This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

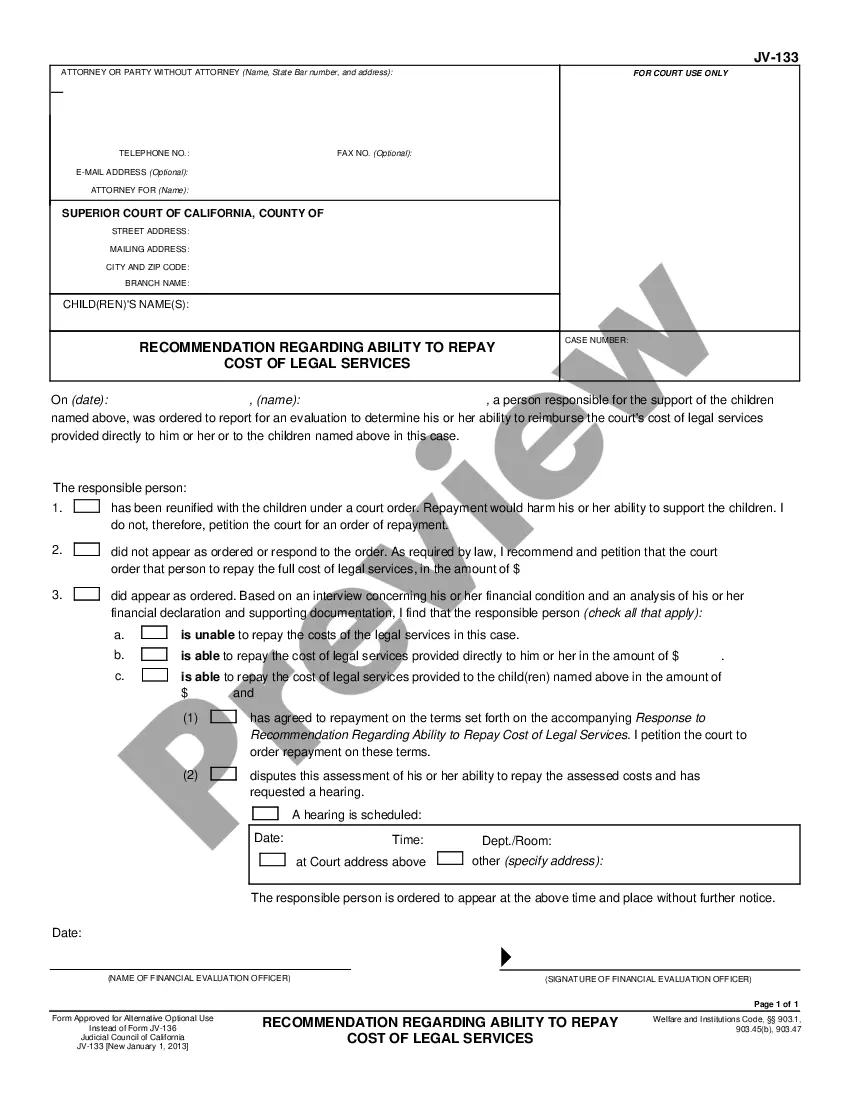

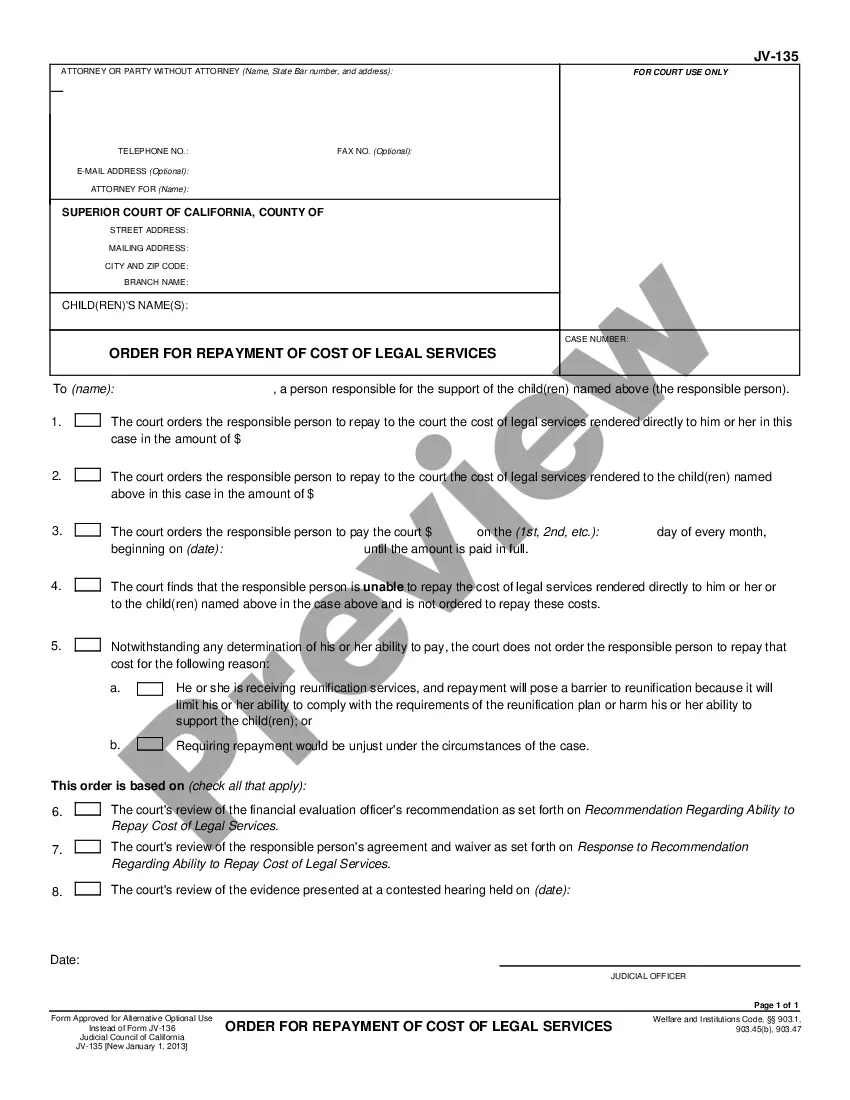

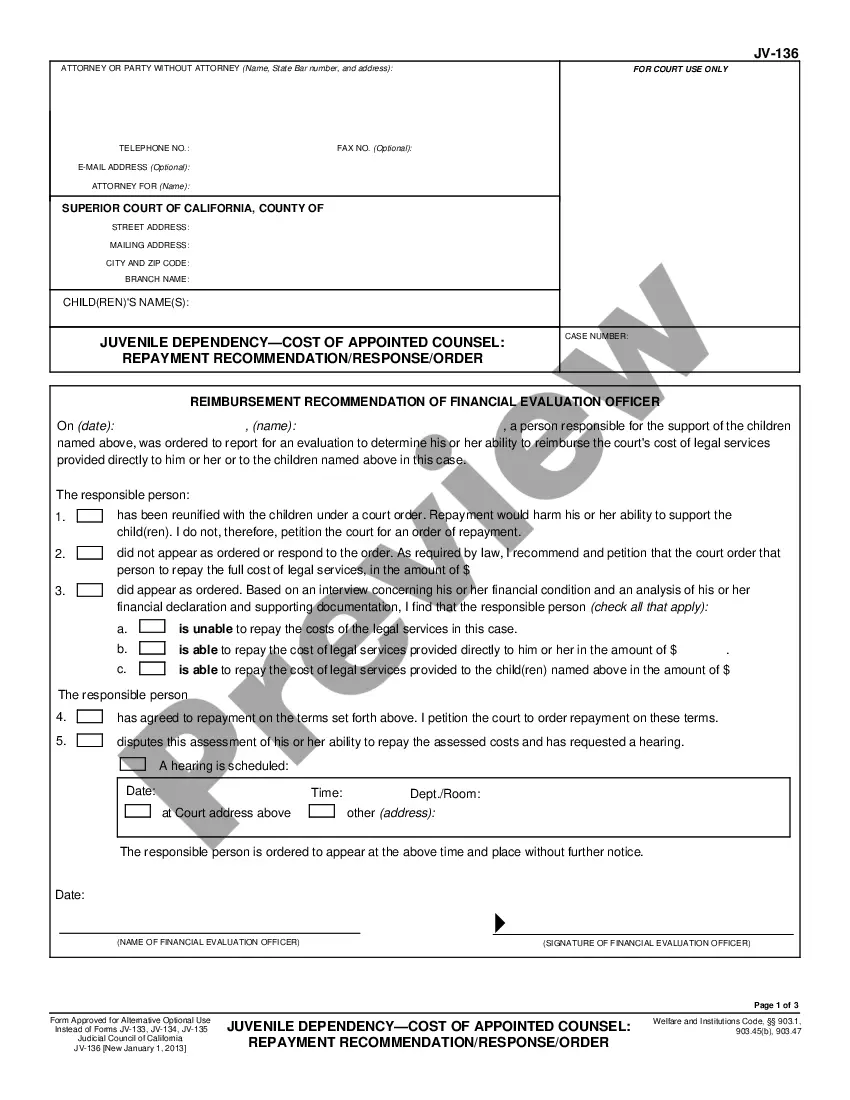

California Response to Recommendation Regarding Ability to Repay Cost of Legal Services

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Response To Recommendation Regarding Ability To Repay Cost Of Legal Services?

If you're seeking precise California Response to Recommendation Regarding Ability to Repay Cost of Legal Services samples, US Legal Forms is exactly what you require; find documents provided and reviewed by state-certified legal professionals.

Using US Legal Forms not only spares you from hassles related to legal documents; it also conserves your time, effort, and finances! Downloading, printing, and completing a professional form is considerably less costly than hiring a lawyer to handle it for you.

And that's all. With just a few clicks, you obtain an editable California Response to Recommendation Regarding Ability to Repay Cost of Legal Services. After you set up your account, all future purchases will be processed even more smoothly. If you have a US Legal Forms subscription, simply Log In to your profile and then click the Download option displayed on the form’s page. Then, when you want to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time and effort sifting through hundreds of forms across multiple websites. Obtain professional copies from a single reliable service!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the steps below to set up an account and locate the California Response to Recommendation Regarding Ability to Repay Cost of Legal Services template to address your concerns.

- Utilize the Preview option or review the document details (if available) to ensure that the form is the one you require.

- Verify its relevance in your state.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Create an account and pay with your credit card or PayPal.

- Select a suitable format and save the document.

Form popularity

FAQ

Yes, in California, you can sue for breach of fiduciary duty. A fiduciary duty arises when one party has a legal or ethical obligation to act in the best interest of another. If you believe someone has violated this duty, you can seek justice through a lawsuit. Understanding your rights and options is crucial, and consulting with a legal expert can help clarify your path forward.

The Statement of Information form shows a company's owners/officers, business address(es), and business description. A corporation/LLC must file a Statement of Information within 90 days of their Articles of Incorporation/Organization to do business in the state of California.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

California Non-Profit Corporations (Domestic) You may file by mail, in-person or online. Online filing is usually processed within one business day. Use Form SI-100 for both initial and renewal reports.

Statement of Information:Statements submitted on paper should be directed to the Secretary of State's office in Sacramento, either by mail or dropped off in person. Statements for limited liability companies and common interest developments must be submitted on paper, by mail or in person (drop off), at this time.

The costs that you pay after your LLC is formed are also tax-deductible. You can deduct California's $800 annual tax, along with any annual fee you pay, from your federal taxes. You can also deduct maintenance costs for your LLC, including business license fees and registered agent fees.

Statement of Information:Form SI-550 must be used when filing the FIRST Statement of Information (due within 90 days after registration with the California Secretary of State) and when ANY information has changed since the last complete Statement of Information was filed.

Statement of Information (Form SI-550) For faster processing, the required statement for most corporations can be filed online at bizfile.sos.ca.gov.

However, such an election does not exempt them from the limited partnership annual tax. Limited partnerships must still file California returns for tax years after making the election. However, they only need to complete the entity information and pay any amounts due.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.