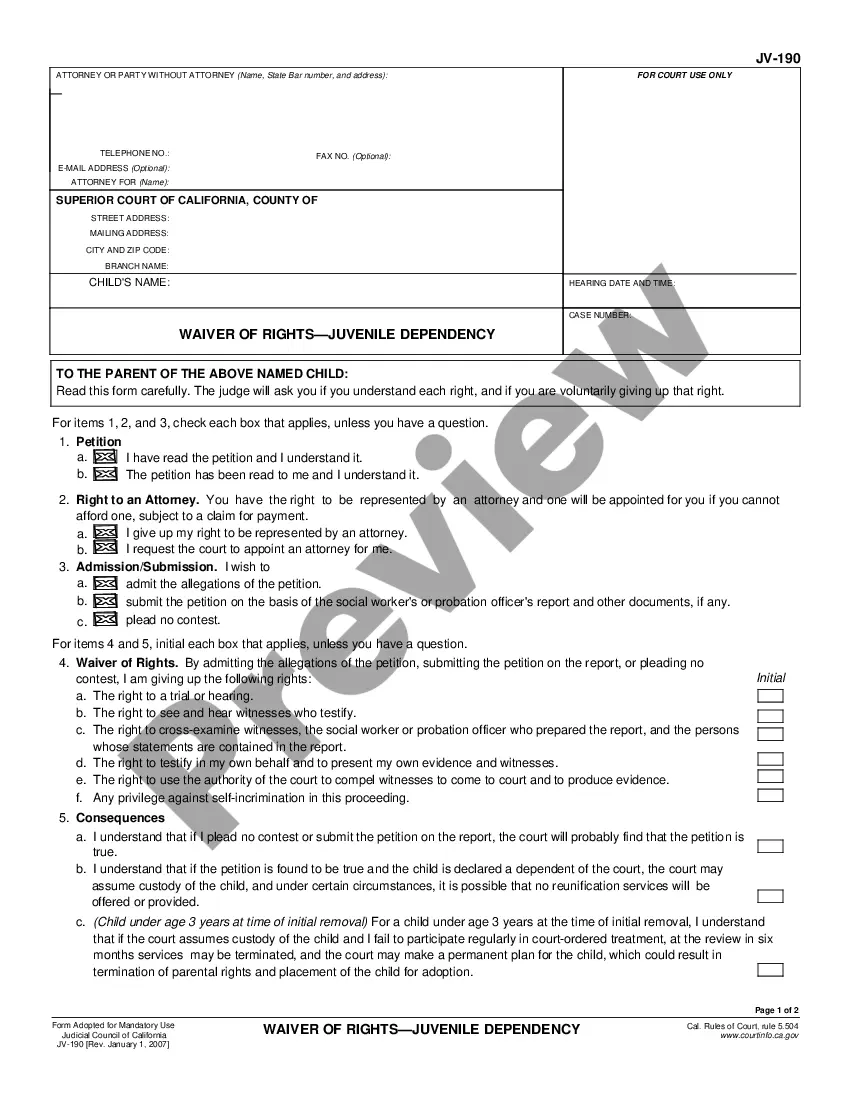

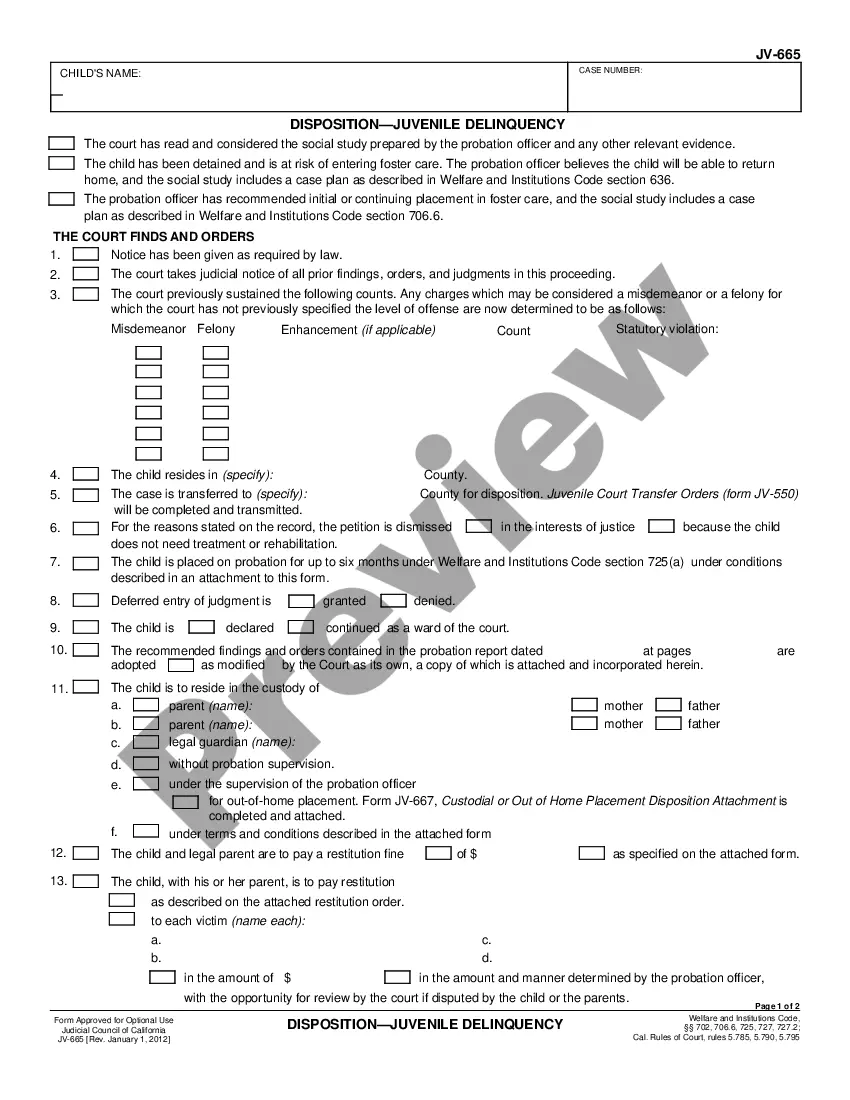

This form sets the terms and conditions for a juvenile who is on probation or under wardship.

California Terms and Conditions

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Terms And Conditions?

If you are seeking accurate California Terms and Conditions templates, US Legal Forms is what you require; discover documents crafted and reviewed by state-licensed legal professionals.

Utilizing US Legal Forms not only prevents you from difficulties related to legal documents; additionally, you conserve time, effort, and money! Downloading, printing, and submitting a professional form is significantly less expensive than hiring a lawyer to draft it for you.

And that's all. In just a few simple steps, you will have an editable California Terms and Conditions. After creating an account, all future orders will be processed even more easily. If you possess a US Legal Forms subscription, simply Log In to your account and then click the Download button located on the form’s page. Then, when you need to use this template again, you will always find it in the My documents section. Do not waste your time comparing various forms on different platforms. Purchase precise documents from a single reputable service!

- To begin, complete your registration process by entering your email and creating a password.

- Follow the instructions below to establish your account and obtain the California Terms and Conditions template to address your concerns.

- Utilize the Preview option or review the file description (if available) to confirm that the form is the one you need.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a suitable pricing plan.

- Create an account and pay using a credit card or PayPal.

- Select an appropriate file format and save the document.

Form popularity

FAQ

Getting government contracts in California requires understanding the bidding process and compliance with specific regulations. Start by registering with the California Department of General Services and exploring websites that list available contracts. It’s wise to familiarize yourself with the California Terms and Conditions that apply to government contracts, as adherence to these rules is critical for successful bidding.

The California government outlines numerous terms relevant to various legal agreements and transactions. While it does not have a fixed number of terms, the legal framework is extensive and continuously evolving. It is essential for businesses and individuals to familiarize themselves with applicable California Terms and Conditions to navigate compliance effectively.

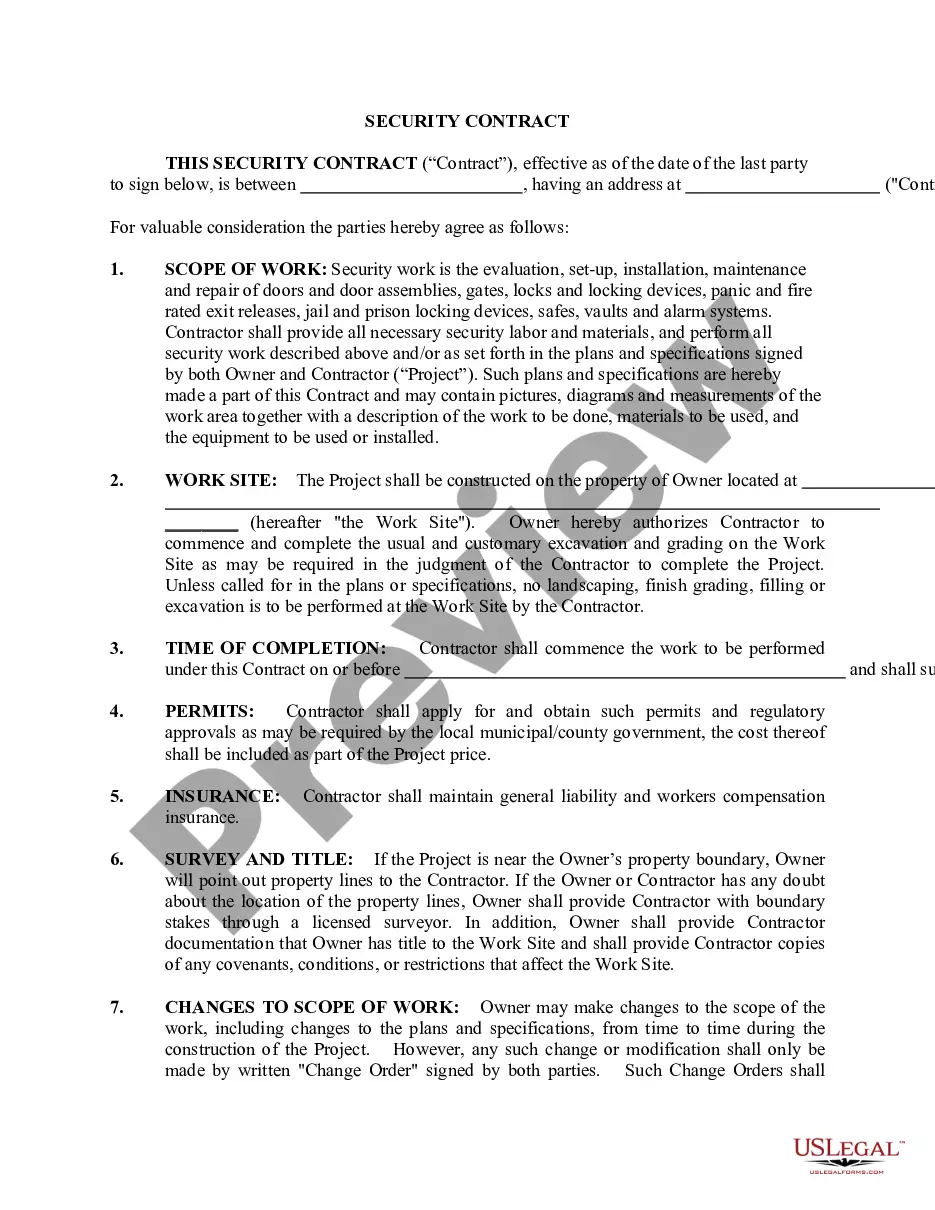

In California, a contract requires four essential elements: offer, acceptance, consideration, and mutual consent. The offer must be clear and specific, while the acceptance must reflect an agreement to the terms. Consideration refers to something of value exchanged between the parties. Understanding these California Terms and Conditions is crucial for ensuring your contract is enforceable.

California mandates e-filing for many taxpayers to improve accuracy and streamline the process. If your income exceeds a specific threshold, e-filing is usually required under California Terms and Conditions. The benefits of e-filing include quicker processing of your return and quicker refunds. Explore options at US Legal Forms to ensure compliance and ease in filing electronically.

If your income is below $5,000 in California, you might not be required to file a tax return. However, certain situations may warrant a return, such as qualifying for tax credits or a refund. Reviewing the California Terms and Conditions can clarify your obligations. Always check your eligibility with tools or resources like those available on US Legal Forms.

Form 3567 can indeed be filed electronically in California, which streamlines the process for many taxpayers. Utilizing electronic submission helps ensure accuracy and fosters timely filing. By adhering to California Terms and Conditions, you can be confident that your electronic submissions meet legal standards. Consider US Legal Forms to facilitate this process.

In California, the income threshold for filing taxes depends on several factors, including your filing status and age. For instance, single filers under 65 typically must file if their income is over a certain amount. Keep in mind that these figures are updated frequently, so reference the latest California Terms and Conditions as you plan your filing.

To file a tax return in California, you must meet specific income thresholds based on your age and filing status. The California Terms and Conditions detail these requirements, which generally vary yearly. If you fall below these thresholds, you may not be required to file, but it’s wise to check if any credits apply.

In California, the minimum filing requirement varies based on your filing status and income. Generally, if your income exceeds a certain threshold, you must file a California tax return. These thresholds, defined by California Terms and Conditions, change annually. It’s essential to stay updated to ensure compliance.

California's term limits regulate how long state officials can serve in office, ensuring fresh leadership and ideas. For example, a Governor can serve up to two four-year terms. Knowing these limits is crucial for anyone interested in state governance and enhances your understanding of California Terms and Conditions when engaging with legal documents and official communications.