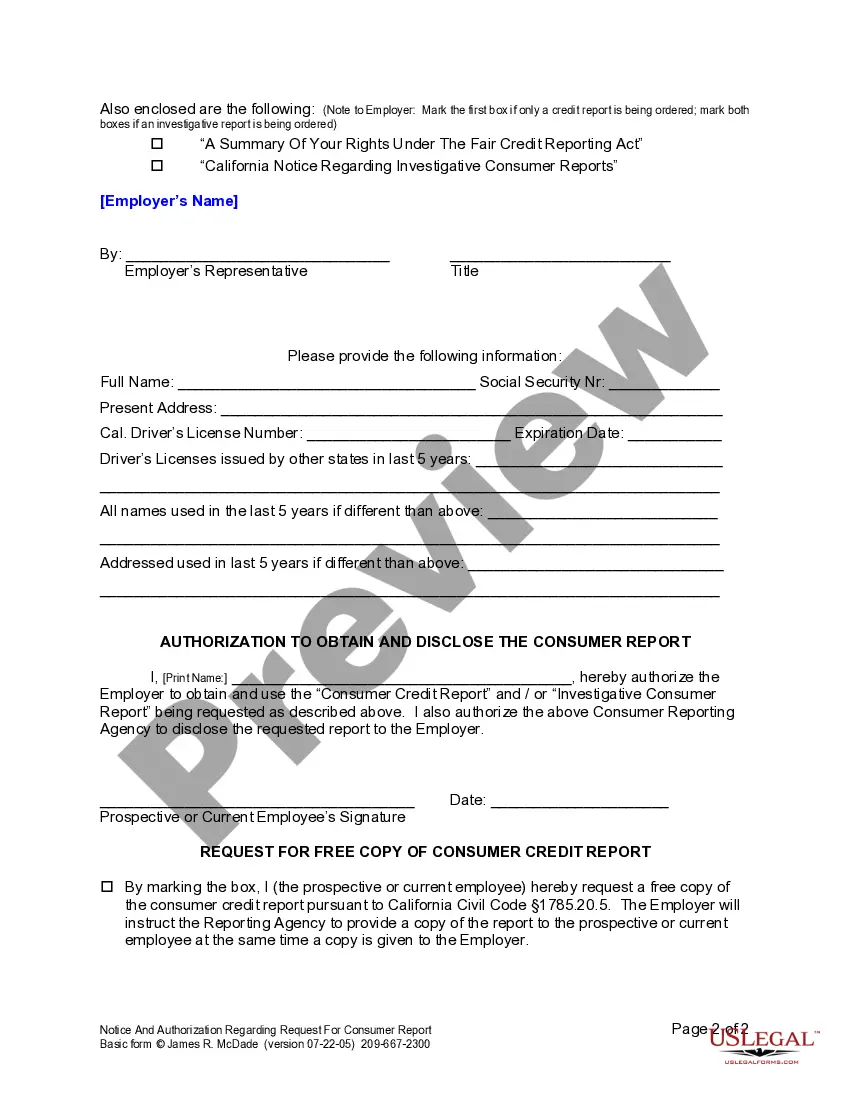

This form is used to obtain permission from an employee or prospective employee prior to the employer requesting a consumer credit report or background investigation.

California Notice and Authorization Regarding Consumer Report

Description

Key Concepts & Definitions

Notice and Authorization Regarding Consumer Report refers to a document or communication that businesses must provide to individuals before obtaining a consumer report. These reports can range from credit histories to background checks, crucial for processes like employment screening, financial loans, or housing applications. The primary regulations governing these are dictated by the Fair Credit Reporting Act (FCRA) to ensure consumer protection and fair competition.

Step-by-Step Guide

- Understanding Requirement: Determine if your business needs to obtain a consumer report for background screening, leasing, or lending purposes.

- Legal Compliance: Review legal resources or consult with a legal expert to comply fully with FCRA and state-specific laws.

- Drafting Notice: Create a clear and comprehensive notice that informs the consumer about what information will be collected and how it will be used.

- Obtaining Authorization: Ensure that the consumer provides written consent for the procurement and use of their report.

- Using Reports: Use the consumer reports ethically and legally, solely for the purpose stated in the notice and authorization.

Risk Analysis

Failure to adhere to notice and authorization requirements can result in significant legal consequences, including lawsuits and hefty fines. This non-compliance can breach consumer protection laws, erode trust, and negatively impact a company's reputation. Proper understanding and implementation mitigate these risks, safeguard consumer rights, and promote fair business practices.

FAQ

- What is a consumer report? A document that includes data regarding an individual's credit history, character, general reputation, or personal characteristics, typically used for credit, employment, or housing decisions.

- Why is authorization necessary before obtaining a consumer report? Authorization ensures transparency and consent in the processing of personal data, aligning with legal standards and protecting consumer rights.

- What happens if a company does not comply with FCRA requirements? Non-compliance can lead to legal action from consumers, penalties from regulatory bodies, and damage to the business's credibility.

Key Takeaways

Ensuring compliance with notice and authorization regarding consumer report standards is crucial for any business involving credit reporting, financial loans, or background checks. It protects both the business and the consumer and upholds the integrity of business practices.

How to fill out California Notice And Authorization Regarding Consumer Report?

If you're seeking precise California Notice and Authorization Regarding Consumer Report templates, US Legal Forms is precisely what you require; access documents created and reviewed by state-licensed attorneys.

Using US Legal Forms not only spares you from difficulties related to legal documents; moreover, you save time, effort, and funds! Obtaining, printing, and completing a professional document is significantly less expensive than having a lawyer do it for you.

And that’s it. In just a few simple steps, you possess an editable California Notice and Authorization Regarding Consumer Report. After your account setup, all subsequent transactions will be even more straightforward. When you have a US Legal Forms subscription, simply Log In to your profile and select the Download button available on the form’s page. Then, whenever you need to use this template again, you can always find it in the My documents section. Don't waste your time comparing numerous documents across different websites. Order exact versions from a single reliable source!

- To commence, finalize your registration process by providing your email and creating a secure password.

- Follow the guidelines outlined below to set up your account and acquire the California Notice and Authorization Regarding Consumer Report template to address your needs.

- Utilize the Preview feature or check the document details (if available) to confirm that the template is what you require.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Select a suitable pricing plan.

- Establish an account and pay using your credit card or PayPal.

Form popularity

FAQ

Opting out of consumer reporting is possible but typically only for marketing purposes. The California Notice and Authorization Regarding Consumer Report does not provide a complete opt-out for credit checks required for loans or employment. If you choose to opt out, be aware that it may limit your ability to receive pre-approved offers or access certain services. For more guidance on managing your consumer report preferences, consider using US Legal Forms as a resource.

An authorization to obtain a consumer credit report is your formal agreement allowing a business to access your credit information. This process is documented within the California Notice and Authorization Regarding Consumer Report. When you sign this authorization, you are confirming that you understand how your credit report will be used. It is a standard practice in financial and employment settings to ensure transparency.

Consent to a consumer report is crucial when applying for loans, jobs, or rental agreements. The California Notice and Authorization Regarding Consumer Report outlines your rights and the information collected in the report. By consenting, you allow potential employers or lenders to make informed decisions based on your credit history. Always read the notice carefully to understand its implications.

The new consumer protection law in California builds on existing regulations to enhance consumer rights and ensure fair treatment. This legislation focuses on data privacy and reinforces transparency between businesses and consumers. Staying informed through resources like uslegalforms helps you better understand requirements like the California Notice and Authorization Regarding Consumer Report.

The California Consumer Privacy Act advisory disclosure and notice inform consumers about their personal data rights. This notice must be clear and accessible, ensuring consumers understand how their information will be used. When considering consent for reports, this awareness ties back to the California Notice and Authorization Regarding Consumer Report.

The Consumer Credit Protection Act grants several rights protecting consumers, including the right to know your credit information and the right to dispute inaccuracies. It aims to promote fair treatment in credit reporting. Familiarizing yourself with these rights can complement the goals of the California Notice and Authorization Regarding Consumer Report.

The California consumer review law prohibits businesses from discouraging customers from posting honest reviews. This law empowers consumers to freely share their experiences without fear of repercussion. The California Notice and Authorization Regarding Consumer Report also emphasizes transparency in consumer information practices.

Under the California Consumer Privacy Act (CCPA), consumers possess seven key rights. These rights include the right to know about personal data collection, the right to request deletion, and the right to opt-out of data selling, among others. Being informed about these rights complements the California Notice and Authorization Regarding Consumer Report.

The consumer review law protects individuals from unfair practices by businesses regarding customer reviews. It prohibits companies from including clauses that prevent customers from sharing honest opinions. Understanding the California Notice and Authorization Regarding Consumer Report helps you navigate your rights in this context.

You generally need to give consent for a consumer report to be obtained, especially in employment or rental scenarios. The California Notice and Authorization Regarding Consumer Report ensures you understand your rights. If you choose not to agree, it could impact your ability to secure a job or housing.