When preparing the California Subordination Agreement, you might need to gather the following documents:

- Current lease agreement between the owner and lessee.

- Deed of trust or loan documents from the lender.

- Title deed for the property.

- Identification of all parties involved.

Having these documents ready can help streamline the completion and execution of the subordination agreement.

What to expect during notarization or witnessing

Notarization is a critical step in the execution of the California Subordination Agreement. During this process:

- A notary public will verify the identity of the individuals signing the document.

- The signers will need to present valid identification.

- The notary will witness the signatures and affix their seal to the document, confirming its legitimacy.

This process not only validates the agreement but also adds an additional layer of protection against potential disputes.

How to fill out California Subordination Agreement For Existing Loan?

US Legal Forms is the most easy and affordable way to find suitable legal templates. It’s the most extensive web-based library of business and individual legal documentation drafted and verified by lawyers. Here, you can find printable and fillable blanks that comply with national and local laws - just like your California Subordination Agreement for Existing Loan.

Obtaining your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted California Subordination Agreement for Existing Loan if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one corresponding to your requirements, or find another one using the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Choose the preferred file format for your California Subordination Agreement for Existing Loan and download it on your device with the appropriate button.

After you save a template, you can reaccess it anytime - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more efficiently.

Take full advantage of US Legal Forms, your trustworthy assistant in obtaining the required official documentation. Try it out!

Form popularity

FAQ

Subordination agreements ensure that a primary lender will be paid in the event the borrower takes on more debt. As with most legal documents, subordination agreements need to be notarized in order to be official in the eyes of the law.

Purpose of a Subordination Agreement A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

A subordination clause is a clause in an agreement which states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

The lender may require a subordination agreement to protect its interests in the event that the borrower deposits additional liens on the property, such as if the borrower were to take out a second mortgage.

A subordinate mortgage loan is any loan not in the first lien position. The subordination order goes by the order the loans were recorded. For example, your first mortgage (the mortgage used to buy the house) is recorded first because it's the first loan you borrow.

The party that primarily benefits from a subordination clause in real estate is the lender. However, if you decide to pursue a second mortgage, then the subordination clause prioritizes the first lender's repayment and contract rights. The most common application of subordination clauses is when refinancing a property.